The municipal bond market saw billions of dollars in new supply hit the screens on Tuesday, led by big competitive bond deals from the states of Georgia and Massachusetts and a competitive note sale from a New York issuer.

Municipal bond prices were steady in quiet trading at mid-session.

Primary market

The state of Georgia sold $1.4 billion of general obligation bonds in four separate competitive offerings on Tuesday.

Bank of America Merrill Lynch won the $430.53 million of Series 2017A Tranche 2 GOs with a true interest cost of 3.06%. The issue was priced to yield from 1.94% with a 5% coupon in 2028 to approximately 3.261% with a 3% coupon in 2037.

Morgan Stanley won the $358.11 million of Series 2017A Tranche 1 GOs with a TIC of 1.46%. Pricing information was not immediately available.

Morgan Stanley also won the $352.45 million of Series 2017C refunding GOs with a TIC of 1.899%. Pricing information was not immediately available.

And Wells Fargo Securities won the $273.45 million of Series 2017B taxable GOs; a TIC was 2.99%. The issue was priced to yield from 1.25% with a 4% coupon in 2018 to 3.15% at par in 2033; a 2037 maturity was priced at par to yield 3.30%.

All four deals are rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

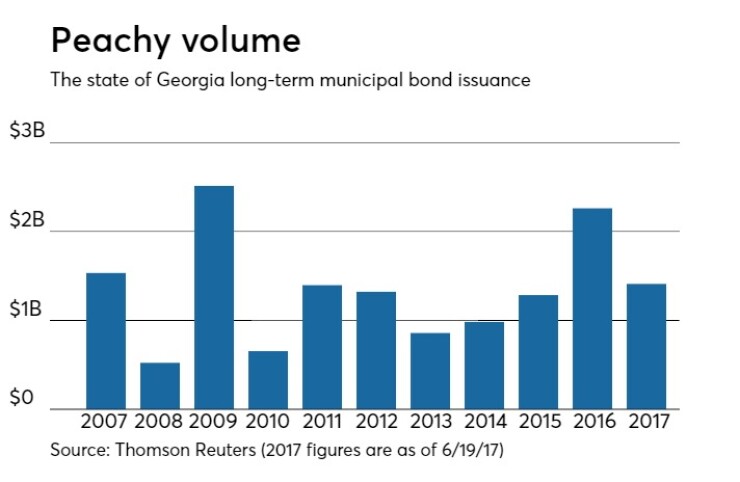

Since 2007 the Peach State has issued roughly $14.46 billion of securities, with the highest yearly total in 2009, when the state issued $2.51 billion of bonds. The lowest year of issuance took place in 2008, when it sold $522 million.

The state of Massachusetts competitively sold almost $785 million of GOs in three separate offerings on Tuesday.

Bank of America Merrill Lynch won the $400 million of consolidated loan of 2017 Series D GOs with a TIC of 3.64%. The issue was priced to yield from 2.62% with a 5% coupon in 2033 to 3.42% with a 4% coupon in 2047.

Citigroup won the $284.85 million of Series 2017D GO refunding bonds with a TIC of 1.92%. The issue was priced as 5s to yield from 1.45% in 2023 to 2.25% in 2028.

Morgan Stanley won the $100 million of consolidated loan of 2017 Series C GOs with a TIC of 2.58%. Pricing information was not immediately available.

The deals are rated Aa1 by Moody’s, AA by S&P and AA-plus by Fitch.

In the competitive note sector, the New York Metropolitan Transportation Authority sold $700 million of transportation revenue bond anticipation notes to several groups. Pricing information was not immediately available.

In the negotiated sector on Tuesday, Loop Capital Markets priced the city of Chicago’s $815.75 million of general airport senior lien revenue and revenue refunding bonds for the Chicago O’Hare International Airport.

The $55.67 million of Series 2017A senior lien revenue refunding bonds not subject to the alternative minimum tax were priced to yield from 1.36% with 5% coupon in 2021 to 3.21% with a 5% coupon in 2037; a 2040 maturity was priced as 5s to yield 3.27%.

The $358.18 million of senior lien revenue refunding non-AMT bonds were priced to yield from 0.92% with a 5% coupon in 2018 to 3.25% with a 5% coupon in 2039.

The $122.16 million of Series 2017C senior lien revenue refunding bonds non-AMT were priced to yield from 1.09% with a 5% coupon in 2019 to 3.51% with a 4% coupon in 2037; a 2041 maturity was priced as 5s to yield 3.28%

The $279.75 million of Series 2017D senior lien revenue bonds subject to AMT were priced to yield from 1.78% with a 5% coupon in 2022 to 3.46% with a 5% coupon in 2037. A 2042 maturity was priced as 5s to yield 3.54%; a 2047 maturity was priced as 5s to yield 3.60%; a 2052 maturity was priced as 5s to yield 3.73%.

The deal is rated A by S&P and Fitch.

Loop also held a second day of retail orders for the New York City Transitional Finance Authority’s $850 million of tax-exempt Fiscal 2017 Series F Subseries F-1 future tax secured subordinate bonds.

A two-day retail order period was scheduled for the bonds, which will be priced for institutions on Wednesday. The TFA will also competitively sell $250 million of taxable bonds in two separate offerings on Wednesday.

The tax-exempts were priced for retail on Monday to yield from 1% with a 3% coupon in 2019 to approximately 3.317% with a 3.25% coupon in 2038; a 2043 maturity was priced as 5s to yield 2.96% and a 2044 maturity was priced as 4s to yield 3.27%. No retail orders were taken in the 2032-2033, 2039 or 2042 maturities.

The issue is rated Aa1 by Moody’s and AAA by S&P and Fitch.

Citigroup priced the Alabama Federal Aid Highway Finance Authority’s $558.57 million of Series 2017A special obligation revenue bonds and Series 2017B special obligation revenue refunding bonds.

The $418.31 million of Series 2017A revenue bonds were priced to yield from 1.06% with a 5% coupon in 2019 to 3.29% with a 4% coupon and 2.91% with a 5% coupon in a split 2037 maturity. A 2018 maturity was offered as a sealed bid.

The $140.27 million of Series 2017B revenue refunding bonds were priced to yield from1.59% with a 5% coupon in 2023 to 2.05% with a 5% coupon in 2026.

The deal is rated Aa1 by Moody’s and AAA by S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $599.2 million to $15.41 billion on Tuesday. The total is comprised of $5.48 billion of competitive sales and $9.93 billion of negotiated deals.

Secondary market

The yield on the 10-year benchmark muni general obligation was steady from 1.86% on Monday, while the 30-year GO yield was flat from 2.70%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were stronger on Tuesday. The yield on the two-year Treasury dropped to 1.34% from 1.36% on Monday, the 10-year Treasury yield declined to 2.15% from 2.17% and the yield on the 30-year Treasury bond decreased to 2.74% from 2.78%.

On Monday, the 10-year muni to Treasury ratio was calculated at 85.0%, compared with 86.3% on Friday, while the 30-year muni to Treasury ratio stood at 96.8% versus 97.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,322 trades on Monday on volume of $7.70 billion.

Jacob Schneider contributed to this report.