An escalating trade war with China threatens further harm to the fortunes of America’s agricultural heartland and state credits in the farm belt, according to Moody’s Investors Service.

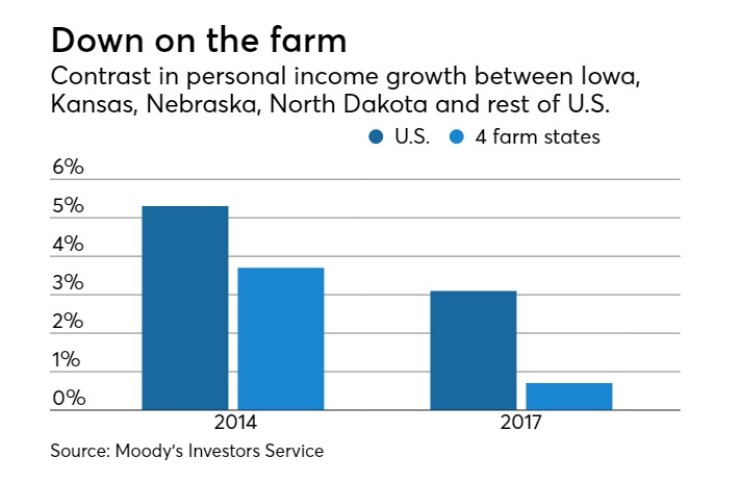

“The U.S. trade dispute with China will weaken the economies of states that are highly dependent on agriculture and compound already troubled agriculture sectors that have suffered from commodity price declines since 2014,” analyst Marcia Van Wagner wrote in Tuesday’s report.

While virtually every state in the nation is involved in agriculture, Moody’s identified four states most at risk of Chinese retaliation: Iowa, rated Aaa with a stable outlook; Kansas, rated Aa2 and stable; Nebraska, rated Aa1 and stable; and North Dakota, Aa1 with a negative outlook.

“Other states — including California (Aa3 stable), Illinois (Baa3 stable), Minnesota (Aa1 stable), Indiana (Aaa stable), Texas (Aaa stable), and Washington (Aa1 stable) — are major producers of agricultural tariff targets are also vulnerable, but have more diversified economies,” analysts wrote.

Of those states, California is by far the largest exporter of agricultural products with more than $20 billion per year, accounting for more than 6% of U.S. gross domestic product. Iowa, the second biggest farm exporter, accounts for less than half of that.

President Trump placed punitive tariffs on solar imports from China in January and announced another $60 billion on other products in March. That has since grown to $200 billion, and last week, Trump announced that the proposed 10% tariff would more than double to 25% to offset any change in currency prices.

China, which retaliated with tariffs on agricultural products, this week announced another $60 billion of tariffs on U.S. imports ready to launch.

The agricultural products China is targeting accounted for more than 18% of goods exported to China in 2016, Moody’s said. China is the largest export market for U.S. agriculture, accounting for $21 billion of U.S. exports, or about 15% of total agricultural exports.

“Tariffs on agricultural exports will exacerbate the effects of falling prices and declining farm income on the agricultural states in recent years,” Moody’s said. “Agricultural commodity prices and farm income are historically volatile.”

After rising through the late 2000s, farm income nationwide peaked in the first half of 2013 at roughly twice the level of early 2005 and has since fallen 75%, analysts said. The four agricultural states highlighted in this report saw a more dramatic rise, approaching three times the 2005 level and a more rapid plunge of 83% through early 2018.

“Even in the absence of tariffs, farm prices and incomes would be depressed because of exchange rate trends,” the report noted. “A 25% increase in the trade-weighted value of the dollar since the beginning of 2013 has contributed to falling farm commodity prices.”

Trump has promised $12 billion to farmers affected by the tariffs, but Moody’s said the taxpayer dollars are unlikely to have much effect on overall income.

“From the first quarter of 2017 to the first quarter of 2018, farm proprietors' income in just these four agricultural states fell $45 billion,” the report noted.

Demographic trends are not promising for the four states, Moody’s said.

The U.S. population has been growing about 0.7% annually since 2010, but the rate is a slower 0.5% in those four agricultural states, even when including the cyclical energy-driven North Dakota population boom, analysts said.

“Kansas has seen domestic outmigration rates that outpace in-migration, contributing to the state's meager population gain,” the report said. “The states are caught in the circular dynamic of tight labor markets contributing to slow growth, inhibiting population growth and further tightening the labor market. While in some cases, a slowdown in one industry will create needed slack in the labor market for other sectors to use, the agriculture sector has little labor to free up.”