The action continued on Tuesday in the primary market as issuers flooded the market ahead of the tax reform vote, in order to get deals done and closed before the end of the year.

Primary market

Barclays Capital is expected to price Houston’s $1.007 billion of pension general obligation taxable bonds on Tuesday. The deal is rated Aa3 by Moody’s Investors Service and AA by S&P Global Ratings.

Houston put out a disclosure regarding a lawsuit that challenges the legality of the city's ballot language, and therefore the deal.

"The suit alleges that because of language in the election proposition, the City misled the voters as to the effect of the election on the revenue limitations of the City Charter and is therefore void," the notice states.

"Because the City is required to comply with the City Charter revenue limitations as a condition for the Attorney General to issue its approving opinion, no case or controversy is presented which would adversely affect issuance of the Bonds. Upon issuance of the Attorney General's opinion in connection with the approval of the Bonds, the Bonds are valid and incontestable under Texas law," according to the notice.

"We’re still moving forward as planned," said Max Moll, spokesman for Houston Controller Chris Brown. "There are people in New York still pricing the bonds. We’ve had over $3 billion of orders for these bonds."

Jefferies sent around a pre-marketing scale on the Railsplitter Tobacco Settlement Authority, Ill.’s $678.61 million of settlement revenue bonds on Tuesday, ahead of institutional pricing on Wednesday. The premarketing has the 2022 maturity about 85 basis points above the comparable Treasury and the 2028 maturity at about 100 basis points above the comparable Treasury. The deal is rated A by S&P with the exception of the 2028 maturity, which is rated A-minus by S&P.

Morgan Stanley is scheduled to price California Health Facilities Financing Authority’s $454.3 million of refunding revenue bonds for Stanford Healthcare. The bonds are priced to yield from 1.67% with a 5% coupon in 2021 to 2.86% with a 5% coupon in 2037. A term bond in 2040 was priced to yield 3.25% with a 4% coupon. The deal is rated Aa3 by Moody’s, AA-minus by S&P and AA by Fitch.

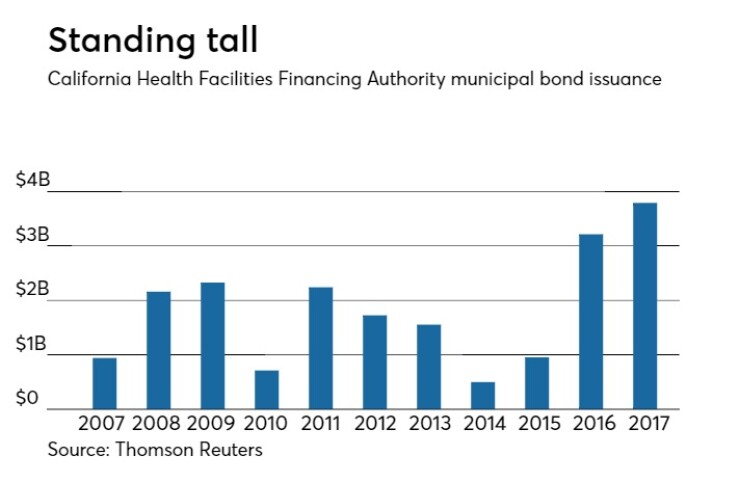

Since 2007, the California HFFA has issued roughly $20.21 billion of bonds, with the most issuance before this year occurring in 2016 when it sold $3.21 billion of bonds. The authority saw a low year of issuance in 2014 when it issued $500 million.

RBC Capital Markets sent around a pre-marketing scale on the New Jersey Economic Development Authority’s $183.215 million of revenue refunding bonds for the Montclair State University Student Housing Project. The bonds were listed about 25 basis points above the benchmark scale with a 4% coupon in 2019 to about 95 basis points above the benchmark scale with a 5% coupon in 2032. A term bond was listed at about 90 basis points above the benchmark scale with a 5% coupon and about 120 basis points above the benchmark scale with a 4% coupon in a split maturity. A 2042 term bond with a split maturity was listed at about 90 basis points above the benchmark scale with a 5% coupon and about 120 basis points above the benchmark scale with a 4% coupon. The deal is rated Baa3 by Moody’s and AA by S&P on the maturities that are insured by Assured Guaranty Municipal Corp.

Wells Fargo priced the California Infrastructure and Economic Development Bank’s $171.5 million of refunding revenue bonds for the Los Angeles County Museum of Art Project. The $78 million of series 2017A bonds were priced at par to yield about 70 basis points above the one-month Libor in 2050 with a mandatory tender date of 2021.

The $93.5 million of series 2017B bonds were priced at par to yield about 70 basis points above the one-month Libor in 2050 with a mandatory tender date of 2021. The deal is rated A3 by Moody’s.

Citi priced Harbor Point Infrastructure Improvement District, Conn.’s $145.855 million of special obligation revenue refunding bonds for the Harbor Point Project. The deal was priced to yield 2.75% with a 5% coupon in 2022, 3.375% with a 5% coupon in 2030 and 3.75% with a 5% coupon in 2039. This deal is not rated.

JPMorgan priced the Medical Center Educational Building Corp.’s $144.22 million of revenue bonds for the University of Mississippi Medical Center. The $131.875 million of series 2017A bonds were priced to yield 1.36% with a 4% coupon in 2018 and from 2.24% with a 5% coupon in 2024 to 3.32% with a 4% coupon in 2034. A term bond in 2042 was priced to yield 3.17% with a 5% coupon and a 2047 term was priced to yield 3.57% and 3.22% with a 4% coupon and 5% coupon in a split maturity.

The $12.345 million of series 2017B taxable bonds were priced at par to yield from 2.45% in 2020 to 3.10% in 2024. The deal is rated Aa2 by Moody’s and AA by Fitch.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was weaker trading through midday on Tuesday.

The 10-year muni benchmark yield rose to 2.315% from Monday’s final read of 2.296%, according to

The MBIS benchmark index, which is comprised of investment-grade municipal securities, is updated hourly on the

Top-rated municipal bonds were weaker on Tuesday morning. The yield on the 10-year benchmark muni general obligation was between two and four basis points higher from 2.03% on Monday, while the 30-year GO was also up between two and four basis points from 2.62%, according to a read of MMD’s triple-A scale.

U.S. Treasuries were weaker on Tuesday around midday. The yield on the two-year Treasury inched up to 1.85% from 1.83%, the 10-year Treasury yield climbed to 2.45% from 2.39% and the yield on the 30-year Treasury rose to 2.81% from 2.74%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.9% compared with 84.5% on Friday, while the 30-year muni-to-Treasury ratio stood at 96.6% versus 96.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 45,574 trades on Monday on volume of $12.545 billion.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.60 billion to $12.36 billion on Tuesday. The total is comprised of $704 million of competitive sales and $11.66 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.

Richard Williamson contributed to this report.