Municipal bonds rallied along with Treasuries on Thursday as stocks swooned on growing political unrest in Washington, D.C.

The District of Columbia hit the primary market with over $550 million of general obligation refunding bonds that received a warm reception from buyers.

Primary market

Siebert Cisneros Shank priced and repriced the

The issue was repriced to yield from 0.99% with a 3% coupon in 2019 to 3.01% with a 5% coupon and 3.33% with a 4% coupon in a split 2037 maturity.

“The deal worked in our favor today as we really benefited from the move in Treasuries and MMD,” said Jeffrey Barnette, D.C.’s deputy chief financial officer and treasurer. “Overall the deal was four times oversubscribed and we were able to tighten spreads on a large portion of the deal.

"The refunded savings were mostly impacting long-term maturities and will provide savings benefits over the life of the bonds. Another positive to the deal is we were able to attract new investors,” he said.

The bonds are rated Aa1 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings. Moody’s and Fitch maintain a stable outlook on the credit while S&P has a positive outlook on D.C.’s bonds.

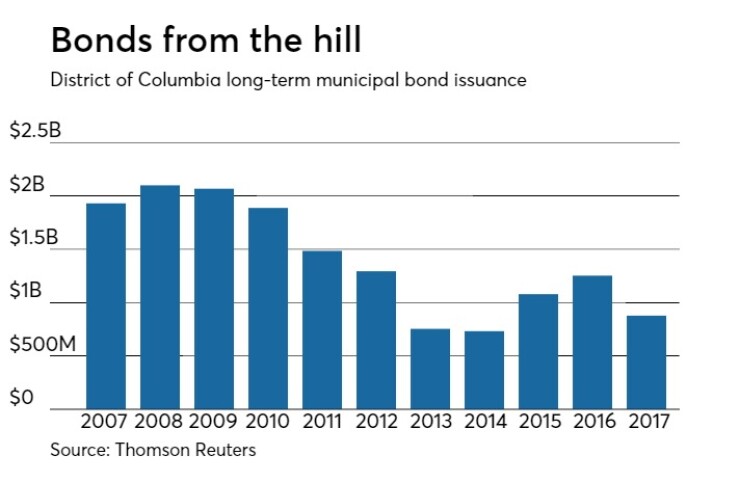

Since 2007, the U.S. capital district has sold $15.76 billion of securities, with the most issuance occurring in 2008 when it sold $2.09 billion. Washington, D.C., has issued bonds every year for the past decade, only selling less than $1 billion in a year twice during that span, with the lowest being $732 million in 2014.

Citigroup priced the Tennessee Housing Development Agency’s $175 million of residential finance program bonds for retail investors.

The $23.11 million of Issue 2017-2A bonds subject to the alternative minimum tax were not priced for retail.

The $151.89 million of Issue 2017-2B non-AMT bonds were priced at par to yield from 1.10% and 1.15% in a split 2019 maturity to 3.15% in 2030, and to yield 3.40% in 2032 and 3.70% in 2036. The split 2018 maturities were offered as sealed bids while the 2042 maturity was not priced for retail.

The deal is rated Aa1 by Moody’s and AA-plus by S&P.

RBC Capital Markets priced the North Carolina Housing Finance Agency’s $255.56 million of home ownership revenue refunding bonds.

The $17.73 million of Series 38-A bonds subject to the alternative minimum tax were priced at par to yield from 1.20% and 1.30% in a split 2018 maturity to 2% in 2022.

The $237.84 million of Series 38-B non-AMT bonds were priced at par to yield from 1.75% and 1.85% in a split 2022 maturity to 2.95% in 2028. A 2032 maturity was priced at par to yield 3.40%, a 2037 maturity was priced at par to yield 3.85%, a 2041 maturity was priced at par to yield 3.95% and a 2047 planned amortization class 2047 maturity was priced as 4s to yield about 2.15% with an average life of five years.

The deal is rated Aa2 by Moody’s and AA by S&P.

In the competitive arena, the Tulsa Public Facilities Authority, Okla., sold $115.3 million of Series 2017 capital improvement revenue bonds.

Mesirow Financial won the deal with a true interest cost of 2.64%. Pricing information was not available.

The deal is rated AA-minus by S&P.

Secondary market

Top-shelf municipal bonds strengthened on worries about the growing political problems that the Trump Administration is having in Washington.

“Political news today was causing an uproar, but our market was very thin, [and I’m] not shocked at yields going down," said one New York trader. "There was lots of room to move and all deals did well.”

The yield on the 10-year benchmark muni general obligation fell seven basis points to 2.02% from 2.09% on Tuesday, while the 30-year GO yield dropped eight basis points to 2.88% from 2.96%, according to the final read of Municipal Market Data's triple-A scale.

The yield on the two-year Treasury fell to 1.24% from 1.29% on Tuesday, while the 10-year Treasury yield dropped to 2.21% from 2.33%, and the yield on the 30-year Treasury bond decreased to 2.90% from 2.99%.

“It was a typical reaction of a market caught off-pace, it was an exacerbated move,” said the trader. “Now the Fed [hiking in June] is in jeopardy, and for however long this will go on for, it’s going to affect domestic and global growth, and has taken everyone’s mind off of where it should be, which is policy.”

In late trading, the Dow Jones Industrial Average fell 1.55% while the S&P 500 Index declined 1.55% and the NASDAQ dropped 2.22%.

The 10-year muni to Treasury ratio was calculated at 91.1% on Wednesday, compared with 89.9% on Tuesday, while the 30-year muni to Treasury ratio stood at 99.3%, versus 99.0%, according to MMD.