Two New York issuers are making their presence felt on Tuesday as they come to market with over $2 billion in combined sales.

Underwriters held a second day of retail orders for the New York City Transitional Finance Authority’s $1 billion of building aid revenue bonds. On Monday, Jefferies priced the TFA’s tax-exempt fixed-rate bonds into a supply starved market with sources saying $712 million of retail orders were placed. The institutional pricing is scheduled for Wednesday with the TFA also competitively selling $73 million of taxable fixed-rate bonds.

Buyside demand seemed to resurface in a big way on the second day of the retail order period for the TFA deal, according to a Dallas underwriter.

Investors made an appearance and exhibited good early demand for the deal, as its retail order period took place while the Municipal Market Data's triple-A general obligation scale held steady and the Treasury market was unchanged to slightly better — providing a strong backdrop for the sale, the trader said.

“There is good demand and buyers are not holding on to their money in fear of something else going on in the market,” he said.

He added there was a lot of “chatter” about the deal Tuesday and the pre-market yields were “not too conservative, but more conservative than usual.”

“Given the positive reception on the retail side, and depending on the reception on the institutional side, there is a good chance they may bump the levels” in the institutional pricing, the trader added.

He said the TFA sale will be the deal of the week as it is considered a benchmark by the market given its size, name recognition and market frequency.

“It’s New York and everyone has their eyes open when they come to market,” he said.

On Tuesday, the Dormitory Authority of the State of New York sold about $1.3 billion of bonds in five competitive sales.

Bank of America Merrill Lynch won DASNY’s $377.69 million of bidding group 4’s Series 2018A state sales tax revenue bonds with a true interest cost of 3.9763%.

BAML also won the $364.81 million of bidding group 2’s Series 2018A state sales tax revenue bonds with a TIC of 3.5235%.

And BAML won the $349.09 million of bidding group 3’s Series 2018A state sales tax revenue bonds with a TIC of 3.9906%.

Goldman Sachs won the $171.31 million of bidding group 1’s Series 2018A state sales tax revenue bonds with a TIC of 2.4015%.

Wells Fargo Securities won the $66.71 million of the Series 2018B taxable state sales tax revenue bonds with a TIC of 2.6029%.

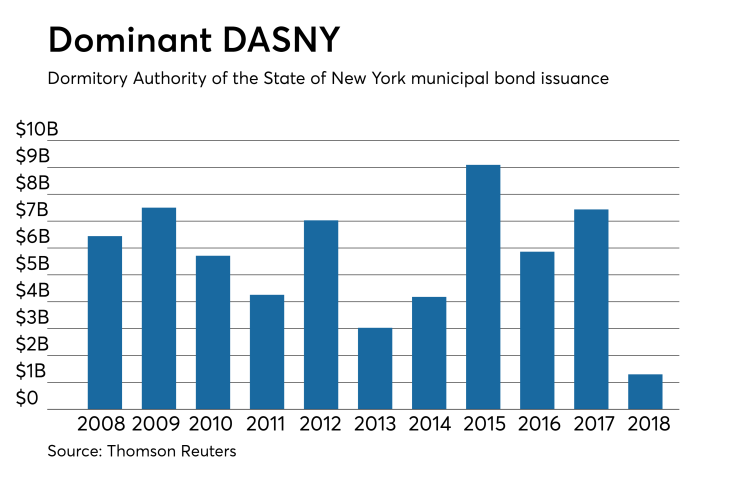

DASNY is one of the biggest municipal bond issuers in the United States. Since 2008, it has sold over $60 billion of bonds, with the most issuance occurring in 2015 when it offered $9.09 billion of securities. The lowest amount it issued prior to this year was in 2013 when it sold $3.02 billion of bonds.

Tuesday’s bond sales

NYC TFA BARBs:

Retail Day2:

Retail Day1:

DASNY bonds:

Bond Buyer 30-day visible supply at $10.06B

The Bond Buyer's 30-day visible supply calendar increased $174.9 million to $10.06 billion on Tuesday. The total is comprised of $4.89 billion of competitive sales and $5.16 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 38,340 trades on Monday on volume of $9.24 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 15.229% of the market, Lone Star State taking 14.659%, and the Empire State taking 11.091%.

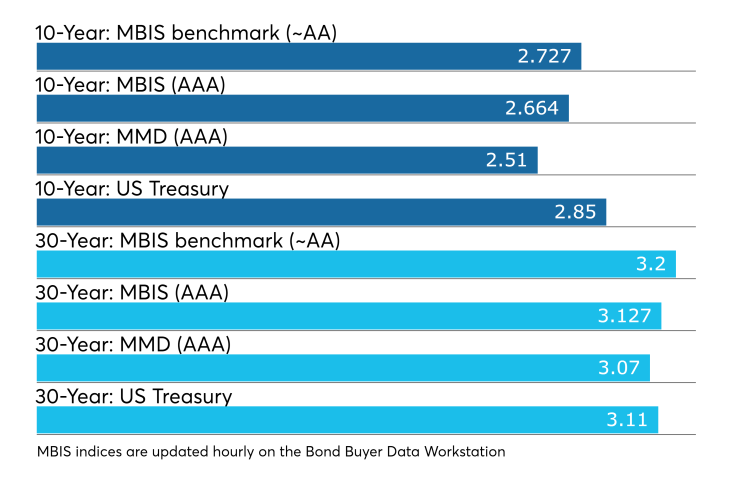

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.