Top-rated municipal bonds finished weaker on Wednesday, sending yields as much as four basis points higher, according to traders, as two large deals from New York issuers priced.

Primary market

Morgan Stanley priced the Dormitory Authority of the State of New York’s $1.74 billion of Series 2017A general purpose state personal income tax revenue bonds for institutional investors after holding a one-day retail order period.

The deal was priced for institutions to yield from 0.99% with a 2% coupon in 2019 to approximately 3.345% with a 3.25% coupon in 2040. The 2018 maturity was offered as a sealed bid.

On Tuesday, the issue was priced for retail to yield from 0.97% with a 2% coupon in 2019 to approximately 3.345% with a 3.25% coupon in 2040.

The deal is rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings.

“The deal saw a lot of interest,” one New York trader said, adding that it was priced attractively, with yields rising on the short end from Tuesday's retail offering.

Citigroup priced the New York Metropolitan Transportation Authority’s $744.95 million of climate bond certified Series 2017B transportation revenue green bonds for retail investors ahead of the institutional pricing on Thursday.

The $444.95 million of Subseries 2017B-1 bonds were priced for retail to yield from 0.97% with a 3% coupon in 2018 to 3.03% with a 5% coupon in 2038. A 2042 maturity was priced as 4s to yield 3.44% and a 2047 maturity was priced as 5s to yield 3.15%. The 2052 and 2057 maturities were not offered to retail.

The $300 million of Subseries 2017B-2 bonds were priced to yield from 1.58% with 3% and 5% coupons in a split 2022 maturity to 2.44% with a 5% coupon in 2028.

The deal is rated A1 by Moody’s, AA-minus by S&P and Fitch Ratings and AA-plus by Kroll Bond Rating Agency.

The deal was increased from an expected $500 million. Last week, the MTA competitively sold $500 million of transportation revenue bond anticipation notes in a sale that was decreased from the $700 million originally planned.

Citi also priced the Allentown Neighborhood Improvement Zone Development Authority, Pa.’s $214.23 million of Series 2017 tax revenue bonds for the City Center refunding project.

The issue was priced to yield 3.50% with a 5% coupon in 2022, 4.00% with a 5% coupon in 2027, 4.50% with a 5% coupon in 2032 and 4.75% with a 5% coupon in 2042.

The deal is rated Ba1 by Moody’s.

JPMorgan Securities priced the Washington Metropolitan Area Transit Authority’s $200.37 million of gross revenue transit refunding bonds.

The $150.66 million of Series 2017A-1 bonds were priced as 5s to yield from 1.22% in 2020 to 2.65% in 2032.

The $49.71 million of Series 2017A-2 2019 crossover bonds were priced as 5s to yield 2.65% in 2032, 2.70% in 2033 and 2.75% in 2034.

The deal is rated AA-minus by S&P and Fitch.

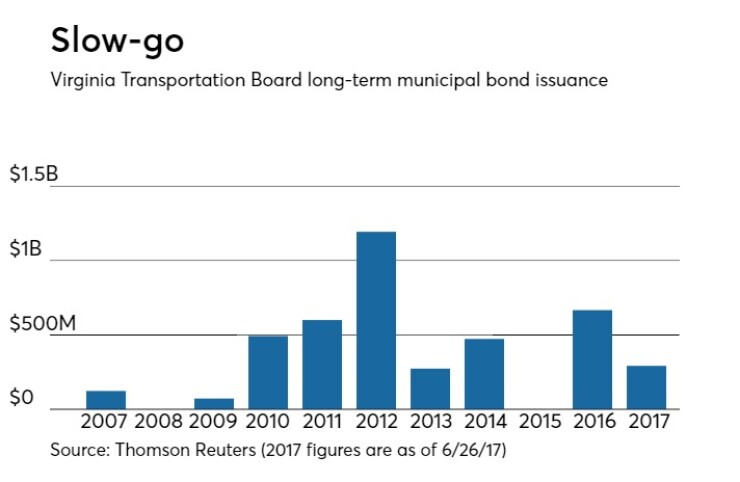

In the competitive arena on Wednesday, the Virginia Transportation Board sold $260.67 million of Series 2017 transportation capital projects revenue bonds.

Bank of America Merrill Lynch won the deal with a true interest cost of 3.16%. The issue was priced to yield from 0.91% with a 5% coupon in 2018 to 3.18% with a 4% coupon in 2038; a 2042 maturity was priced as 4s to yield 3.26%.

The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Since 2007 the board has sold about $4.19 billion of securities, with the highest issuance in 2012 when it sold roughly $1.19 billion. It did not come to market in 2008 or 2015.

Secondary market

The yield on the 10-year benchmark muni general obligation rose four basis points to 1.92% from 1.88% on Tuesday, while the 30-year GO yield increased four basis points to 2.74% from 2.70%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were mixed on Wednesday. The yield on the two-year Treasury fell to 1.35% from 1.37% on Tuesday, the 10-year Treasury yield rose to 2.22% from 2.20% and the yield on the 30-year Treasury bond increased to 2.77% from 2.74%.

The 10-year muni to Treasury ratio was calculated at 86.4% on Wednesday, compared with 85.6% on Monday, while the 30-year muni to Treasury ratio stood at 98.7% versus 98.5%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 44,053 trades on Tuesday on volume of $9.10 billion.

Puerto Rico bonds

Among the actively traded securities, Puerto Rico bonds were weaker on Wednesday.

In late trading, the Puerto Rico Commonwealth’s Series 2011C public improvement refunding 5.75s of 2037 were trading at a low price of 100.80 cents on the dollar in 21 trades totaling $1.51 million, according to the Municipal Securities Rulemaking Board’s EMMA website. On Tuesday, the 5.75s of 2037 were trading at a low price of 101.33 in four trades totaling $70,000.

The Commonwealth Highway and Transportation Authority’s pre-refunded refunding Series AA of 2003 highway revenue 5.5s of 2018 were trading at a low price of 104.453 cents on the dollar in 17 trades totaling $8.4 million. On the previous trading date of June 14, the 5.5s of 2018 were trading at a low price of 104.651 in two trades totaling 100,000.

Pre-refunded bonds typically trade over par, but the Commonwealth's 5.75s of 2037 are higher because they are insured by Assured Guaranty Municipal.