Top-rated municipal bonds finished stronger on Tuesday, according to traders, as the competitive arena heated up with the Dormitory Authority of the State of New York’s offering of four bond sales totaling almost $1.5 billion. The state of New Mexico brought two sales to market that totaled almost $370 million.

Primary market

DASNY sold $1.4 billion of state sales tax revenue bonds in four competitive sales.

Bank of America Merrill Lynch won the $517.02 million of Series 2017A Group C bonds with a true interest cost of 3.76%. The issue was priced to yield from 2.81% with a 5% coupon in 2040 to 3.19% with a 4% coupon in 2047.

Jefferies won the $469.02 million of Series 2017A Group B bonds with a TIC of 3.44%. The issue was priced as 5s to yield from 2.37% in 2030 to 2.78% in 2039.

RBC Capital Markets won the $337.89 million of Series 2017A Group A bonds with a TIC of 2.00%. The deal was priced as 5s to yield from 1.16% in 2021 to 2.25% in 2029; maturities in 2019 and 2020 were sold and not available.

Citigroup won the $72.78 million of taxable Series 2017B bonds with a TIC of 1.71%. The deal was priced at par to yield 1.40% in 2019, 1.70% in 2020 and 1.86% in 2021.

The deals are rated AAA by S&P Global Ratings and AA-plus by Fitch Ratings.

New Mexico competitively sold $369.78 million of bonds in two separate sales.

Citigroup won the $300.31 million of capital projects general obligation and GO refunding bonds with a TIC of 1.56%. The $148.52 million of Series 2017A GOs were priced as 5s to yield from 0.87% in 2018 to 2% in 2027. The $151.79 million of Series 2017B refunding GOs were priced as 5s to yield from 0.87% in 2018 to 1.68% in 2025.

Morgan Stanley won the $69.47 million of Series 2017A severance tax bonds with a TIC of 1.74%.

The GOs are rated Aa1 by Moody’s Investors Service and AA by S&P and the severance tax bonds are rated Aa2 by Moody’s and AA-minus by S&P.

In the negotiated sector, Loop Capital Markets priced and repriced the New Jersey Turnpike Authority’s $650.05 million of Series 2017B turnpike revenue bonds.

The issue was repriced to yield 1.96% with a 5% coupon in 2025 and from 2.32% with a 5% coupon in 2027 to 3.35% with a 4% coupon in 2037; a 2040 maturity was priced as 5s to yield 3.12%.

The deal is rated A2 by Moody’s, A-plus by S&P and A by Fitch.

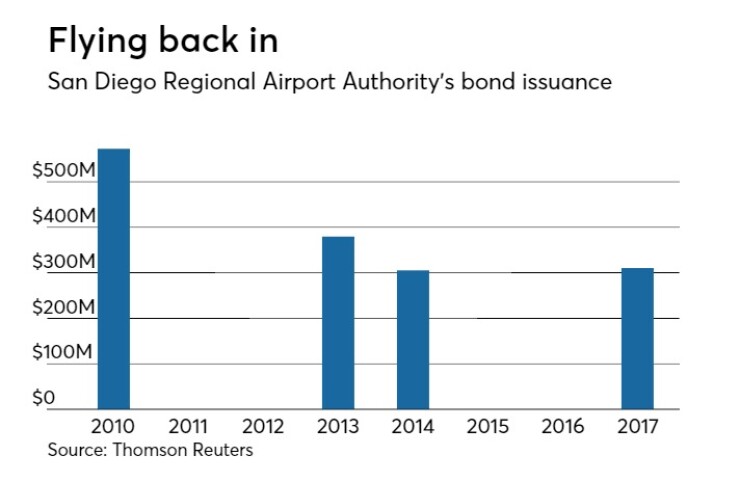

Morgan Stanley priced and repriced the San Diego Regional Airport Authority’s $293.36 million of subordinate airport revenue bonds consisting of Series 2017A bonds not subject to the alternative minimum tax bonds and Series 2017B non-AMT bonds.

The $147.08 million of Series 2017A non-AMT bonds were repriced as 4s to yield 0.87% in 2018 and as 5s to yield from 0.93% in 2019 to 2.97% in 2037, 3.03% in 2042 and 3.08% in 2047.

The $146.28 million of Series 2017B AMT bonds were repriced as 5s to yield from 1.04% in 2019 to 3.21% in 2037, 3.24% in 2042 and 3.29% in 2047.

The deal is rated A2 by Moody’s and A by S&P and Fitch.

Since 2010, the airport authority has issued about $1.5 billion of bonds, with the most issuance occurring in 2010 when it sold almost $573 million of debt. The authority did not come to market in 2011, 2012, 2015 or 2016.

Morgan Stanley also priced the Chicago Transit Authority’s $226.88 million of refunding Series 2017 capital grant receipts revenue bonds.

The $91.06 million of federal transit administration section 5307 urbanized area formula funds refunding bonds were priced as 5s to yield from 2.09% in 2022 to 2.88% in 2026.

The $135.83 million of federal transit administration section 5337 state of good repair formula funds refunding bonds were priced to yield from 1.40% with a 2% in 2018 to 2.83% with a 5% coupon in 2026.

The deal is rated A by S&P and BBB by Fitch.

JPMorgan Securities priced the Indiana Finance Authority’s $110.63 million of Series 2017A hospital refunding revenue bonds for Parkview Health.

The issue was priced as 5s to yield from 0.99% in 2018 to 2.96% in 2030. The deal is rated Aa3 by Moody’s and AA-minus by S&P.

JPMorgan also priced the Virginia Small Business Financing Authority’s $234.80 million of Series 2017 senior lien revenue bonds for the 95 Express Lanes LLC project.

The issue, which is subject to the AMT, was priced as 5s to yield 3% in 2034 and 3.15% in 2040. The deal is rated BBB by S&P and Fitch.

Citi priced the Monroe County Industrial Development Agency, N.Y.’s $124.41 million of Series 2017 school facility revenue bonds for the Rochester Schools modernization project.

The issue was priced as 5s to yield from 0.96% in 2019 to 2.69% in 2033. The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

Barclays Capital priced the Connecticut Health and Educational Facilities Authority’s $250 million of Series 2014A revenue bonds as a remarketing for Yale University.

The bonds were repriced at par to yield 1.30% in 2048 with a mandatory put date in 2020. The deal is rated triple-A by Moody’s and S&P.

NYC plans $860M bond sale

New York City plans to sell about $860 million of general obligation bonds next week, the city announced on Monday.

The deal will consist of $800 million of tax-exempt fixed rate refunding bonds and $60 million of taxable fixed-rate reoffered bonds.

The tax-exempt part of the deal is slated to have a two-day retail order period starting on Monday, July 24, and be priced for institutions on Wednesday, July 26, by a group including book-running senior manager Bank of America Merrill Lynch, with Citigroup, Goldman Sachs, Jefferies, J.P. Morgan, Loop Capital Markets, Ramirez & Co., RBC Capital Markets and Siebert Cisneros Shank & Co., serving as co-senior managers.

Secondary market

The yield on the 10-year benchmark muni general obligation fell five basis points to 1.94% from 1.99% on Monday, while the 30-year GO yield dropped five basis points to 2.74% from 2.79%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were stronger on Tuesday. The yield on the two-year Treasury dipped to 1.35% from 1.36% on Monday, the 10-year Treasury yield dropped to 2.26% from 2.32% and the yield on the 30-year Treasury bond decreased to 2.85% from 2.91%.

The 10-year muni to Treasury ratio was calculated at 85.8%, compared with 86.4% on Monday, while the 30-year muni to Treasury ratio stood at 98.0% versus 96.5%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 36,208 trades on Monday on volume of $7.18 billion.