The municipal bond market will see a light new issue calendar next week as the Federal Reserve meeting on monetary policy puts a damper on new debt issuance.

Ipreo estimates weekly volume at $4.26 billion, down from a revised total of $7.95 billion in the prior week, according to updated data from Thomson Reuters. Average weekly volume in 2017 has been about $4.5 billion, off sharply from 2017’s average of over $6 billion a week.

Next week’s calendar is composed of $2.89 billion of negotiated deals and $1.37 billion of competitive sales.

Primary market

Topping next week’s slate are two deals from the Dormitory Authority of the State of New York totaling $931 million.

Wells Fargo Securities is set to price DASNY’s $606 million of Series 2018A tax-exempt and Series 2018B taxable revenue bonds for New York University on Thursday.

Goldman Sachs is set to price DANSY’s $325 million of revenue bonds for Columbia University of Tuesday after a one-day retail order period.

The deal is rated triple-A by Moody’s Investors Service and S&P Global Ratings.

Secondary market

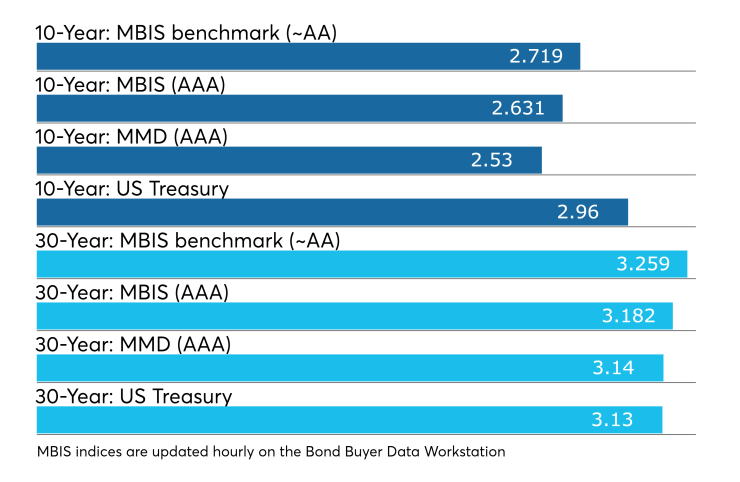

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields dropped as much as a basis point all along the curve.

Yields calculated on MBIS’ AAA scale were also stronger as yields declined as much as a basis point in the one- to 30-year maturities.

Munis were also stronger according to Municipal Market Data’s AAA benchmark scale, which showed yields declining as much as two basis points in the 10-year maturity and dropping from one to three basis points in the 30-year maturity.

Treasury bonds were weaker as the Dow Jones Industrial Average, S&P 500 Index and Nasdaq Composite Index were little changed.

Bond Buyer 30-day visible supply at $7.19B

The Bond Buyer's 30-day visible supply calendar increased $1.57 billion to $7.19 billion on Friday. The total is comprised of $3.86 billion of competitive sales and $3.33 billion of negotiated deals.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended April 27 were from New York and California issuers, according to

In the GO bond sector, the New York City zeroes of 2042 traded 22 times. In the revenue bond sector, the New York Transportation Development Corp. 4s of 2036 traded 82 times. And in the taxable bond sector, the California 4.6s of 2038 traded 14 times.

Week's actively quoted issues

Virgin Island, New York and California names were among the most actively quoted bonds in the week ended April 27, according to Markit.

On the bid side, the Virgin Islands Public Finance Authority revenue 5s of 2029 were quoted by 48 unique dealers. On the ask side, the New York City GO 3.375s of 2038 were quoted by 255 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 25 dealers.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,691 trades on Thursday on volume of $13.93 billion.

New York, California and Texas were the states with the most trades, with the Empire State taking 15.278% of the market, the Golden State taking 15.135% and the Lone Star State taking 8.385%

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds reversed course and put cash back into the funds, according to Lipper data released on Thursday.

The weekly reporters saw $229.481 million of inflows in the week ended April 25, after outflows of $515.154 million in the previous week.

Exchange traded funds reported outflows of $12.637 million, after outflows of $60.766 million in the previous week. Ex-ETFs, muni funds saw $242.118 million of inflows, after outflows of $454.39 million in the previous week.

The four-week moving average remained negative at -$194.379 million, after being in the red at -$242.552 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $88.923 million in the latest week after outflows of $83.861 million in the previous week. Intermediate-term funds had inflows of $67.332 million after inflows of $16.059 million in the prior week.

National funds had inflows of $257.056 million after outflows of $421.893 million in the previous week. High-yield muni funds reported inflows of $177.482 million in the latest week, after inflows of $45.728 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.