Requests for municipal bond identifiers rose in June for the fourth month in a row, CUSIP Global Services said on Wednesday. The rise was mostly due to a gain for note issuance, the company said.

The total of identifier requests of all municipal securities, which includes bonds, long-term and short-term notes and commercial paper, rose 14.1% from May. The aggregate total for all municipals totaled 1,533 in June, the highest level since November 2017.

However, on a year-over-year basis, total muni CUSIP requests have fallen17% from the same period in 2017, reflecting the slowdown in volume during the first quarter of 2018.

Before March, muni bond issuance had been trending lower after the passage of the Tax Cuts & Jobs Act, which repealed advanced refunding of muni bonds.

“Municipal issuers have driven CUSIP request volume to a level we haven't seen since November of last year," said Gerard Faulkner, Director of Operations for CUSIP. "The increase is likely driven by a combination of pent-up demand and a desire to secure funding before the Federal Reserve raises interest rates again."

Among top state issuers, CUSIPs for scheduled public finance offerings from New York, Texas, and Wisconsin were the most active in June.

Primary market

The Dormitory Authority of New York competitively sold $1.79 billion of state sales tax bonds in five deals. Strong demand for the bonds exhibited the pent-up appetite for new paper amid a supply starved market, according to a New York trader.

Morgan Stanley won the $492.385 million of Series 2018C Bidding Group 4 bonds with a true interest cost of 3.8105%.

Bank of America Merrill Lynch won the $447.285 million of Series 2018C Bidding Group 3 bonds with a TIC of 3.3244%. BAML also won the $406.81 million of Series 2018C Bidding Group 2 bonds with a TIC of 2.3391%.

JPMorgan Securities won the $372.36 million of Series 2018C Bidding Group 1 bonds with a TIC of 1.7955%. And Morgan Stanley won the $73.97 million of Series 2018D taxable bonds with a TIC of 3.0494%.

The deals are rated AAA by S&P Global Ratings and AA-plus by Fitch Ratings. The financial advisors are Public Resources Advisory Group and Rockfleet Financial Services; bond counsel are Hawkins Delafield and Holley James.

“It was a riot on these things,” the New York trader said, noting he observed nine firms bidding on the competitive offerings.

“There was very strong bidding — all the big guys were all over this thing trying to get it,” he added. “Everyone is looking to buy new issues — all the demand is primary driven. On the new issues there’s definitely a food fight.”

The DASNY deal in particular was appetizing for investors due to its reputation as a strong credit, according to the trader. “It’s a great name, triple-A and double-A plus, great quality, and a great name that’s different — it doesn’t come very often,” the trader said, explaining these were sales tax bonds, compared to DASNY’s more frequent personal income tax credit.

Overall, he said municipals showed some evidence of getting “a little rich to Treasuries” because of the week’s supply flurry amid the July reinvestment demand. In addition, he said the headlines regarding the tariff wars may be hurting the stock market, but bonds remained strong Wednesday.

Most of the demand he has observed lately is 10 years and under. “People are still concerned and still want shorter paper,” he said. “Institutional investors have tons of money and a lot of bonds maturing,” he added, noting demand for New York paper should ramp up even more, with a large amount of calls by the Port Authority of New York & New Jersey slated for July 15.

“There’s lots of money, but not a lot of bonds,” he added.

Also on Wednesday, the Metropolitan Atlanta Rapid Transit Authority competitively sold $165.875 million of Series 2018A sales tax revenue bonds.

Citigroup won the bonds with a TIC of 2.1428%. Financial advisors are Hilltop Securities, First Tryon Advisors and TKG & Associates; the bond counsel is Holland & Knight. The deal is rated Aa2 by Moody's Investors Service and AA-plus by S&P.

In the negotiated sector, Morgan Stanley priced the Trustees of the California State University’s $495.35 million of Series 2018A systemwide revenue bonds for retail investors ahead of the institutional pricing on Thursday.

The deal is rated Aa2 by Moody’s and AA-minus by S&P.

Citi also priced the San Diego Unified School District, Calif.’s $200 million of Series 2018-19A tax and revenue anticipation notes. The TRANs are rated SP1-plus by S&P.

BAML priced the State of New York Mortgage Agency’s $125 million of homeowner mortgage revenue bonds, consisting of Series 211 bonds not subject to the alternative minimum tax and Series 212 AMT bonds.The SONYMA deal is rated Aa1 by Moody’s

BAML also priced Houston, Texas’ $249.08 million of Series 2018C combined utility system first lien revenue refunding bonds. The deal is rated Aa2 by Moody’s and AA by Fitch.

Piper Jaffray priced Texas’ $239.16 million of Series 2018B general obligation water financial assistance refunding bonds, Water Infrastructure Fund, Subseries 2018B-1, 2018B-2, and 2018B-3. The deal is rated triple-A by Moody’s, S&P and Fitch.

Since 2008, Texas hold sold nearly $3.5 billion of bonds, with the most issuance occurring in 2013 when it sold $640.6 million of bonds. The state did not come to market in 2016.

Strong investor appetite will continue to be present for the heavier municipal calendar pricing this week given the ample summer reinvestment needs offset by indications that supply will be limited in coming weeks, according to Jeffrey Lipton, head of municipal research and strategy and fixed income research at Oppenheimer & Co. Inc.

"In the aggregate, we do not expect to see any dramatic shifts in new-issue volume through year end," Lipton said in a July 9 municipal report. “We can, however, anticipate further increases in the new-money component as issuers bond for essential infrastructure needs,” he said.

Some of that is occurring this week with some of the large new issue offerings, such as DASNY in New York and large California offerings, which are in high demand, sources said.

“Munis can be expected to offer investment opportunities through the second half of the year,” Lipton wrote. “Market technicals are currently supportive of additional performance and the asset class provides quality attributes and portfolio diversification in terms of geographic, sector, credit and structural exposure.”

Lipton suggests a barbell strategy is likely to be a prudent strategy through year end.

“We still believe that there should be an allocation to longer-dated maturities,” he said, but cautioned duration-conscious investors against moving out beyond 15 years as the yield pick-up does not provide appropriate compensation.

Overall, municipals should be able to overcome any global uncertainty.

“There is likely to be ongoing volatility tied to global trade issues, and this could become more pronounced if there is a belief that economic underpinnings are beginning to weaken,” he said.

“As a consequence of escalating trade tensions, munis would be well-positioned to not only outperform UST, but corporate bonds as well,” Lipton continued. “We would highlight that the broader and steeper the tariffs become, the wider the reach across corporate industries.”

Wednesday’s sales

New York:

Georgia:

California:

Texas:

Bond Buyer 30-day visible supply at $10.89B

The Bond Buyer's 30-day visible supply calendar decreased $1.04 billion to $10.89 billion on Thursday. The total is comprised of $3.48 billion of competitive sales and $7.42 billion of negotiated deals.

Secondary market

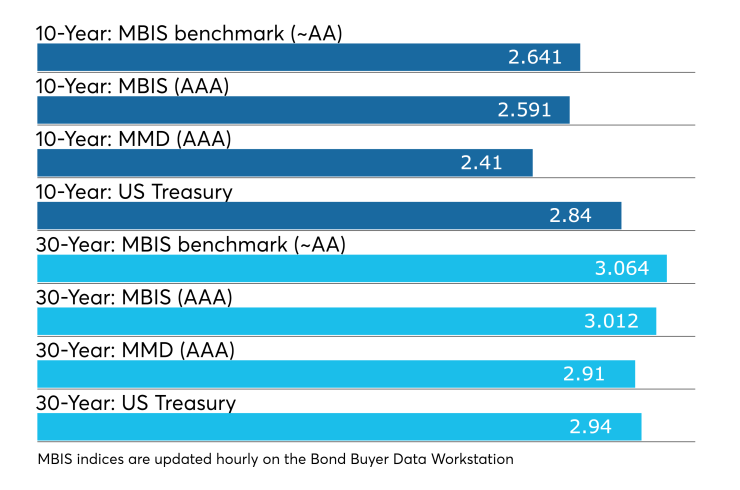

Municipal bonds were stronger on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS’ AAA scale falling as much as two basis points across the curve.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the 10-year muni general obligation yield falling two basis points while the 30-year muni maturity yield remained unchanged.

Treasury bonds were stronger as stocks traded lower.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 84.7% while the 30-year muni-to-Treasury ratio stood at 99.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,324 trades on Tuesday on volume of $10.34 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 17.763% of the market, the Empire State taking 12.485% and the Lone Star State taking 9.105%.

Treasury sells $22B re-opened 10-year notes

The Treasury Department auctioned $22 billion of 9-year 10-month notes with a 2 7/8% coupon at a 2.859% high yield, a price of 100.131750. The bid-to-cover ratio was 2.57.

Tenders at the high yield were allotted 14.27%. All competitive tenders at lower yields were accepted in full. The median yield was 2.820%. The low yield was 2.388%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.