A federal court in Atlanta Thursday dismissed an appeal challenging Jefferson County, Alabama’s exit from Chapter 9 bankruptcy.

The U.S. Court of Appeals for the Eleventh Circuit

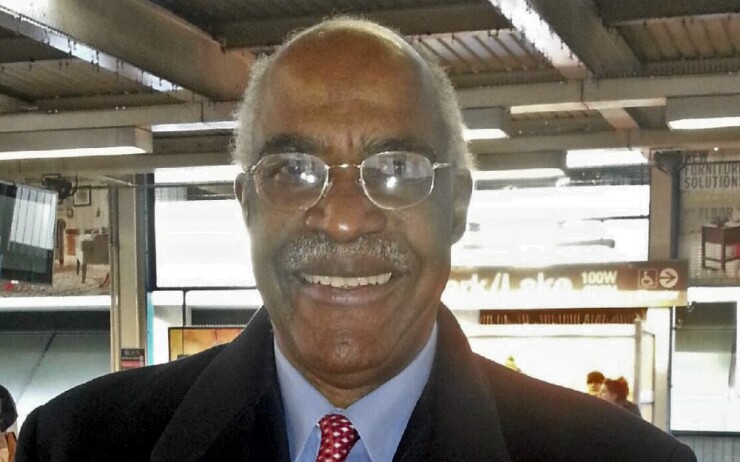

County Commission President Jimmie Stephens said the ruling is a successful outcome and it closes “the final chapter in our saga of bankruptcy.”

Attorney Calvin Grigsby, who represents the ratepayers, said the ruling is a “completely political opinion” and that he will ask for a rehearing.

Jefferson County filed for reorganization on Nov. 9, 2011. The county emerged from bankruptcy in December 2013 after closing on $1.8 billion of 40-year sewer warrants to write down $3.2 billion of old sewer debt, resulting in an overall 40% haircut to bondholders.

The case remained alive because of the appeal, making it one of the longest ongoing Chapter 9 cases among large municipalities, according to bankruptcy attorney James Spiotto.

The case was remanded to the district court for dismissal of the ratepayers' appeal.

Jefferson County Commissioner David Carrington, who led the county’s negotiations during its Chapter 9 case, said the county is pleased.

“We were always confident in our Chapter 9 plan of adjustment,” he said, adding that the long running case was “a minor irritation that unfortunately cost the citizens of Jefferson County hundreds of thousands of dollars in frivolous litigation fees that could have been used for capital improvements to the sewer system.”

Appellate Judge Adalberto Jordan, who wrote the ruling on behalf of three judges who heard oral arguments in December 2016, focused on the fact that the ratepayers did not seek a stay to delay the implementation of the county’s bankruptcy plan after U.S. Bankruptcy Judge Thomas Bennett confirmed it on Nov. 22, 2013.

Eleven days after Bennett confirmed the plan, the county closed on $1.8 billion of new, 40-year sewer warrants sold in the bond market to write down $3.2 billion of old sewer debt, resulting in an overall 40% haircut to bondholders.

“The county and others have taken significant and largely irreversible steps in reliance on the unstayed plan confirmed by the bankruptcy court,” Jordan wrote. The “new warrants were sold based on a commitment - backed up by an unstayed court order - to set sewer rates at particular amounts over the course of the next 40 years.”

The county’s confirmed Chapter 9 exit plan included a requirement that the bankruptcy court retain jurisdiction over the case to ensure that county commission’s sewer system rates at levels that will service the debt over the life of the warrants.

The ratepayers challenged that provision and asked the district court to strike it from the plan as a violation of the constitution.

“The relief sought here, even if limited to striking the provision giving the bankruptcy court jurisdiction with respect to future rates, would seriously undermine actions taken in reliance on the confirmation order,” the appellate ruling said. “We think it is fair to assume that, at the very least, whoever ultimately held those warrants would be adversely affected.”

The ruling concurred with Jefferson County’s contention that the appeal was mooted when the sale of the new sewer warrants closed, and that unwinding the deal would inequitably affect those who purchased the sewer warrants in reliance of the plan’s confirmation.

“The county argues that the doctrine of equitable mootness bars the ratepayers’ appeal from the bankruptcy court, and that the district court erred in concluding otherwise. We agree,” said the ruling. “We conclude that the case is not constitutionally moot, but hold that it is equitably moot, and therefore reverse and remand for dismissal of the ratepayers’ appeal from the bankruptcy court’s confirmation order.”

Grigsby said Thursday that the court’s decision looks at what is “equitable” only from the viewpoint of the bondholders who are getting paid and “totally disregards the rights of the households and businesses” that will repay the sewer debt.

He also said the court’s finding “violates all prior Supreme Court decisions and every other equitable mootness decision in other circuit courts.

“This decision is of great national importance because it allows the taking of property of individual homeowners and businesses without a hearing…in violation of due process,” he said. “The opinion in my view is irrational because a county commission should not be allowed to use federal bankruptcy court to take real property without a hearing.”

Grigsby also said the lower court case should be allowed to proceed in order to consider the ratepayers' arguments regarding the amount of debt sewer ratepayers must repay because it was inflated in part by bribes, no-bid contracts, waste and corruption that tainted building projects financed with sewer warrants.

Spiotto said the 11th Circuit’s ruling is consistent with the bankruptcy court’s approval of the plan.

“It’s a good decision,” he said. “I think it makes rational sense and the ratepayers concerns were at best somewhat technical from their side because clearly the plan anticipated the approval of rates to cover the bond debt, the operating expenses and capital improvements of the utility.”

He said the ratepayers will find it difficult to get the judges to reconsider the decision.

“They have to show a basis for a rehearing,” he said. “Once you have a decision that is well reasoned it’s a very uphill battle.”

Stephens said the appellate ruling marks an important turning point.

“It represents an ending but more importantly a new beginning for our great county,” he said. “This ruling further validates the course of action taken to navigate Jefferson County through its financial troubles.”