The Chicago Board of Education lowered borrowing costs as it returned to the market on Thursday, selling $1.03 billion of general obligation bonds. In secondary trading, municipals ended weaker with Treasuries.

Primary market

JPMorgan Securities priced and repriced the Chicago BOE's $1.025 billion of Series 2017 unlimited tax dedicated revenue general obligation and GO refunding bonds.

The $354.175 million of Series 2017C refunding GOs were repriced as 5s to yield from 3.40% in 2019 to 4.55 in 2027, 4.63% in 2030 and 4.70% in 2034. The $79.94 million of Series 2017D refunding GOs were repriced as 5s to yield from 3.40% in 2019 to 4.55% in 2027 and 4.66% in 2031.

The $22.205 million of Series 2017E refunding GOs were repriced as 5s to yield 3.94% in a 2021 bullet maturity. The $165.755 million of Series 2017F refunding GO were repriced as 5s to yield from 3.00% in 2018 to 4.28% in 2024. The $122.925 million of Series 2017G refunding GOs were repriced as 5s to yield 4.70% in 2034 and 4.78% in 2044.

The $280 million of Series 2017H GOs were priced as 5s to yield 4.72% in 2036 and 4.80% in 2046.

Two 10-year maturities in the deal landed at 4.55%, a 255 basis point spread to the MMD AAA benchmark. Strong demand shaved about five basis points off those maturities. The district’s long bond in 2044 landed at a yield of 4.78%, a 212bp spread. That was down by 20 basis points from the preliminary scale.

The preliminary wire more closely reflected recent trading levels but the final pricing “was bumped 20 basis points in some spots” lowering yields, said Daniel Berger, municipal strategist at MMD.

In the district’s July sale structured in three maturities, the district paid rates of 7.25% on a 2030 bond, a 489 basis point spread to the AAA; a 7.55% rate on a 2042 bond, a 475 basis point spread; and 7.65% on a 2046 bond, a 481 basis points spread.

The district in early 2016 paid a punishing rate of 8.5%, 580 basis points over the MMD AAA as questions over its market access were raised.

“I was a surprised at the strong demand and their ability to bump the deal, and partly when they upsized the deal by over $100 million,” said one portfolio manager. “The 2046 maturity was bumped 20 basis points to a 213 point spread from the high-grade scale.”

This series is rated B by S&P Global Ratings, BB-minus by Fitch Ratings and BBB by Kroll Bond Rating Agency.

"The BOE GO deal was well subscribed, but I am curious to see how it performs on Friday when it's free to trade,” said one Midwest trader. “High-yield munis still very much in demand.”

On Wednesday, JPMorgan priced the BOE’s $64.9 million Series 2017 dedicated capital improvement tax bonds. That series is rated A by Fitch Ratings and BBB by Kroll.

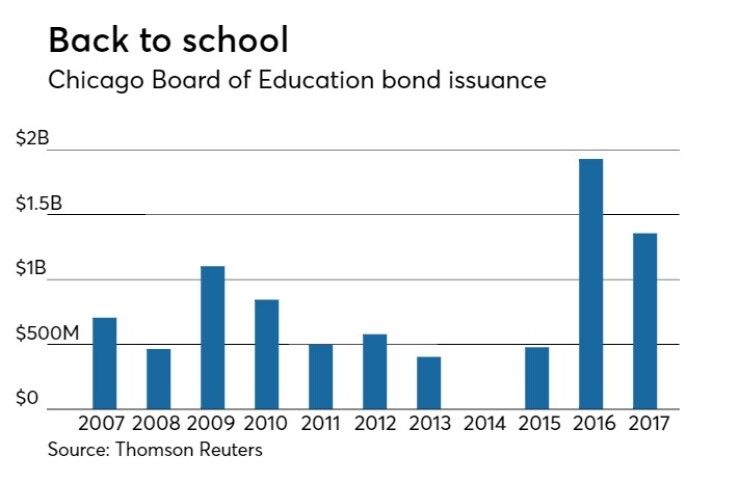

Since 2007, the BOE has sold about $8.36 billion of debt, with the most issuance occurring in 2016 when it issued $1.93 billion of bonds. The board did not come to market in 2014.

Citigroup priced the South Jersey Port Corp.’s $255 million of Series 2017A and B subordinated marine terminal revenue bonds.

The $24.73 million of Series 2017A tax-exempts were priced as 5s to yield 4.18% in a 2049 bullet maturity. The $240.28 million of Series 2017B bond subject to the alternative minimum tax were priced as 5s to yield from 3.12% in 2024 to 4.31% in 2037, 4.35% in 2042 and 4.40% in 2048.

The deal is rated Baa1 by Moody’s Investors Service.

Bank of America Merrill Lynch priced the Pittsburgh Water and Sewer Authority’s $164.85 million of Series 2017A tax-exempt and Series 2017B taxable water and sewer system first lien revenue refunding bonds.

The $159.255 million of Series 2017A tax-exempts were priced to yield from 1.34% with a 5% coupon in 2018 to 3.13% with a 3% coupon in 2032. The series is insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P.

The $5.595 million Series 2017B taxables were priced at par to yield 1.891% in a 2018 bullet maturity. The series was rated A2 by Moody’s and A by S&P.

In the competitive arena, Dallas sold $302.85 million of Series 2017 GO refunding and improvement bonds.

RBC Capital Markets won the bonds with a true interest cost of 2.8850%. The issue was priced as 5s to yield from 1.23% in 2018 to 2.73% in 2031. A 2033 maturity was priced as 3s to yield approximately 3.167%, a 2035 maturity was priced as 3 1/8s to yield approximately 3.278% and a 2037 maturity was priced as 3 1/4s to yield 3.36%. The deal is rated AA-minus by S&P and AA by Fitch.

Charleston County, S.C., sold $212.5 million of GOs in three separate offerings.

JPMorgan Securities won the $103.18 million of Series 2017A GO capital improvement bonds with a TIC of 2.8638%; BAML won the $93.615 million of Series 2017C GO transportation sales tax refunding GOs with a TIC of 2.320% and BAML also won the $15.705 million of Series 2017B GO refunding bonds with a TIC of 2.153%. The deals are rated triple-A by Moody’s, S&P and Fitch.

Secondary market

The yield on the 10-year benchmark muni general obligation rose one basis point to 2.00% from 1.99% on Wednesday, while the 30-year GO yield increased one basis point to 2.69% from 2.68%, according to a read of Municipal Market Data’s triple-A scale.

U.S. Treasuries were weaker on Thursday. The yield on the two-year Treasury rose to 1.71% from 1.68% on Wednesday, the 10-year Treasury yield gained to 2.36% from 2.33% and the yield on the 30-year Treasury increased to 2.80% from 2.78%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 84.9% compared with 85.3% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 96.1% versus 96.4%, according to MMD.

AP-MBIS 10-year muni at 2.278%, 30-year at 2.800%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was mixed in late trade.

The 10-year muni benchmark yield fell to 2.278% on Thursday from the final read of 2.295% on Wednesday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 43,957 trades on Wednesday on volume of $14.85 billion.

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $39.4 million, lowering total net assets to $129.20 billion in the week ended Nov. 13, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $1.03 billion to $129.24 billion in the previous week.

The average, seven-day simple yield for the 199 weekly reporting tax-exempt funds was unchanged from 0.47% in the previous week.

The total net assets of the 834 weekly reporting taxable money funds increased $5.38 billion to $2.586 trillion in the week ended Nov. 14, after an inflow of $553.9 million to $2.581 trillion the week before. The average, seven-day simple yield for the taxable money funds increased to 0.71% from 0.70% in the prior week.

Overall, the combined total net assets of the 1,033 weekly reporting money funds increased $5.34 billion to $2.715 trillion in the week ended Nov. 14, after inflows of $1.59 billion to $2.710 trillion in the prior week.

Yvette Shields contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on The Bond Buyer Data Workstation.