Municipals were sleepy on Monday, typical for the asset class after a quiet trading session on Friday where they outperformed Treasuries; some investors were looking ahead to the upcoming week’s supply, led by a pair of billion dollar deals from California and Oklahoma issuers.

“The market is ready to take on more supply and certainly Cal is going to bring it to us,” said Miles Benickes, managing director at underwriting firm and wealth manager Hilltop Securities in Los Angeles.

With much anticipation of the deal causing pent-up demand, he said, many retail customers have called to ask about its arrival.

Although the market has changed in recent months, Benickes said retail investors will still seek their usual preferred structures from the California offering — par bonds on either the short or long end, or bonds with a slight discount or premium.

“My expectation is that’s where the initial demand will be,” he said, adding there may be some demand for the intermediate bonds at levels similar to those seen in large deals that priced last week, including the New York State Thruway Authority offering.

Bonds priced to yield 3.5% to 3 ⅝% should pique buyers' interest, he said.

“I think it’s been a while since we have seen a Cal deal, and I think there will be a lot of pent up demand and it should get a very good reception,” Benickes said.

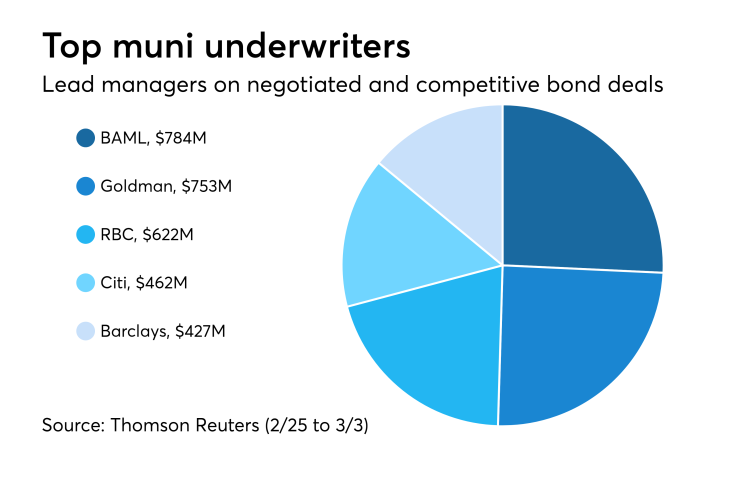

Previous week's top underwriters

The top municipal bond underwriters of last week included Bank of America Merrill Lynch, Goldman Sachs, RBC Capital Markets, Citi and Barclays, according to Thomson Reuters data.

In the week of Feb. 25 to March 3, BAML underwrote $784 million, Goldman $753 million, RBC $622 million, Citi $462 million and Barclays $427 million.

Previous session's activity

The Municipal Securities Rulemaking Board reported 37,945 trades on Friday on volume of $9.267 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 17.93% of the market, the Empire State taking 9.779% and the Lone Star State taking 8.806%.

Primary market

Ipreo estimates volume will jump to $7.52 billion, from the revised total of $3.08 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $5.12 billion of negotiated deals and $2.40 billion in competitive sales.

The top 2017 municipal bond issuer, the state of California, is set for its first sale of the year. Morgan Stanley is scheduled to price the Golden State’s $2.1 billion of general obligation various purpose and refunding bonds on Wednesday after a one day retail order period. The deal is rated Aa3 by Moody’s Investors Service, AA by S&P Global Ratings and AA-minus by Fitch Ratings.

Bank of America Merrill Lynch is slated to price the Oklahoma Development Finance Authority’s $1.2 billion of health system revenue and taxable bonds for the Oklahoma University Medicine Project on Tuesday. The deal is rated Baa3 by Moody’s and BB-plus by S&P, but portions of the deal are expected to be insured by Assured Guaranty Municipal Corp., and will be rated AA by S&P.

In the competitive arena, the state of Washington will is set to sell a total of $604.36 million in two sales — $491.95 million of various purpose GO bonds and $112.41 million of motor vehicle fuel tax GO bonds. Both deals are rated Aa1 by Moody’s, AA-plus by S&P and Fitch and will take place on Tuesday.

New York State to sell $215 competitively on Thursday

State Comptroller Thomas P. DiNapoli announced Monday that the state of New York will competitively sell $215.2 million of tax-exempt and taxable New York State general obligation bonds.

This coming Thursday, the Empire state expects to sell $146.2 million for new money transportation, education and environmental purposes. Depending on market conditions, the state also expects to sell $69 million to refund a portion of certain outstanding general obligation bonds to reduce the state’s debt service costs.

The net proceeds of $123.7 million of the new money portion of the Series 2018A tax-exempt bonds will finance projects authorized by the following voter-approved bond acts: Environmental Quality (1972), Environmental Quality (1986), Clean Water/Clean Air (1996), Rebuild and Renew New York Transportation (2005) and Smart Schools (2014). The net proceeds of $63.6 million of the refunding portion of the Series 2018A tax-exempt bonds will refund certain outstanding general obligation bonds. The Series 2018A tax-exempt bonds will mature over 14 years.

The net proceeds of $36.6 million of the Series 2018B taxable bonds will finance projects authorized by the following voter-approved bond acts: Environmental Quality (1972), Environmental Quality (1986), Clean Water/Clean Air (1996), Rebuild and Renew New York Transportation (2005) and Smart Schools (2014). The Series 2018B taxable bonds will mature over 10 years.

The net proceeds of $12.7 million of the Series 2018C tax-exempt refunding bonds will provide funds to refund certain outstanding state general obligation bonds. The Series 2018C bonds would mature over 9 years.

Tender auction, announcement

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the three-months incurred a 1.660% high rate, up from 1.645% the prior week, and the six-months incurred a 1.830% high rate, unchanged from 1.830% the week before.

Coupon equivalents were 1.690% and 1.873%, respectively. The price for the 91s was 99.5803891 and that for the 182s was 99.074833.

The median bid on the 91s was 1.630%. The low bid was 1.600%.

Tenders at the high rate were allotted 12.54%. The bid-to-cover ratio was 3.26.

The median bid for the 182s was 1.810%. The low bid was 1.790%.

Tenders at the high rate were allotted 15.34%. The bid-to-cover ratio was 3.19.

The Treasury Department said it will sell $65 billion of four-week discount bills Tuesday. There are currently $84.000 billion of four-week bills outstanding.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.