It will seem like Christmas in August for municipal investors when nearly $12 billion of new issuance arrives, though global developments may become a factor the market reception for the year’s largest supply bonanza.

The coming week’s anticipated volume is the largest in 2018 and more than double last week’s actual volume. It arrives amid a seasonal supply shortage and year-to-date drought that have left investors clamoring for tax-exempt paper.

Ipreo forecasts weekly bond volume at $11.8 billion, up from a revised total of $5.3 billion in the past week, according to updated data from Thomson Reuters. The calendar is composed of $11.1 billion of negotiated deals and $725.7 million of competitive sales. The upcoming weekly swell in supply far surpasses the $9.9 billion that was estimated for the week of May 14 to May 18, according to Ipreo.

While municipal investors have been eagerly awaiting such a boost in volume and demand trends are strong enough to support the supply growth, a New York trader said the tax-exempt arena could see a “regurgitation of the market as a result of news in Turkey and a flight to quality in Treasuries.” Turkey's currency fell to record lows against the U.S. dollar Friday amid the European country's political and economic crisis spurring investor concern that the fiscal turmoil could spread into financial markets around the world.

Before Friday, the municipal market has benefited from a positive environment for credit spreads and new issues, the trader said. "So far, the backdrop is good in terms of customers flush with cash, earnings, economic data, and consumer confidence; everything signals the green light for issuers accessing the capital markets and getting deals done,” he said.

“There is lot of money to be put to work and bonds have been coming at little or no new-issue concessions,” he continued. “Deals have been three to four times oversubscribed -- even this week with 10 to 11 or 12 issues there has been no disruption of secondary spreads and new issues were put away and all deals performed great.”

In addition, he said he has observed two-way trading flows, with customers taking some profits as spreads are tight and Treasuries have rallied in the midst of a positive backdrop that demonstrates the market’s willingness to absorb the large boost in supply ahead of a late summer slowdown in activity before Labor Day.

“But, I think these global concerns and where we stand when we walk in on Monday morning will be a consideration,” he said. “If we walk in on Monday and there is a rebound in equities and things have seemed to subside to some extent we will pick up here we left off,” he explained. “If there’s further development and we don’t, it will be tougher,” he added.

Primary market

Topping the new issue calendar is a $2.28 billion deal from the city and county of Denver.

Bank of America Merrill Lynch is expected to price the airport system subordinate revenue bonds on Tuesday. The offering consists of Series 2018A bonds subject to the alternative minimum tax and Series 2018B non-AMT bonds.

Proceeds of the sale will be used to refund certain revenue bonds. The deal is rated A2 by Moody’s Investors Service, A by S&P Global Ratings and A-plus by Fitch Ratings.

Also in the aviation sector, Miami-Dade County is coming to market with a $716.55 million issue.

JPMorgan Securities is expected to price the aviation revenue refunding bonds on Wednesday after a one-day retail order period. The offering consists of Series 2018A AMT bonds, Series 2018B non-AMT bonds and Series 2018C taxable bonds.

Proceeds of the sale will be used to finance some of the costs of the airport’s 2018-2022 capital program and to refund certain revenue bonds. The deal is rated A by S&P and Fitch, and AA-minus by Kroll Bond Rating Agency.

Also on tap, Citigroup is set to price the Allegheny County (Pa.) Hospital Development Authority’s $915 million of Series 2018A revenue bonds for the Allegheny Health Network Obligated Group on Wednesday. The deal is rated A by S&P.

Siebert Cisneros Shank & Co. is expected to price Connecticut’s $889.135 million of general obligation bonds on Wednesday after a one-day retail order period.

The issue consists of Series 2018E GOs, Series 2018F refunding GOs, Series 2018A taxable GOs. The deal is rated A1 by Moody’s, A by S&P, A-plus by Fitch and AA-minus by Kroll Bond Rating Agency.

Bond Buyer 30-day visible supply at $16.06B

The Bond Buyer's 30-day visible supply calendar increased $7.24 billion to $16.06 billion for Friday. The total is comprised of $1.77 billion of competitive sales and $14.29 billion of negotiated deals.

Secondary market

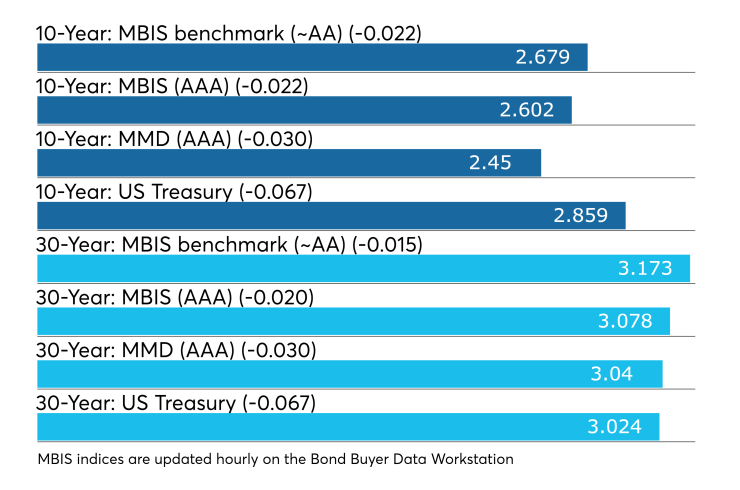

Municipal bonds were stronger on Friday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS’ AAA scale falling as much as one basis point in the two- to 30-year maturities and rising less than a basis point in the one-year maturity.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on the 30-year muni maturity declining by three basis points.

Treasury bonds were stronger as stock prices fell.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 85.7% while the 30-year muni-to-Treasury ratio stood at 100.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,987 trades on Thursday on volume of $17.281 billion.

Puerto Rico, California and New York were the municipalities with the most trades, with Puerto Rico taking 15.886% of the market, the Golden State taking 14.29% and the Empire State taking 9.8%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Aug. 10 were from Puerto Rico, California and Connecticut issuers, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 79 times. In the revenue bond sector, the California Statewide Communities Development Authority 5.5s of 2058 traded 74 times. And in the taxable bond sector, the New Haven, Conn., 4.834s of 2033 traded 22 times.

Week's actively quoted issues

Illinois, New York and California names were among the most actively quoted bonds in the week ended Aug. 10, according to Markit.

On the bid side, the Illinois Finance Authority revenue 5.25s of 2052 were quoted by 97 unique dealers. On the ask side, the NYC Transitional Finance Authority BARB 3.5s of 2047 were quoted by 293 dealers. And among two-sided quotes, the California taxable 7.7s of 2050 were quoted by 26 dealers.

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds reversed course and put cash back into the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $622.556 million of inflows in the week ended Aug. 8, after outflows of $368.353 million in the previous week.

Exchange traded funds reported inflows of $43.513 million, after outflows of $115.709 million in the previous week. Ex-ETFs, muni funds saw $579.043 million of inflows, after outflows of $252.643 million in the previous week.

The four-week moving average remained positive at $515.689 million, after being in the green at $522.791 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $369.991 million in the latest week after outflows of $294.317 million in the previous week. Intermediate-term funds had inflows of $167.562 million after inflows of $60.620 million in the prior week.

National funds had inflows of $565.261 million after outflows of $262.958 million in the previous week. High-yield muni funds reported inflows of $263.825 million in the latest week, after outflows of $78.037 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.