Municipal bond market participants were waiting for Wednesday afternoon’s Federal Open Market Committee interest rate announcement. Bonds were little changed in quiet morning activity.

Most analysts expect the Fed will raise its federal funds rate target rate to a range of 1.75% to 2%, with the possibility of at least one more increase this year.

Primary market

JPMorgan Securities restructured the New York City Housing Development Corp.’s $550.55 million of Series 2018C multi-family housing revenue sustainable neighborhood bonds on Wednesday.

The bonds are rated Aa2 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

In the competitive arena, the West St. Paul-Mendota Heights-Eagan Independent School District No. 197, Minn., sold $116.41 million of Series 2018A general obligation school building bonds under the Minnesota school district credit enhancement program.

Raymond James & Associates won the bonds with a true interest cost of 3.4571%.

Wednesday’s bond sales

New York:

Bond Buyer 30-day visible supply at $6.65B

The Bond Buyer's 30-day visible supply calendar decreased $2.57 billion to $6.65 billion on Wednesday. The total is comprised of $3.52 billion of competitive sales and $3.14 billion of negotiated deals.

Secondary market

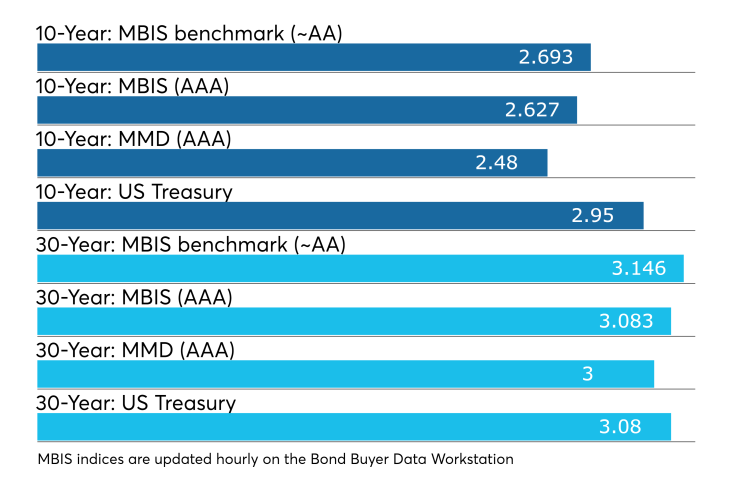

Municipal bonds were little changed on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose less than one basis point in the 10- to 30-year maturities and fell less than a basis point in the one- to nine-year maturities.

High-grade munis were mixed, with yields calculated on MBIS’ AAA scale rising less than one basis point in the 12- and 13-year and 20- to 29-year maturities, falling less than a basis point in the one- to 10-year and 14- to 18-year maturities and remaining unchanged in the 11-, 19- and 30-year maturities.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed yields rising as much as one basis point in the 10-year muni general obligation and remaining unchanged in the 30-year muni maturity.

Treasury bonds were slightly weaker as stock prices were slightly stronger.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 83.9% while the 30-year muni-to-Treasury ratio stood at 97.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,210 trades on Tuesday on volume of $13.307 billion.

New York, California and Texas were the states with the most trades, with the Golden State taking 14.089% of the market, the Empire State taking 12.649% and the Lone Star State taking 7.528%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.