WASHINGTON – The growth of Airbnb and other short-term housing rental sites could become a challenge to hotel occupancy tax revenue linked to some bonds.

Some cities and states are embracing this growth in the sharing economy by reaching agreements with Airbnb for the collection of occupancy taxes to avoid a drain on their revenues.

Critics say the agreements with Airbnb are often are on terms dictated by the firm that don't guarantee as much income as regular hotel occupancy taxes.

Last week the commonwealth of Puerto Rico signed a tax collection agreement with Airbnb to collect 7% on rentals on behalf of the Puerto Rican Tourism Company. That's less than Puerto Rico's 9% lodging tax, however.

"Airbnb has over 4,300 hosts and 7,100 listings in Puerto Rico," the commonwealth said in a press release. "From June 1st, 2016 to June 1st, 2017, Airbnb welcomed over 250,000 guests, an 83 percent increase from the year prior."

Last month Airbnb says it reached a similar agreement with the U.S. Virgin Islands.

The City Council in Sacamento, Calif. is scheduled to vote Tuesday to authorize an agreement with Airbnb beginning Sept. 1, 2017 that is expected to produce about $200,000 to $250,000 annually, mayoral spokeswoman Kelly Fong Rivas said in an email.

That's significant because Sacramento last month agreed to finance about $90 million bonds for convention center upgrades largely finance by hotel occupancy taxes.

The National Conference of State Legislatures earlier this month discussed this trend at a meeting held by its task force on taxation, because many states and communities are playing catch up.

“They are certainly losing out on enormous amounts of potential revenue in the sense that people are renting rooms as an alternative to hotel rooms,’’ said Michael Mazarov, a senior fellow with the state fiscal project of the Center on Budget and Policy Priorities.

“These companies are becoming very big and accounting for a lot of room rentals,’’ said Mazerov, who attended the discussion. “And state and local governments are definitely taking notice.’’

The growth in the marketplace for rentals through the so-called sharing economy by budget conscious tourists and business travelers is evident by the spread of other websites such as Tripping, FlipKey and HomeAway.

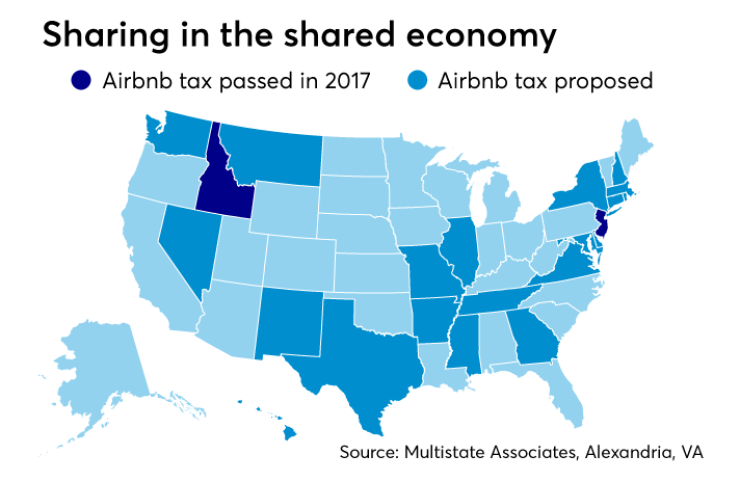

In 2016 eight tax-related bills on short-term housing rentals were enacted in six states, according to Liz Malm, a consultant for MultiState Associates in Alexandria, Va. who shared her findings with the National Conference of State Legislatures.

“Some are changing definitions of traditional lodging taxes to include these new technologies,’’ Malm said. “Some make collection optional. Some require it. Some pre-empt localities from doing things. Others authorize localities to do things.”

This year there were 86 bills proposed in 28 states and the District of Columbia covering the regulation or taxation of short-term housing rentals.

“This is just another example of the digital economy changing the way we have to think about tax policy,’’ Malm said.

The New Jersey Legislature last week sent to Gov. Christie legislation allowing the taxation of short-term housing rentals, making it the second state, in addition to Utah, to act this year.

Christie has not indicated whether he will sign the bill, a spokesman for the governor said in an email Friday.

New Jersey is one of 24 states with a lodging tax, according to the National Conference of States Legislatures. But none of New Jersey’s outstanding bonds have dedicated payments linked to hotel taxes, according to Willem Rijksen, spokesman for the New Jersey Treasury Department.

Lodging taxes at the state level run as high as 15% in Connecticut, 14.5% in the District of Columbia, 9.25% in Hawaii and 9% in New Hampshire and Vermont.

The new Las Vegas stadium that will be used by the relocated Oakland Raiders of the National Football League will be partly funded by the regional hotel occupancy tax.

Clark County – where the new Raiders stadium will be located -- has prohibited short-term housing rentals for about a decade, according to spokesman Erik Pappa.

“Our primary concern has been protecting the quality of life in our neighborhoods,’’ Pappa said in an email. “No one wishes to live next to a hotel, which is what short-term rentals become. We have seen enough complaints from residents to know that our approach is the right one for our citizens.’’

In the Las Vegas area, only the city of North Las Vegas permits Airbnb rentals, according to Mehmet Erdem of the University of Nevada, Las Vegas College of Hotel Administration.

“For Airbnb to survive and thrive, they have to play ball,’’ Erdem said. “It is in your best interest to look into ways where there is taxation and there is some sort of commitment to a local relationship. I think in the near term you are going to see a lot of back and forth between communities and Airbnb.’’

Some states and communities are embracing Airbnb as a source of revenue for both government and the residents who rent out a bedroom or entire home for extra income.

Airbnb’s website says it entered into 250 voluntary tax agreements through May with jurisdictions around the United States.

The company is aggressively pursuing this approach, having presented a video at the January meeting of the U.S. Conference of Mayors that featured positive comments from Detroit Mayor Mike Dugan, Tallahassee (Fla.) Mayor Andrew Gillum, New Orleans Mayor Mitch Landrieu and Jersey City Mayor Steven Fulop. Each praised the benefits of home sharing for their neighborhoods and the extra tax revenue their agreement with Airbnb has brought their city.

Other localities and states, however, have not been as quick to embrace this latest example of the sharing economy. Some have enacted zoning restrictions or limits on how many days a home can be used for short-term rentals.

And the voluntary agreements that Airbnb is offering to states and communities are under fire since the March release of a report underwritten by the American Hotel and Lodging Association.

Dan Bucks, a former executive director of the Multistate Tax Commission who authored the report, found that the Airbnb agreement contain unnecessary secrecy requirements.

“The agreements Airbnb is getting states and cities to sign do not require Airbnb to disclose all information relevant to its tax status, and they consciously shield with secrecy the identity and addresses of local lodging operators, or ‘hosts’ as Airbnb calls them,’’ Bucks said when he released the report. “They do not contain actual tax information. In short, they do not do what normal tax agreements do.”

Later that same month, the Multistate Tax Commission announced it would study amendments to its model law on lodging taxes.