Municipals were mixed on Thursday as the bond markets await Friday’s release of July’s employment report.

“Bond market participants are treating today as a typical summer Thursday, keeping an eye on the current news, but waiting for 8:30 a.m. tomorrow to provide further direction,” ICE Data Services said in a late day market comment.

“We expect lower but still pretty strong numbers for July, with total non-farm payrolls up 180,000, the unemployment rate slipping but still rounding to 4.0%, and average hourly earnings growth remaining at 0.2%. The average workweek should hold at 34.5 hours once again,” IFR Markets said in a Thursday market comment. “Once again, labor market growth far above steady state should help keep the Fed in a slightly more aggressive state than they began the year, which is to say headed more clearly toward four 2018 rate hikes. The only possible hitch is that the unemployment rate looks now like it might fall a little more slowly than they’d recently forecast, but that’s a minor issue; it remains well below their estimate of the long-run value.”

With most new issues priced earlier in the week, there was a lot more inactivity than activity in the municipal market on Thursday afternoon, according to traders around the country.

“It definitely seems a little on the quieter side,” said a Nashville trader. “It feels like after yesterday with the selloff, we have stabilized a little bit, but I don’t think things are any cheaper.”

There was not much in the way of new issuance or action on Thursday as the market adapted a quiet tone ahead of the release of economic numbers on Friday, according to the trader.

“There’s a few competitive deals today, but most of the bulk of the deals were priced earlier in the week,” he added. “We got beat up a little bit yesterday, and stuff is transacting around where the cuts were yesterday.”

A California/Texas trader agreed there was a lull in activity on Thursday, aside from some institutional selling among banks offloading tax-exempt bonds as a consequence of tax reform and the decrease of the corporate tax rate to 21%.

Although a few deals were freed to trade on Thursday, a Memphis trader said the tone of the market continued to feel muted as volume remains low and summer vacations are in high gear in several parts of the country.

“It’s the last hurrah before school, which starts next week for some states,” and the market seems to be reflecting that common thread, he said.

“In terms of strength or weakness I just don’t see much trading going on at all,” he added. “It’s not very voluminous ... there are just small pockets of activity. Anything trading up stems from new issues that may have been nicely priced” earlier in the week.

Given that August is predicted to see a larger volume of redemptions than July — with estimates at $51 billion for the month — he said demand should only get stronger. “It’s a gigantic month and we just don’t have the volume to handle that,” he said.

Primary market

Municipal bond buyers saw the last of the week’s new issue supply sell as the market’s gaze turned to next week’s volume.

Citigroup received the official award Thursday on the Washington State Convention Center Public Facilities District’s $1 billion of Series 2018 lodging tax bonds and subordinate lodging tax bonds.

The lodging tax bonds are rated Aa3 by Moody’s Investors Service and A-plus by S&P Global Ratings while the subordinate lodging tax bonds are rated A1 by Moody’s and A-minus by S&P.

Wells Fargo Securities priced the Killeen Independent School District of Bell and Coryell Counties, Texas’s $269.005 million of Series 2018 unlimited tax school building bonds. The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and S&P. Already on next week's calendar are issues from New York City, which intends to sell about $870 million of general obligation bonds, and offerings from Minnesota and Michigan, which plan competitive sales of about $619 million and $149 million, respectively.

Thursday’s bond sales

Washington

Texas

Secondary market

Municipal bonds were mostly weaker on Thursday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the three- to five-year and 10- to 30-year maturities and fell as much as nine basis points in the one-year maturity and fell less than a basis point in the two-year and six- to nine year maturities.

High-grade munis were mostly weaker, with yields calculated on MBIS’ AAA scale rising as much as one basis point in the two- to five-year, nine-year and 13- to 30-year maturities and falling as much as eight basis points in the one-year maturity and falling less than a basis point in the six-to eight-year maturities and remaining unchanged in the 10- to 12-year maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation and the yield on the 30-year muni maturity both remaining unchanged.

Treasury bonds were mixed as stocks traded little changed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 83.1% while the 30-year muni-to-Treasury ratio stood at 97.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,218 trades on Wednesday on volume of $16.92 billion.

ICI: Long-term muni funds saw $613M inflow

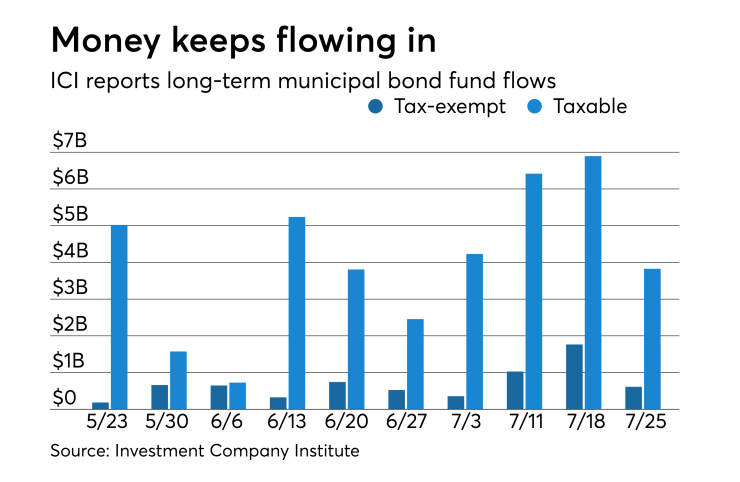

Long-term tax-exempt municipal bond funds saw an inflow of $613 million in the week ended July 25, the Investment Company Institute reported.

This followed an inflow of $1.765 billion into the tax-exempt mutual funds in the week ended July 18 and inflows of $1.028 billion, $356 million, $525 million, $742 million, $326 million, $648 million, $661 million, and $185 million in the eight prior weeks.

Taxable bond funds saw an estimated inflow of $3.826 billion in the latest reporting week, after seeing an inflow of $6.894 billion in the previous week.

ICI said the total estimated inflows to long-term mutual funds and exchange-traded funds were $3.856 billion for the week ended July 25 after inflows of $8.014 billion in the prior week.

Tax-exempt money market funds outflows

Tax-exempt money market funds reported outflows of $3.09 billion, lowering total net assets to $131.48 billion in the week ended July 30, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $2.97 billion to $134.58 billion in the prior week.

The average, seven-day simple yield for the 201 weekly reporting tax-exempt funds rose to 0.58% from 0.54% the previous week.

The total net assets of the 832 weekly reporting taxable money funds fell $3.67 billion to $2.671 trillion in the week ended July 31, after an inflow of $9.23 billion to $2.675 trillion the week before. The average, seven-day simple yield for the taxable money funds rose to 1.56% from 1.55% from the prior week.

Overall, the combined total net assets of the 1,033 weekly reporting money funds fell $6.76 billion to $2.803 trillion in the week ended July 31, after inflows of $6.26 billion to $2.810 trillion in the prior week.

Treasury announces auction details

The Treasury Department said Thursday it will auction $51 billion 91-day bills and $45 billion 182-day discount bills Monday.

The 91s settle Aug. 9, and are due Nov. 8, and the 181s settle Aug. 9, and are due Feb. 7, 2019.

Currently, there are $62.001 billion 91-days outstanding and no 182s.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.