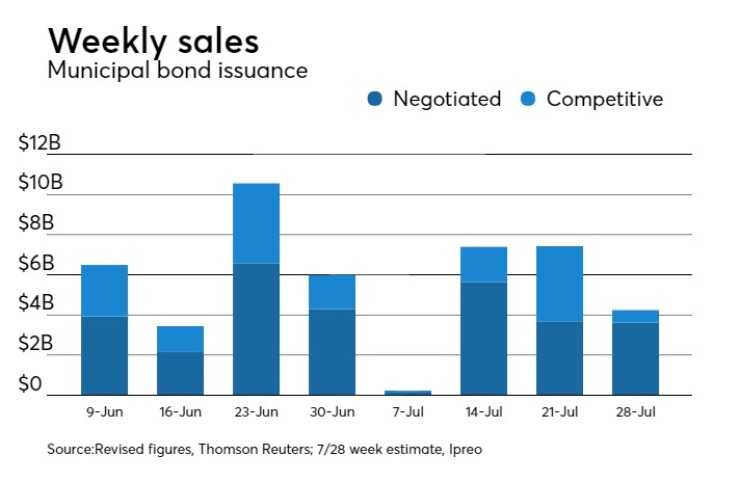

The primary municipal bond market faces a drop in issuance, even though the past week's declining yields have created an issuer-friendly environment.

Ipreo estimates volume will sink to $4.24 billion, from the revised total of $7.46 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $3.62 billion of negotiated deals and $621 million of competitive sales.

There are only nine deals scheduled larger than $100 million, all of them on the negotiated side, and there are no billion-dollar deals. The slow week comes as no surprise, said Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management.

“Its just one of those things that happen in the summer when things just slow down,” he said. “Volume should pick up, but it might take several weeks.”

Heckman also said that demand is still tremendous. The problem, he said, is that low volume and spreads are making it hard to profit as an underwriting firms. The latest small firm to exit munis, he said, was

Health care and tax reform have formed a dark cloud over the muni market. On July 20, House Speaker Paul Ryan talked about desire to get something done on tax reform, even if there is no movement on the healthcare.

“We have seen the true pace of trying to get something done in Washington, it is going to take a long time to get anything finalized,” Heckman said. “We believe that without healthcare reform taking place, it will be very challenging to get something done on individual tax reform. They might make a run at it but at the end of the day, it will be corporate side.”

Bank of America Merrill Lynch is scheduled to price New York City’s $800 million of general obligation bonds on Wednesday after a two-day retail order period. The deal is rated Aa2 by Moody’s and AA by S&P Global Ratings and Fitch Ratings.

The big apple will also sell $60 million of taxable GO bonds on Wednesday in addition to the large negotiated offering.

Ciit is set to run the books on the Port of Seattle’s $608 million of intermediate lien revenue and refunding bonds featuring tax-exempt, taxable and alternative-minimum tax bonds. It is scheduled to be broken down into $17.33 million of Series 2017A bonds, $266 million of Series 2017B taxable and $324.8 million of Series 2017C AMT bonds. Series B is expected to price on Monday and the other two on Tuesday. The deal is rated A1 by Moody’s, A-plus by S&P and AA-minus by Fitch.

After those transactions, the size of deals really drops off. Barclays is slated to price the City of Philadelphia’s $152.855 million of water and wastewater revenue refunding bonds on Tuesday. The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

Goldman Sachs is scheduled to price the Washington Economic Finance Authority’s $125.22 million of environmental facilities revenue bonds for the Columbia Pulp 1, LLC Project on Wednesday.

The largest competitive sale will take place on Tuesday, as Alexandria, Va., will be auctioning off $94.93 million of GO capital improvement bonds. The deal is rated triple-A by Moody’s and S&P.

Secondary market

Top shelf municipal bonds finished stronger on Friday. The yield on the 10-year benchmark muni general obligation fell two basis points to 1.90% from 1.92% on Thursday, while the 30-year GO yield dropped two basis points to 2.69% from 2.71%, according to the final read of Municipal Market Data's triple-A scale.

Yields were about 10 basis points lower on the week. On Friday, July 14, the 10-year muni yield stood at 2.00% while the 30-year yield was at 2.79%

Treasuries were stronger on Friday. The yield on the two-year Treasury dropped to 1.34% from 1.36% on Thursday, the 10-year Treasury yield declined to 2.23% from 2.26% and the yield on the 30-year Treasury bond decreased to 2.80% from 2.84%.

The 10-year muni to Treasury ratio was calculated at 85.1% on Friday, compared with 84.8% on Thursday, while the 30-year muni to Treasury ratio stood at 96.0% versus 95.6%, according to MMD.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended July 21 were from Texas, Pennsylvania and Illinois issuers, according to

In the GO bond sector, the Crandall ISD, Texas, 4s of 2043 were traded 24 times. In the revenue bond sector, the Pennsylvania Turnpike 4s of 2037 were traded 73 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 37 times.

Week's actively quoted issues

Illinois and New York names were among the most actively quoted bonds in the week ended July 21, according to Markit.

On the bid side, the Illinois taxable 5.1s of 2033 were quoted by 65 unique dealers. On the ask side, the New York City TFA revenue 4s of 2036 were quoted by 276 unique dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 59 unique dealers.

Lipper: Muni bond funds see inflows

Investors in municipal bond funds reversed course and put cash back into the funds in the latest week, according to Lipper data.

The weekly reporters saw $298.554 million of inflows in the week of July 19, after outflows of $172.555 million in the previous week.

The four-week moving average was positive at $41.012 million, after being in the red at $256.274 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $183.175 million in the latest week after inflows of $77.841 million in the previous week. Intermediate-term funds had inflows of $84.015 million after outflows of $145.902 million in the prior week.

National funds had inflows of $342.243 million after outflows of $177.995 million in the previous week. High-yield muni funds reported inflows of $39.178 million in the latest reporting week, after inflows of $75.010 million the previous week.

Exchange traded funds saw inflows of $7.650 million, after outflows of $9.757 million in the previous week.