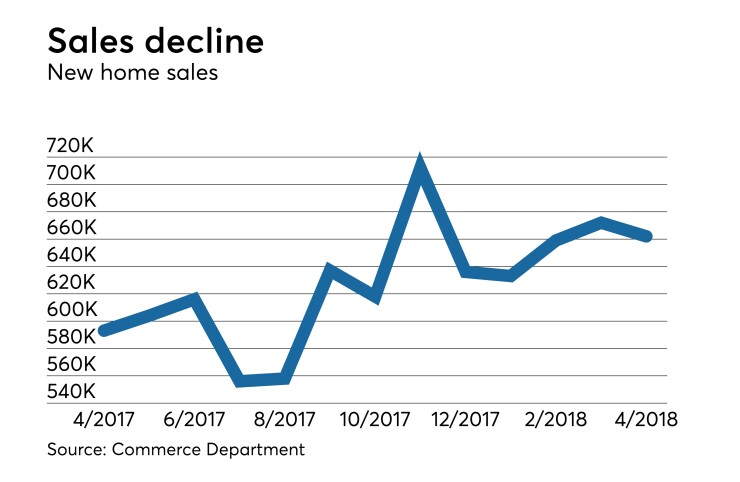

WASHINGTON — New single-family home sales fell by 1.5% to 662,000 in April following downward revisions to the sales pace in both February and March, data released by the Commerce Department Wednesday showed.

New home sales pace was below the 680,000 expected, based on an MNI survey of economists, and combined with the downward revision in recent months, may be seen as slightly pessimistic by market participants. However, the sales pace remains well above its year ago level, up 12.4% unadjusted from April 2017.

New homes sales in March were revised down to a 672,000 pace from the 694,000 previously announced rate. The February pace was revised down to 659,000 from 667,000. Annual revisions were included in the data.

When the revisions are incorporated, the April sales pace was slightly ahead of the 655,000 averages seen in both the fourth and first quarters.

When broken down regionally, the decline in April headline sales was due to a 7.9% pullback in sales in the West following a 14.4% gain in the previous month. There were gains in the Northest (11.1%) and South (0.3%) regions, while sales in the Midwest were flat.

The supply of new homes for sale rose by 0.7% in the month to a level of 300,000, the highest since the same level in April 2009. The current level of supply is 12.4% higher than a year earlier, suggesting that supply is nearly adequate to meet demand.

Based on the movements in sales and supply in April, the months' supply rose slightly to 5.4 months from the March months supply of 5.3 months. The April level was unchanged from the April 2017 level, but below the 6.0 months supply seen last summer.

The median sales price fell by 6.9% to $312,400 from $335,400 in March, hitting its lowest point since April 2017. The April median price still stands 0.4% above that $311,100 level in April 2017, suggesting that new home prices are not accelerating rapidly, in contrast to existing home prices.