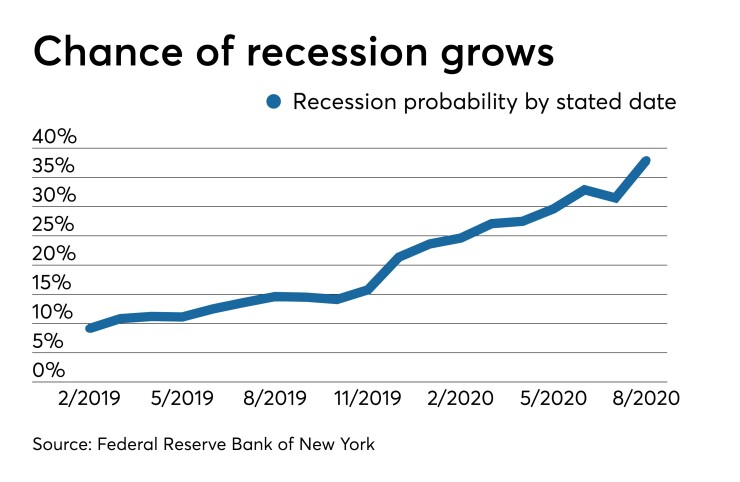

The Federal Reserve Bank of New York sees a nearly 38% chance of recession by August 2020, according to a model released Wednesday.

The model estimates the probability of a recession based on difference between the 10-year and 3-month Treasury rates. The prior reading showed a 31.5% probability of recession by July 2020.

“The most striking news over the past 24 hours is the probability rise of a recession by the New York Fed’s Recession Model to over 37%,” according to Charles Self, chief operating officer at iSectors. “In conjunction with the plummeting consumer sentiment numbers last week, a U.S. recession may begin this year.” He added, “The holiday sales will be telling.”

Employment

Meanwhile, the labor market continues to add jobs. ADP reported a 195,000 rise in private sector employment increased by jobs from July to August. The July number was revised down to 142,000 from the initially reported 156,000

“Businesses are holding firm on their payrolls despite the slowing economy,” said Mark Zandi, chief economist of Moody’s Analytics. “Hiring has moderated, but layoffs remain low. As long as this continues recession will remain at bay.”

IFR Markets projected a 155,000 gain.

Initial jobless claims were virtually unchanged, creeping up to a seasonally adjusted 217,000 in the week ended Aug. 31 from 216,000 the prior week, the Labor Department reported Thursday.

Continued claims fell to 1.662 million in the week ended Aug. 24 from1.701 million a week earlier.

Economists expected 210,000 initial and 1.671 million continued claims.

“The robust ADP number and consistently low initial claims prints while manufacturing surveys in particular point to a slowdown both in the U.S. and globally underscores the powerful transition to a services-based economy the U.S. has already undergone,” said Doug Tommasone, senior fixed income portfolio manager at Fiduciary Trust Company International.

Non-manufacturing survey

The U.S. services sector expanded at a faster pace in August as the non-manufacturing index gained to 56.4 from 53.7 in July, on a seasonally adjusted basis, the Institute for Supply Management reported Thursday.

An index reading below 50 signals a slowing economy, while a level above 50 suggests expansion.

Economists had expected a 53.1 level.

Comments from respondents were mixed, with fear about trade and tariffs, but optimism about holiday sales.

“The ISM non-manufacturing business activity index jumped by 8.4 points to 61.5, the highest level since February, and the new orders index increased by 6.2 points to 60.3,” Berenberg Capital Markets Chief Economist U.S., Americas and Asia Mickey Levy and U.S. Economist Roiana Reid wrote in a note. “Both measures suggest that activity is expanding relatively rapidly. According to the ISM report, respondents commented that ‘Sales are improving’ and ‘Delayed projects are starting to become active again.’”

The stronger-than-expected report “shows the U.S. services expansion remains resilient despite growing headwinds from manufacturing and slowing global growth,” according to Scott Anderson, chief economist at Bank of the West.

Productivity

Second quarter non-farm productivity expanded at a 2.3% pace, unchanged from the prior estimate, the Labor Department reported. In the first quarter productivity rose at a 3.5% rate.

Unit labor costs were revised up to a 2.6% rate of increase from the preliminary 2.4% growth pace in the quarter. In the first quarter labor costs jumped 5.7%.

Productivity was expected to be up 2.3% while costs were seen rising 2.4%.

Factory orders

Factory orders gained 1.4% in July, according to the Commerce Department, while excluding transportation, orders rose 0.3% after a 0.1% drop in June.

Economists expected a 1.3% gain in orders and 0.1% growth excluding transportation.

Beige book

The Federal Reserve’s Beige Book said the economy continued to expand at a “modest rate” and despite “concerns regarding tariffs and trade policy uncertainty” most businesses “remained optimistic about the near-term outlook.”