DALLAS -- Everything from innovative mileage-based fee systems to changes in state fuel taxes are on the table across the country as states seek new ways to increase funding for transportation infrastructure, according to a new report from the American Association of State Highway and Transportation Officials.

Some states have been making progress raising more money for transportation through initiatives and legislative action since early 2013, but others have done little, the state-by-state report shows.

Most state initiatives involve consideration of a mileage-based fee, or increases in the state gasoline tax or a sales tax on fuels or both, the AASHTO report said. But Virginia and Maryland want to dedicate to transportation needs some of the potential revenues they receive from their sales taxes on internet purchases.

Fuels taxes and the resulting federal grants to states account for about 25% of total annual spending on U.S. transportation, but the viability of the fuels tax revenues was called into question this summer as the Highway Trust Fund almost evaporated into insolvency.

Congress in late July extended the highway fund's ability to pay the bills through May 31, 2015. The patch did not fix the structural imbalance in the fund, with expenditures outpacing revenues from the 18.4 cent per gallon federal tax on gasoline and the 24.4 cent federal tax on diesel fuel, neither of which have risen since 1994.

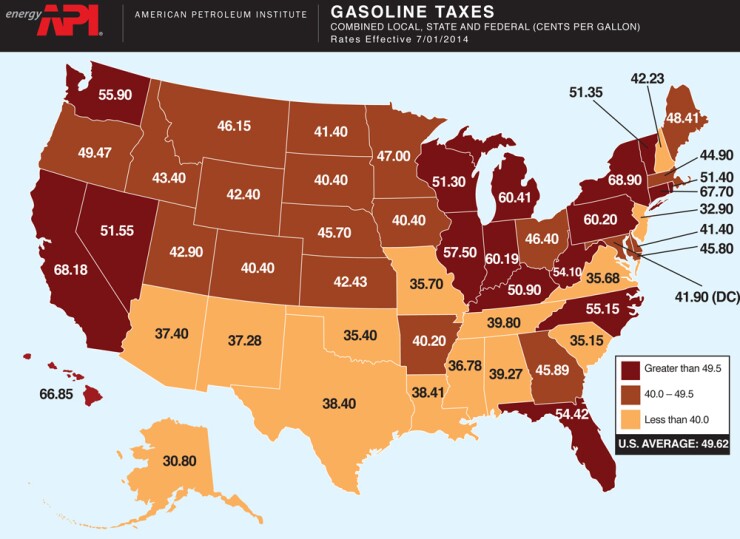

The average motorist pays 49.6 cents per gallon in state and federal gasoline taxes and 55.4 cents for diesel.

The average state gasoline tax has lost 20% of its purchasing power, or almost 7 cents per gallon, since it was last raised, said Matt Gardner, executive director of the Institute on Taxation and Economic Policy. The 36 states with a fixed-rate tax that is not indexed to inflation have seen the value of that tax fall by 29%, or 9.5 cents per gallon, since first levied, Gardner said.

Linking the gasoline tax to inflation only solves part of the problem, he said.

"The welcome news is that more states are looking at tying their gasoline tax to construction-cost inflation," Gardner said. "But the first thing they should do is raise it to where it should be as a result of past inflation because they're already in a big hole."

Maryland, Vermont, and Wyoming have raised their state gasoline taxes over the last 18 months, AASHTO said. Virginia replaced its gasoline tax with a wholesale sales tax.

Oregon is beginning a limited vehicle-miles-traveled fee system in 2015, based on two successful pilot programs and similar measures are being discussed in Arizona, California, Florida, and several other states, AASHTO said.

Virginia replaced its 17.5 cent per gallon gasoline tax with a 3.5% sales tax on gasoline at the wholesale level and a 6% tax on diesel, both indexed to inflation. A $64 annual fee for alternatively fueled vehicles was later repealed.

Virginia's revised taxes and other modifications are expected to generate $1.4 billion a year for transportation needs.

Maryland lawmakers last year passed a comprehensive transportation bill that is expected to generate $800 million of new revenue a year when fully implemented. The measure indexed to inflation the state's 23.5 cent per gallon tax, but stipulated the tax rate cannot go up by more than 8% a year.

The Maryland bill also levied a 3% sales tax on gasoline at the wholesale level. If Congress does not allow states to tax purchases on the internet, the gasoline sale tax will go to 4% on Jan. 1, 2016 and to 5% on July 1, 2016.

Texas voters will decide in November on a constitutional amendment that would divert $1.2 billion per year of oil and gas production tax revenues to the state transportation fund from the state's Rainy Day Fund, AASHTO said.

The Texas Transportation Commission has created a special committee to recommend how to spend the new money from the amendment. The nine-member panel will complete its work before the election, said commission chairman Ted Houghton, and give its recommendations soon after the statewide vote if the measure passes.