WASHINGTON – The Supreme Court issued an opinion on Monday affirming that a local Puerto Rico debt restructuring law is unconstitutional, leaving congressional action on a House bill as the only option left for the struggling commonwealth to deal with its debt crisis.

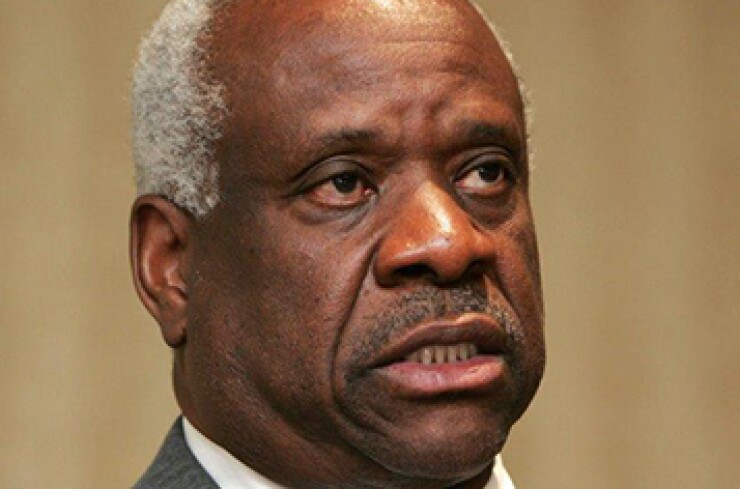

Justice Clarence Thomas wrote the opinion for the 5 to 2 majority that found that the local law, called the Puerto Rico Public Corporation Debt Enforcement and Recovery Act (DERA), is pre-empted by federal bankruptcy law and thus unconstitutional under the Supremacy Clause. DERA would have allowed the commonwealth's utilities, such as the Puerto Rico Electric Power Authority (PREPA), to restructure their debts in a similar way to what they could do if they were given protections under Chapter 9 of the code, which applies to municipal bankruptcies.

In total, Puerto Rico is struggling with roughly $70 billion in debt and $46 billion in unfunded pension liabilities.

Resident Commissioner Pedro Pierluisi, Puerto Rico's nonvoting representative in Congress, said in a statement following the release of the ruling that, "the practical significance of the court's holding is crystal clear … only Congress can provide the Puerto Rico government with the authority to restructure its debts."

Pierluisi has played a key role in advancing legislation designed to help the commonwealth. The bill, called PROMESA, passed the House by a vote of 297 to 127 on June 9. It seeks to balance competing interests by creating a strong oversight board that would have the power to require balanced budgets and fiscal plans, as well as to file debt restructuring petitions on behalf of the commonwealth and its entities in a federal district court as a last resort if voluntary negotiations do not succeed.

The Senate is expected to take the bill up before the end of the month or in early July.

The decision concludes two consolidated cases -- Puerto Rico v. Franklin California Tax-Free Trust and Melba Acosta-Febo v. Franklin Tax-Free Trust – that pitted the commonwealth against hedge fund BlueMountain Capital Management and two sets of mutual funds advised by OppenheimerFunds and Franklin Advisors. All of the funds together hold roughly $2 billion of PREPA bonds.

The funds argued that the federal code pre-empted Puerto Rico's local law. However, Puerto Rico argued that it is not bound by a section of federal bankruptcy code that prohibits states from passing laws that would allow their public entities to restructure without approval of those entities' creditors because Puerto Rico is specifically barred from authorizing its public authorities to file for bankruptcy under Chapter 9.

Justices Ruth Bader Ginsberg and Sonia Sotomayor, in a dissent authored by Sotomayor, agreed with Puerto Rico that the federal bankruptcy code's exemption of Puerto Rico from allowing bankruptcies exempts the commonwealth from being treated as a state under Chapter 9.

Justice Samuel Alito did not participate in the case.

Matthew McGill, a lawyer with Gibson, Dunn & Crutcher who served as counsel for BlueMountain and was the advocate for the bondholders before the Supreme Court, said his clients are "grateful" for the Supreme Court's "careful consideration of the case" and are "pleased that" they can now put the litigation behind them.

Lawyers who represented Puerto Rico could not be reached for comment.

Henry Kevane, managing partner in the law firm Pachulski Stang Ziehl & Jones' San Francisco office, said the decision came down to Thomas taking a narrow view of the code language and was an "elegant and probably correct outcome" but one that "ignored the larger picture."

"I always felt that the Franklin petitioners had somewhat the better argument given the history of the statute, but at the same time I think Justice Sotomayor also has a very good point which is, "Okay so they can't [restructure] themselves, they can't do it under the bankruptcy code, and now they're largely dependent on Congress."

David Fernandez, a public finance attorney with the law firm Buchanan, Ingersoll & Rooney PC, said that from a personal perspective, he would not have expected anything other than the ruling the Supreme Court handed down on Monday.

"[DERA] was a valiant attempt by the Puerto Rican legislature to try to put in place a mechanism that would allow them to restructure or to get leverage to restructure their debt, but the fact that it was challenged and the fact that it was overruled was not surprising," he said.

The bond market seemed similarly unsurprised by the result with an analyst from Interactive Data saying he saw very little trading in Puerto Rico Electric Power Authority or other corporation debt and only light activity in the commonwealth's general obligation bonds.

Justice Thomas wrote that the Court's decision is based on interpretation of three federal municipal bankruptcy provisions found in Chapter 9: the "gateway" provision in Section 109; the preemption provision in Section 903(1); and the definition of "state" in Section 101(52).

The gateway provision requires that a Chapter 9 debtor be an insolvent municipality that is specifically authorized by a state to be a debtor. However, under a 1984 amendment to the definition of "state," Puerto Rico is a state "except for the purpose of defining who may be a debtor under Chapter 9." The preemption provision bars states from enacting their own municipal bankruptcy laws.

"Puerto Rico interprets this amended definition to mean that Chapter 9 no longer applies to it, so it is no longer a 'state' for purposes of Chapter 9's preemption provision," Thomas wrote. "We hold that Congress' exclusion of Puerto Rico … does not sweep so broadly."

He later wrote that "the 1984 amendment precludes Puerto Rico from authorizing its municipalities to seek relief under Chapter 9, but it does not remove Puerto Rico from the reach of Chapter 9's pre-emption provision."

"Had Congress intended to 'alter th[is] fundamental detai[l]' of municipal bankruptcy, we would expect the text of the amended definition to say so," Thomas wrote.

Sotomayor and Ginsberg instead argued that because "Puerto Rico's municipalities cannot pass through the [Section] 109(c) gateway to Chapter 9, nothing in the operation of a Chapter 9 case affects Puerto Rico's control over its municipalities."

"By amending the definition of state to exclude Puerto Rico … and [its] municipalities from [Section] 109(c)'s gateway, Congress excluded Puerto Rico from Chapter 9 for all purposes – it shut the gate and barred it tight," Sotomayor wrote. "And because Chapter 9's process and rules by their terms can only affect municipalities and states eligible to pass through the gateway in [Section] 109(c), that must mean that none of Chapter 9's provisions – including [Section] 903's pre-emption provision – apply to Puerto Rico and its municipalities."

She concluded her dissent by saying that "statutes should not easily be read as removing the power of a government to protect its citizens."