Next week’s calendar should benefit from timing and availability of paper coming on the heels of both the income tax deadline and the holiday-shortened week.

Munis will be very much on the minds of lots of people who paid larger bills due to the state and local tax changes, which may increase demand for next week’s slate, according to John Mousseau, director of fixed income at Cumberland Advisors.

“One way to combat that is to own more tax-free bonds,” he said, indicating that the market next week will absorb new supply with ease.

Overall, he said the market may be poised for a change from the current norm.

“The strength the market has experienced has to abate somewhat,” Mousseau added. “This is just some normal reversion to the mean.”

He noted that visible supply has averaged $7 billion so far in 2019.

“This is all very navigable for the market,” Mousseau said.

Next week’s bond calendar features 10 negotiated deals $100 million and larger with the largest bond deal coming in at just over $300 million.

However the largest deal is In the short-term sector, as the New York State Thruway Authority is set to competitively bring $1.6 billion of general revenue junior indebtedness obligation anticipation notes on Tuesday.

Goldman Sachs is scheduled to price Los Angeles Department of Water and Power’s (NR/AA/AA) $309.985 million of power system revenue bonds on Thursday after a one-day retail order period.

Well Fargo is expected to run the books on Frisco, Tx., Independent School District’s (Aaa/AAA/NR) $278.115 million of unlimited tax school building and refunding bonds on Wednesday.

JPMorgan is set to price Michigan Finance Authority’s (A2/A/NR) $252.530 million of hospital revenue bonds for Henry Ford Health System on Thursday.

“Mutual fund inflows, while remaining positive, slowed to less than $1 billion last week [according to ICI]. This is likely due to typical tax season liquidations to raise tax payments, but it could also reflect increased investor caution, as relative value indicators, such as muni to Treasury ratios, reach cyclical lows, suggesting recent muni outperformance is coming to an end,” Alan Schankel, managing director at Janney, said.

He added that Lipper data out later on Thursday may shed light on whether inflow slowdown is due to tax payment or investor caution.

“I believe next week’s calendar will see plenty of demand due to variety of issues and sectors with state and local GO, airport, healthcare, higher education and public power all well represented,” Schankel said.

Others agree demand will continue to thrive next week — despite the slow market last week — especially for specialty state paper.

“The seasonal factors kicked in this week when Tax Day and Easter week combined to soften demand,” said John Donaldson of Haverford Trust.

However the market should make up for that next week, he said.

“We continue to see exceptionally strong demand from investors in high tax states,” he said. New deals in California, Connecticut and Minnesota should get a warm reception, he noted, namely the Henry Ford Hospital deal in Michigan.

“There haven’t been that many large hospital deals so there should be some pent-up demand,” he said on Thursday.

In addition, he said there should be inherent interest for several Texas PSF issues pricing next week.

“Our experience is that every time we think the market might be saturated with PSF issuance, the deals still get good demand,” which describes the strength of general demand for tax-exempt paper, according to Donaldson.

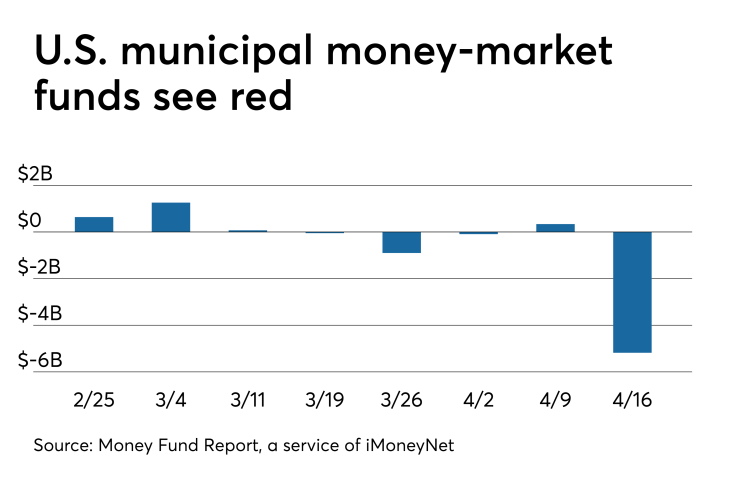

Muni money market funds see huge outflow

Tax-free municipal money market fund assets decreased $5.18 billion, lowering their total net assets to $133.84 billion in the week ended April 15, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 186 tax-free and municipal money-market funds jumped to 1.16% from 1.09% last week.

Taxable money-fund assets fell $2.883 billion in the week ended April 16, bringing total net assets to $2.883 trillion.

The average, seven-day simple yield for the 809 taxable reporting funds was unchanged from 2.06% last week.

Overall, the combined total net assets of the 995 reporting money funds decreased $53.19 billion to $3.016 trillion in the week ended April 16. It marks the 15th consecutive week total money-fund assets have exceeded $3 trillion.

Secondary market

Munis were slightly stronger on the MBIS benchmark scale Thursday, which showed yields less than one basis point lower on both the 10-year maturity and the 30-year maturity. High-grade munis were also a tad stronger, with yields decreased by less than one basis point in both the 10- and 30-year.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yields on both the 10-year GO and the 30-year dipped one basis point.

The 10-year muni-to-Treasury ratio was calculated at 76.2% while the 30-year muni-to-Treasury ratio stood at 91.2%, according to MMD.

Previous session's activity

The MSRB reported 39,675 trades Tuesday on $14.956 billion of volume.

California, New York and Texas were most traded, with the Golden State taking 17.63% of the market, the taking Empire State 12.287% and Lone Star State taking 8.222%.

The Martin County, Fla., Health Facilities Authority 4s of 2046 traded 18 times with a par of $39.750 million.

Treasury auctions announced

The Treasury Department announced these auctions:

$32 billion seven-year notes selling on April 25;

$41 billion five-year notes selling on April 24;

$40 billion two-year notes selling on March 26;

$20 billion two-year floating rate notes selling on April 23;

$26 billion 364-day bills selling on April 23;

$36 billion 182-day bills selling on April 22; and

$42 billion 91-day bills selling on April 22.

Treasury auctions bills

The Treasury Department Thursday auctioned $50 billion of four-week bills at a 2.400% high yield, a price of 99.813333.

The coupon equivalent was 2.445%. The bid-to-cover ratio was 2.61.

Tenders at the high rate were allotted 64.61%. The median rate was 2.370%. The low rate was 2.340%.

Treasury also auctioned $35 billion of eight-week bills at a 2.390% high yield, a price of 99.628222.

The coupon equivalent was 2.439%. The bid-to-cover ratio was 2.95.

Tenders at the high rate were allotted 29.66%. The median rate was 2.375%. The low rate was 2.340%.

The Treasury Department Thursday auctioned $17 billion of five-year inflation-indexed notes with a 1/2% coupon, at a 0.515% high yield, an adjusted price of 100.137446.

The bid-to-cover ratio was 2.50.

Tenders at the high-yield were allotted 34.35%. All competitive tenders at lower yields were accepted in full.

The median yield was 0.470%. The low yield was 0.405%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.