DALLAS – Texas sales tax collections grew 4.4% in February compared to the same month last year to $2.4 billion, Texas Comptroller Glenn Hegar reported.

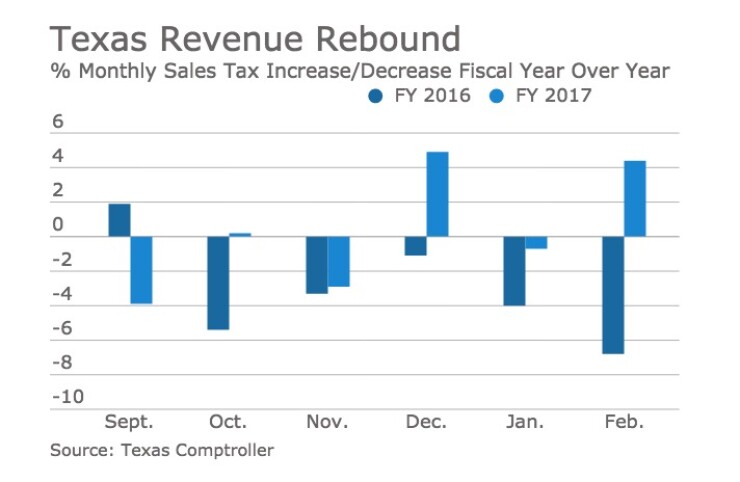

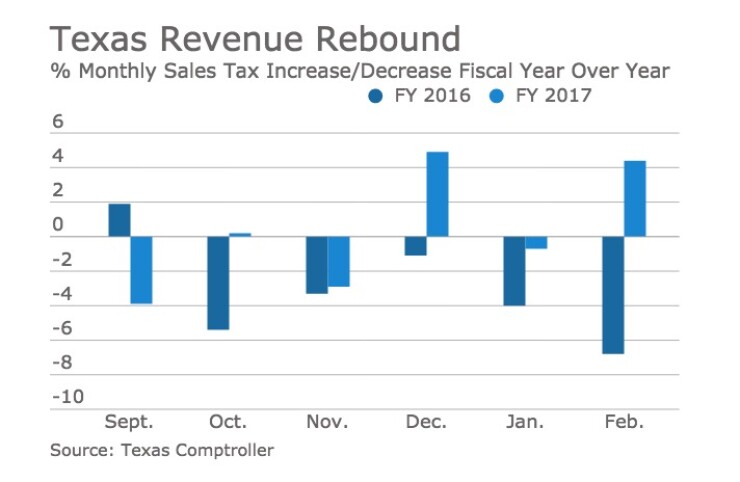

The 4.4% gain was the second largest of the current fiscal year that began Sept. 1, 2016. December saw the largest increase at 4.9%. Revenues have risen in three of the six months since the fiscal year began.

The strong February numbers Hegar reported March 2 followed a January report that was essentially flat. Total sales tax revenue for the three months ending in February was up by 2.8% compared with the same period a year ago.

"Growth in sales tax revenue was due to increased collections from most sectors of the economy," Hegar said. "While tax collections from oil- and gas-mining remain subdued, receipts from telecommunications, construction, services and retail and wholesale trade increased significantly."

Sales tax revenue is the largest source of funding for the Texas budget, accounting for 58% of all tax collections in fiscal 2016. Motor vehicle sales and rental taxes, motor fuel taxes and oil and natural gas production taxes are also large revenue sources for the state.

Motor vehicle sales and rental taxes rose 0.3% to $373.2 million in February, while motor fuel taxes grew by 1.1% to $277.7.

Oil and natural gas production taxes soared 150% to $277.7 million, but that increase was partly attributed to refunds that went to natural gas severance taxpayers in February 2016, resulting in artificially low tax collections during that period.

The Federal Reserve Bank of Dallas reported that the Dallas Manufacturing Survey index jumped to 16.7 from 11.9 in February. However, new orders slowed.

Oil prices have remained stable for several months, with futures prices around $54 per barrel for West Texas Intermediate crude. Prices fell Tuesday after the American Petroleum Institute reported a rise in stockpiles that was much larger than expected. U.S. crude oil in storage rose by 14.2 million barrels last week, according to the API. That was more than five times analysts' forecasts for a 2.5-million barrel increase.

Gasoline stocks rose by 2.9 million barrels, compared with analysts' expectations in a Reuters poll for a 1.1-million barrel gain.

Since September, U.S. production has climbed roughly 125,000 barrels per day on average each month, pushing total production above 9 million barrels per day, according to Bloomberg. That is a much faster pace of growth than the original shale boom that began six years ago. The 2011-2014 shale boom saw monthly growth of just 93,000 bpd.