The New York City Comptroller's Office expects to choose a software vendor next month as it aims to fine-tune its risk analytics.

Software would estimate portfolio risk and analyze investment and manage returns – a so-called attribution platform, said Miles Draycott, chief risk officer at city Comptroller Scott Stringer's Bureau of Asset Management.

"This is a really major initiative for all of BAM, I think," Draycott said during Monday's quarterly

An important objective, said Draycott, is to procure software useful to both the risk team and the asset teams. The software needs to be capable of both top-down, or "factor" analysis of the total plan and "ground-up" scrutiny.

"We want to be able to perform much more granular analysis of what had been heretofore relatively opaque investments such as the investments in many of the private asset classes," said Draycott. "In the case of private real estate, we want to know every holding, every investment that a GP [general partner] makes. We want to know the name of the company, we want to know what industry it's in, what location it's in, how much leverage is on it."

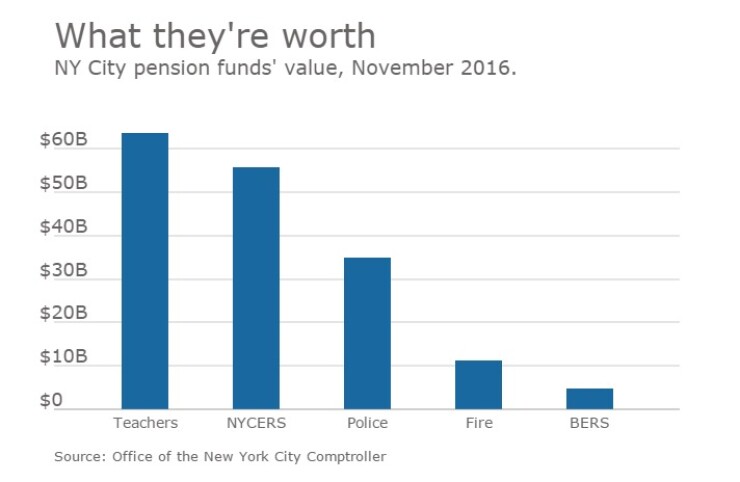

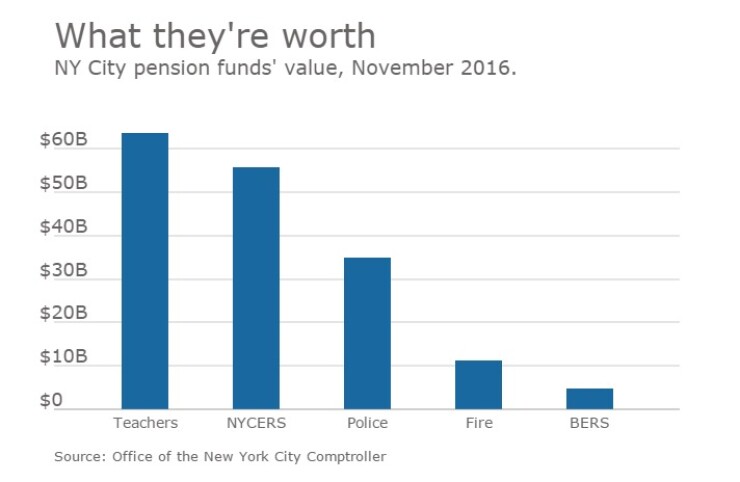

The group, which meets monthly, involves all five city retirement systems. They are the New York City Employees' Retirement System, the Teachers' Retirement System of the City of New York, the New York City Police Pension Fund, the New York City Fire Department Pension Fund, and the New York City Board of Education Retirement System.

The pension funds were valued at about $170.6 billion as of November.

Modernizing risk management was among the recommendations from Funston Advisory Services in a far-reaching

"The BAM investment program has become highly complex over the past ten years. At the same time, the level of staffing and resourcing has not kept up with the significant increase in requirements," said Funston.

"As a result, operational risk is very high and an operational failure is increasingly likely. There is no quantitative investment risk management, which limits BAM's ability to effectively structure its investment portfolios and gain needed insight into portfolio risk."

The bureau issued a request for proposals last August and eight vendors responded, said Draycott. It scored responses in December and has conducted trials of three applications since January.

It will recommend a firm at the April meeting, said Draycott. The bureau hopes to execute the contract in May and implement the system by year's end.