BRADENTON, Fla. - Orlando-Orange County Expressway Authority board members left a $230 million gift for central Florida in what was likely their final act before the nearly 51-year-old agency is absorbed by a new, larger organization.

The three members of the authority's five-member board who remain after a grand jury investigation that saw one board member indicted and another resign after pleading guilty to violating the state's open meetings law signed off Tuesday on a $230 million contribution to the Florida Department of Transportation.

The OOCEA funds will go toward the state's major reconstruction of an interchange between Interstate 4 and State Road 408 in downtown Orlando that currently is one of the most congested links in and out of the city during rush hour.

The interchange is also part of FDOT's largest transportation venture to date - the $2.3 billion "Ultimate Interstate 4" project to reconstruct 21 miles of I-4 through central Florida and add tolled express lanes.

The OOCEA board's decision Tuesday commits its successor to making the payments in fiscal years 2018, 2019, and 2020, some of which could come from the proceeds of bonds.

The board is expected to disband without approving an $870 million, 2014-2018 draft work plan incorporating most of the interchange expenses as well as payments for other, ongoing major projects.

They did condition the I-4/408 financial aid on receiving $18.4 million from the FDOT by June 30, which will go toward land needed for the $1.6 billion Wekiva Parkway toll road project being constructed by the authority and the state.

The 21-mile Wekiva, a limited-access expressway, will complete the western beltway in central Florida and is intended to relieve congestion on I-4.

The Orlando-Orange County Expressway Authority is in the midst of buying right of way for the beltway, and future construction costs are included in the $870 million 2014-2018 draft work plan, and beyond.

"I look forward to the new board, which I assume will be the next one to meet here," said board chairman Walter Ketcham at the end of Tuesday's meeting at the authority's offices in Orlando.

Ketcham has served on the panel since 2009.

"In the time that I've spent here, I've found the staff as good as they get," he said. "I'd hate to see anyone go elsewhere or leave for any reason."

Another board member, Orange County Mayor Teresa Jacobs, praised Ketcham for his handling of the recently concluded investigation by the local state attorney's office, and said she would like to see him appointed to the new organization's board.

It was Ketcham who ordered the authority's attorney to contact the state attorney last year after three board members conducted a surprise vote to seek a new executive director, leading then-director Max Crumit to resign.

The inquiry led to a grand jury investigation that culminated June 4 with the indictment of three people for violating Florida's sunshine law, which prohibits appointed or elected board members from talking about agency business in private.

The indictments included suspended Expressway Authority board member Scott Batterson, who had previously been indicted on one count of bribery and two counts of solicitation for receiving unlawful compensation.

Board member Marco Peña resigned from the board May 16, and later pleaded guilty to breaking the sunshine law.

The three remaining OOCEA board members conducted Tuesday's meeting, which is expected to be their last.

The scandal that unfolded over many months is believed to have provided impetus for the Legislature to work out differences on a bill to replace the agency in the final days of session, which concluded May 2.

The Expressway Authority's governance is now up in the air as the clock ticks toward the June 30 end of the fiscal year, while the agency's staff tends to daily business.

While both legislative chambers unanimously approved Senate Bill 230 to create the larger, regional board called the Central Florida Expressway Authority, the bill had not been sent to Gov. Rick Scott as of Wednesday.

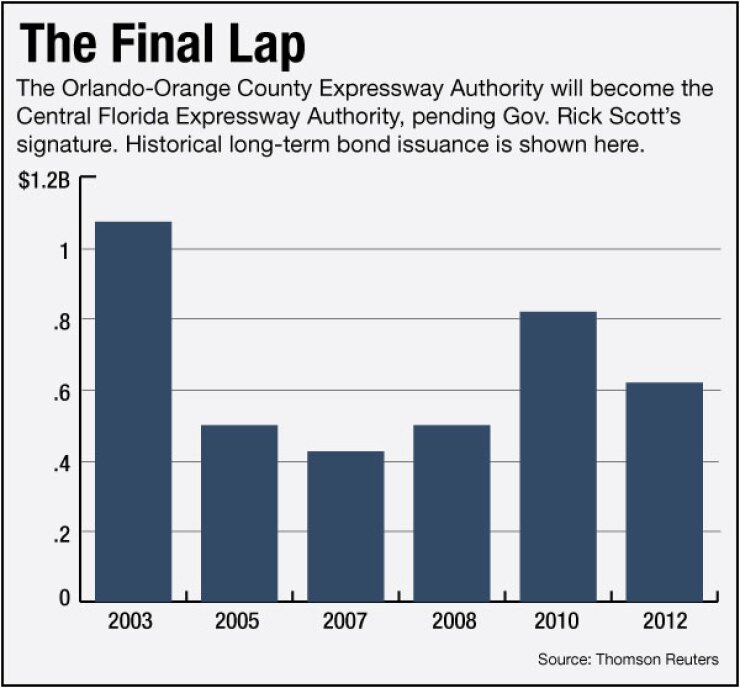

Scott has said that he will sign the bill, and if that occurs the legislation becomes effective immediately and the Central Florida authority would take control of the assets and liabilities of the Orlando-Orange County Expressway Authority, including its five toll roads covering 109 miles and $2.2 billion of outstanding revenue bonds.

The bonds will not be refunded, and will remain outstanding under the same covenants as when they were issued, according to agency staff.

SB 230 states that the transfer of the debt will not impair the terms of the contract between the Orlando-Orange County Expressway Authority and the bondholders, "does not act to the detriment of the bondholders, and does not diminish the security for the bonds."

The new Central Florida Expressway Authority would expand to include Orange, Seminole, Lake, and Osceola counties, with a nine-member governing board.

It is not clear how quickly those members will be appointed, though the mayors of Orlando and Orange County would be automatic appointments. The governor, who has three appointees, typically takes considerable time making his selections partly because of a lengthy application and vetting process.

Even without the governor's appointees, the CFX board likely could ramp up quickly once local appointments are made. In that case, the board would constitute a quorum for decision-making purposes, expressway authority staff said.

The anticipated change in governance has been noted by rating agencies, though without penalty so far.

Moody's Investors Service revised the outlook on the Orlando-Orange County authority's bonds to stable from negative, while affirming its A2 ratings in April.

Returning the outlook to stable was largely due to changes in tolling structure that did not create a negative impact on traffic volumes, and a reduction in swap exposure, according to analyst Myra Shankin.

The stable outlook also included Moody's expectation that traffic revenues will continue to provide strong financial margins and debt service coverage ratios while the authority retains adequate liquidity levels, despite a capital plan that requires significant borrowing through 2023, she said.

Challenges facing the authority include the pending governance issues that could impact future capital plans and toll increases, and create "instability that could put downward pressure on the rating," said Shankin.

The existing board has expressed some resistance to toll rate increases scheduled in future years, though no action was taken to deal with the issue on Tuesday after the board reviewed several scenarios for the proposed work plan and debt needed to support it.

Those scenarios included foregoing a toll rate increase planned for 2018, and funding the work plan without any future toll increases. In both cases, the authority would experience periods where it would not meet its targeted planning debt service coverage ratio of 1.6 times, and millions of dollars in funding for projects would have to be deferred. The authority’s bond covenants require a 1.2 times ratio.

Without any definitive action on the work plan or tolls, it remains to be seen if the new Central Florida Expressway Authority will adopt the same priorities as those that were being considered by the Orlando-Orange County Expressway board.

The OOCEA's long-term capital program through 2023 totals $1.5 billion to be supported by $500 million of new senior lien debt and $200 million of loans from the federal Transportation Infrastructure Finance and Innovation Act program.

The authority's bonds are also rated A by Fitch Ratings and Standard & Poor's. Both maintain stable outlooks.