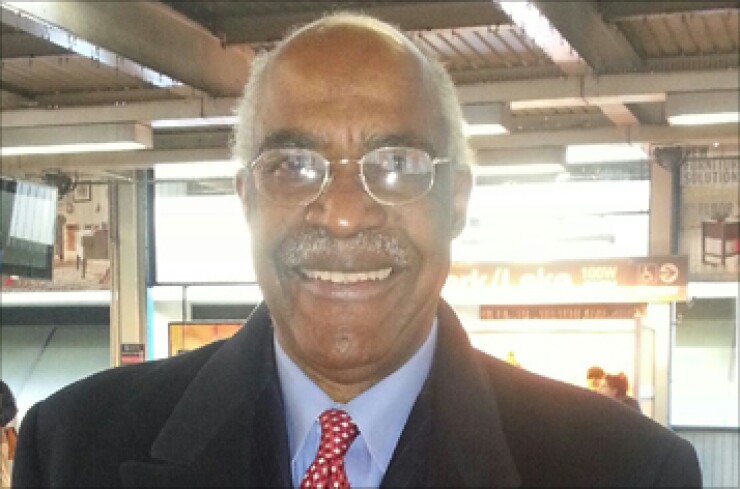

BRADENTON, Fla. - A federal judge is mulling whether to dismiss a discrimination lawsuit brought by former financial advisor Calvin Grigsby against the city of Shreveport, La.

U.S. Magistrate Judge Karen Hayes denied Grigsby's request for an expedited ruling in a case, which centers on $53,000 in bond issuance fees paid by Shreveport to Grigsby in 2011 that the city later sought to claw back.

Hayes, in a Sept. 19 ruling, said the court will continue to consider Shreveport's motion to dismiss the lawsuit Grigsby filed in July 2014.

Earlier this month, Grigsby had asked the court to expedite its consideration of the motion.

The city filed the motion to dismiss nine months ago, Grigsby said in an email Friday.

He wants a ruling in order to file an appeal, if the motion is granted, or begin discovery if the court rules against the city, he said.

"All that happened is the court denied my motion to expedite its ruling," Grigsby said. "The court basically said they will take as long as they want to consider the motion to dismiss and will not be rushed by me."

City Attorney William Bradford was out of the office Friday, and was unavailable to comment, a spokesman said.

Grigsby filed a suit in U.S. District Court in the Western District of Louisiana, charging the City Council with breach of contract, fraud, unfair trade practices, malicious prosecution, defamation, and discrimination based on race.

The suit asked for preliminary and permanent injunctions as well as $3.5 million plus legal fees.

Grigsby contends that city officials conspired to terminate his financial advisory contract and destroy his business, at the time Grigsby & Associates, by using city money "to make false and wantonly malicious statements" about his performance.

The federal suit is an outgrowth of a dispute between Grigsby and the Shreveport council over fees he charged for financial advisory work on the sale of $81.5 million of general obligation bonds in 2011.

After months of investigating the FA's charges, the City Council determined that Grigsby overbilled Shreveport by about $50,000.

Although Grigsby said his fees received numerous approvals from the city and the Louisiana State Bond Commission, he agreed to place the disputed amount in escrow after the city filed a lawsuit in Caddo Parish District Court in February 2014 seeking to claw back the fees it had already paid.

The Caddo Parish lawsuit is still pending, Grigsby said Friday.

In the city's motion to dismiss the federal case, Shreveport's attorney said that Grigsby's claims for fraud, unfair trade practices, defamation, and violations of his civil rights occurred outside of a one-year time limit.

While there is no federal time limit to bring such charges, the city's motion contends that in this case Louisiana law controls and Grigsby's case was filed outside the state's one-year time limit.

The city's attorney also said that the "absolute and qualified immunity" granted to City Council members by virtue of their legislative status bars Grigsby charges.

The suit should also be dismissed because it "fails to state a claim for declaratory and injunctive relief" and doesn't include the necessary facts that show that Grigsby is entitled to relief, Shreveport's motion said.