CHICAGO – Illinois-based MercyRockford Health System enters the market next week with a nearly $500 million deal to lay the groundwork for both a new hospital and new identity as Mercy Health Corp.

The $485 million fixed-rate sale is expected May 4 with Ziegler in the senior manager position. JPMorgan is a co-manager and Chapman and Cutler LLP is bond counsel on the deal being sold through the Illinois Finance Authority.

The new name takes effect next month. It reflects the 2015 merger of then Wisconsin-based Mercy Alliance, Inc. and Illinois-based Rockford Health System. The combined system operates four hospitals and other facilities that serve more than a dozen counties in north-central Illinois and south-central Wisconsin with about $1 billion in revenue.

Proceeds of the 30-year bonds will refund existing debt and raise new money to finance the construction of the Riverside Campus in Rockford. The system envisions the campus as "a destination center for regional healthcare needs" led by a specialty referral hospital, according to bond documents.

Located off a major interstate, the campus will offer a 188-licensed-bed hospital; Level I trauma center; Level III neo-natal intensive care unit; a state-designated regional perinatal center; a children's medical center; brain and spine center; and ambulatory care and physician clinical offices.

"We provide an attractive alternative" to Chicago-, Milwaukee- and Madison-based healthcare services, the system's chief financial officer John Cook said in an investor presentation.

Transplant and burn unit services are the only major specialties that won't be offered at the new campus.

The deal includes capitalized interest through 2018 and will refund all of the former Rockford Health system's $85 million of debt, which included a mix of privately placed fixed-rate bonds and floating-rate paper. The new deal will cancel an outstanding swap tied to the floating-rate rate issuance and cover the negative valuation costs. The deal also will refund some of Mercy Alliance's $190 million of debt.

The merged Rockford-based system faces a $1.9 million payment to cancel the swap and $1.1 million fee to terminate its private placement. The goal of the structure is aimed at keeping debt service low in the early years during the construction phase. Maximum annual debt service will hit $44 million.

After the issue, all of the system's $670 million of debt will be fixed rate.

"It's a conservative debt structure but one that would serve Mercy Health well into the future," finance officials said in the presentation.

All of the debt is being issued as an obligation of the new Mercy Health Corp. obligated group. The facilities counted as members of the obligated group generated about 95% of the system's revenues last year.

Ahead of the sale, Moody's Investors Service affirmed the combined system's A3 rating and stable outlook. The rating agency also downgraded the legacy debt of Mercy Health Alliance by one level to A3 to reflect the parity position of all MRHS obligations that occurs with the upcoming issue.

"The affirmation and assignment of MRH's A3 rating reflects the scale and market presence of the combined legacy health systems, good balance sheet resources and proven management team as evidenced by the notable operating momentum already achieved," Moody's said.

The system's finance team outlines in its investor presentation strides made over the last year as the integration of the two systems continues.

Unrestricted cash and investment grew to $602 million from $571 million. Revenue so far this year is at $612 million, about $20 million up for the same period last year. Officials say the merger has allowed them to act more quickly to the changing healthcare landscape as a result of federal healthcare reform and they have so far navigated the consolidation smoothly.

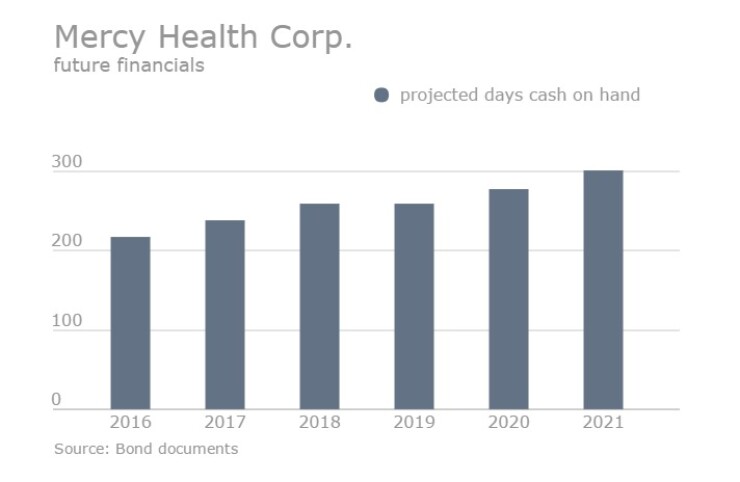

The system assumes steady growth with the new campus but officials insist their modest growth projections are conservative. Cash on hand to cover operations is projected to grow to 302 days from 218 over the next five years.

A primary challenge for the system is the competitive landscape it operates in, according to Moody's and several buyside representatives.

"The rating is constrained by market wide competition, risks inherent with integration and operational improvement initiatives, as well as sizable capital building plans which materially elevate MRHS's leverage," Moody's said.

The system believes the new campus will help its competitive edge. Its Mercy Hospital holds a top market share in its primary service area in southern Wisconsin despite a hospital built by competitor SSM Health Care.

Rockford Hospital holds a second-place market share in its region. Rockford facilities face competition from SwedishAmerican Hospital which has joined the University of Wisconsin Hospital and Clinics.

"The stable rating outlook reflects financial improvement, achieved to date, and the benefits expected to be achieved from the merger," Moody's said. "The outlook assumes ability to build upon improvement already achieved while at least sustaining current liquidity levels and market share."

The system could win an upgrade if it can strengthen its consolidated operating and cash flow margins for multiple years and it completes its strategic capital plans as scheduled. If the system fails to hit projected performance targets it could lose ratings ground.

The system's merger and operating results reflect sectorwide healthcare trends Moody's described in a report published Tuesday.

Hospital medians support continuing revenue growth and a stabilization of the sector overall, and median days cash on hand in fiscal 2015 rose to 218.8 from 216.7 the previous year, Moody's said in the report.

"Stronger median annual revenue growth was driven by continued consolidation in the sector, benefits from gains in insurance coverage, and favorable utilization trends," wrote Moody's analyst Beth Wexler.

The IFA board authorized the issuance of up to $525 million for MercyRockford at its April meeting.

The IFA board also signed off on an up to $60 million sale for Iowa Health System, which does business as UnityPoint Health. Proceeds will refund outstanding debt issued for its Proctor Hospital and finance upgrades at its Methodist Medical Center and Glen Oak.