CHICAGO – Chicago's tax-increment financing program is in the spotlight after the city said it would release a bigger-than-planned chunk of surplus TIF revenues to help Chicago Public Schools pay for a new teachers' contract.

Mayor Rahm Emanuel unveiled a proposed 2017 budget Tuesday that declares a $175 million TIF surplus.

Based on the distribution formula, the city will receive about $40.5 million while about $88 million will flow to the financially distressed school district.

CPS had only built $32 million of TIF money into its fiscal 2017 budget, expecting the city to declare a more modest $60 million surplus.

The remainder will go to other area taxing bodies. CPS received $103 million in fiscal 2016.

Word began to circulate of the expected action in the early morning hours of Tuesday shortly after CPS and the Chicago Teachers' Union reached a tentative agreement on a new four-year contract that averted a strike set to begin Tuesday.

The city has annually freed up surplus TIF revenue but it has resisted political pressure by limiting the amount with the annual releases varied in size.

The action -- promoted and endorsed by some city council members and union officials and initially resisted by Emanuel -- has prompted debate over a series of issues.

They include questions over the appropriate use of TIF revenues, which are supposed to be set aside for development purposes, whether even more should be freed, and whether the funds provided too easy a political escape hatch for the district, which was seeking deeper concessions from the Chicago Teachers' Union.

They also have spurred questions over whether or not the revenue represents a non-recurring revenue stream that can't be counted annually to cover an annual operating expense, a position Emanuel seemed to previously back in statements.

That position has now changed.

"I don't see TIF surplus at this stage as a one-time revenue," city budget director Alexandra Holt said when asked about the issue during a meeting with Crain's Chicago Business' editorial board. "I see it as an ongoing revenue."

Much of the surplus funding being freed up comes from frozen, canceled, and expiring TIFs as well as the "declared" amount.

Holt projected that surpluses will be available for well over a decade, and therefore should not be considered a so-called one-shot.

Holt made her case during an interview along with Emanuel and chief financial officer Carole Brown that Crain's posted

The majority of this year's surplus comes from the seven downtown TIF districts that were frozen last year and will be retired when existing projects are paid off.

Those districts will generate about $250 million in surplus revenue over the next five years, according to the city's annual financial analysis.

Market participants, rating agencies, and budget watchdogs warn against relying on non-recurring revenue streams to cover recurring operational expenses as they drive up structural gaps.

The district's heavy use of one-shots, from debt restructurings to a three-year partial pension holiday to cover past deficits, have driven the school district's structural deficit up to $1 billion and helped sink its ratings deep into junk territory.

One of Emanuel' top council allies acknowledged TIF funding is only a temporary salve.

"TIF is a one- or two-year fix," Emanuel's floor leader, Alderman Patrick O'Connor, said on WTTW's Chicago Tonight program. "We've done it this year so we can keep the schools open…but what we need to do is find a permanent solution."

TIF has long been used to support school capital projects -- the city committed funds to bond issues in 2007 and 2010 under former Mayor Richard Daley's school modernization program -- so it's not improper to now use to help with an operating expense, O'Connor added.

Chicago's 146 TIF districts are expected to generate $475 million next year. The program began in 1984 and Daley used it heavily to spur development resulting in criticism that it provided subsidies for wealthy downtown developers for areas some might not consider "blighted."

Once designated a TIF district, the amount of property taxes that flows to general government coffers is frozen and revenue growth goes to fund qualified work in the district to support development for 23 to 24 years. The city has also issued bonds backed by the revenue.

Emanuel implemented reforms after taking office in 2011 and signed an executive order in 2013 that required the city to declare a surplus from TIF districts annually of at least 25 % of the available cash balance after accounting for current and future projects or commitments.

Emanuel froze the downtown TIFs last year.

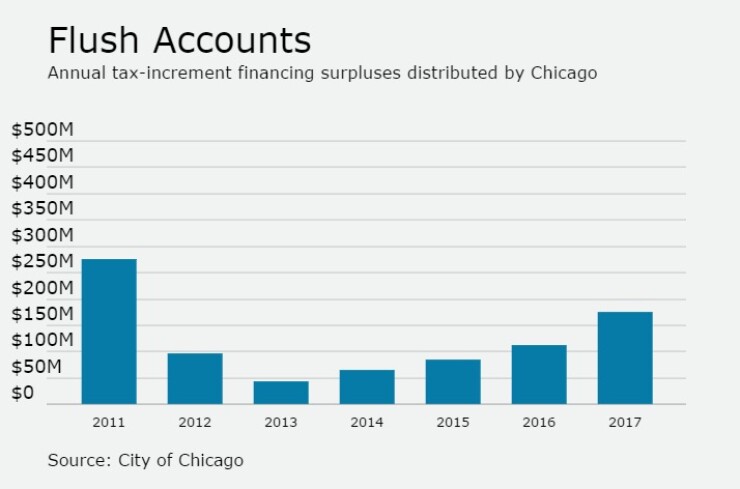

Since 2011, a total of $853 million of surplus revenue has been distributed but the amount has varied significantly.

In 2011, a $276 million surplus was distributed to taxing bodies.

That dropped to $97 million in 2012, $43 million in 2013, $65 million in 2014, $84 million in 2015, $113 million in 2016, and now $175 million will be released in 2017.

The use of revenue that can't be relied upon annually, at least at the level being freed up in 2017, heightens worry over the district's prospects because of its precarious liquidity, reliance on credit lines to keep afloat, and the uncertainty over some funding streams in its budget.

The state committed $215 million to help fund teachers pensions' but only if Gov. Bruce Rauner and Democratic lawmakers can bridge their partisan divide that has blocked passage of a state budget and agree on state pension reforms. An additional $130 million of state aid is also uncertain beyond fiscal 2017.

CPS has further fueled concerns by failing to provide a price tag for the new teachers contract.

"For the district, not only does this deal provide teachers with a raise and secure their pensions, it also achieves meaningful savings that helps stabilize our finances," CPS spokeswoman Emily Bitner said in a statement that offered no dollar figures.

The union's House of Delegates will meet next week and decide whether to recommend a rank-and-file vote.

The district's $5.4 billion fiscal 2017 budget was based on figures from a January offer that was rejected by union delegates.

It counted on $30 million in savings this year assuming the district would phase out the $130 million annual expense of covering 7% of teachers' 9% pension contribution.

But the tentative agreement leaves intact that benefit for existing teachers. It phases the cost out for teachers hired after Jan. 1 but gives them a 7% base pay raise.

Cost-of-living raises proposed in January were scaled back and occur in only year three and year four.

Teachers also agreed to healthcare concessions.

An early retirement offer for some teachers adds to the unknown costs of the deal.

The contract would be retroactive to last year, when the previous pact expired.

"Chicago Public Schools are in big financial trouble, they did not budget anything for additional spending," said Laurence Msall, president of the Civic Federation, adding that the budget is "already over reliant on things coming from Springfield that haven't been fully settled."

Emanuel defended the deal and denied that it too generously favored the union.

"Getting the agreement that didn't adversely affect the classroom was the goal," he said, acknowledging that the district had to relent on the pension pickup.

Emanuel argued the present value of the contract is not that far off from the January offer after the raises were scaled back.

But his administration offered no figures to support that assessment.