The municipal bond market rallied to the tune of seven basis points as the first new issuance of 2020 — and the biggest slate in over two weeks — looms on the horizon. Municipal bond buyers have plenty of cash in hand and will have various options as to where to put that money to work.

Primary market

IHS Ipreo is estimating supply will come in at $7.96 billion in a calendar composed of $4.08 billion of negotiated deals and $3.88 billion of competitive sales. There are 28 deals scheduled $100 million or larger, with 17 negotiated deals and 11 competitive transactions. Nine of those deals are either taxable or partially taxable.

There was no end in sight to the voracious appetite from cash-flush municipal investors returning to the market on Friday as tax-exempt bonds exhibited noticeable strength to end the holiday week, according to a New York trader.

“With the brand new year coming out of the gate, there is lots of cash to be put to work,” he said. “While some people might be patient and wait, those people will miss this rally,” the trader said.

He said bond market “exploded” as munis were up by five basis points on the long end, while Treasuries were up by seven basis points at midday on the heels of the U.S.-led drone strike in Baghdad that killed Iranian leader and Gen. Qassem Soleimani.

He said municipals were “very strong,” and given the lack of supply, he described the scenario as a “frenzy” for paper — especially due to the excessive amount of calls and redemptions that came due Jan. 1.

The seasonal demand is compounding the already-strong appetite for municipals, according to the trader, who said next week’s estimated $7.9 billion new issue calendar will be devoured by the pent-up demand.

“There is so much money and Jan. 1 is a big interest payment date,” he said. “January and July are the two biggest days, with a lot of bonds called on Jan. 1, there will definitely be demand.”

“There is a ton of money out there, so everything will get gobbled up next week,” he added, noting that many structures, coupons, and maturities will be in demand across the board in what he said will be a "food fight" for bonds.

“They will buy everything — short, long, 5%s, 2%s,” he said. “They need to,” he added, “they have so much cash to spend.”

Citi is slated to price University of Massachusetts Building Authority’s (Aa2/AA-/AA/NR) $569.12 million of project revenue bonds on Wednesday. The tax-exempt portion is expected to have a par amount of $212.295 million, while the taxable portion should be for $356.825 million.

Barclays is scheduled to price New Jersey Economic Development Authority’s (Baa1/BBB+/A-) $500 million of transit transportation project bonds on Thursday.

JPMorgan Securities is expected to price the Arizona Transportation Board’s $466.48 million of highway revenue taxable bonds on Thursday.

Topping the competitive slate next week will be the New York Metropolitan Transportation Authority, which is coming to market with around $2.4 billion of deals composed of about $940 million of green revenue bonds selling on Thursday and $1.5 billion of bond anticipation notes selling on Monday.

Secondary market

Munis were stronger on the MBIS benchmark scale, with yields falling by two basis points in the 10-year maturity and by three basis points in the 30-year maturity. High-grades were also stronger, with yields on MBIS AAA scale decreasing no more than one point in the 10-year maturity and by three basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year and 30-year GO were lower by seven basis points to 1.37% and 2.00%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 76.5% while the 30-year muni-to-Treasury ratio stood at 88.7%, according to MMD.

Treasuries were lower and stocks were falling after the U.S. airstrike.

The Dow Jones Industrial Average was down about 0.64%, the S&P 500 Index lost around 0.54% and the Nasdaq was lower by about 0.55%.

The Treasury three-month was yielding 1.515%, the two-year was yielding 1.521%, the five-year was yielding 1.588%, the 10-year was yielding 1.794% and the 30-year was yielding 2.258%.

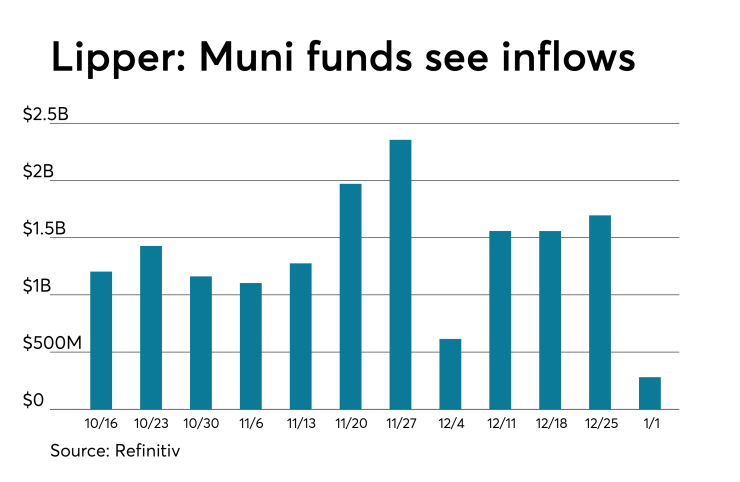

Lipper sees inflows for 52nd consecutive week

For the 52nd week in a row, investors put their money to work in the municipal bond arena as they continued to pour cash into tax-exempt mutual funds.

In the week ended Jan. 1, weekly reporting tax-exempt mutual funds attracted $280.585 million of inflows, after inflows of $1.694 billion in the previous week, according to data released by Refinitiv Lipper late on Thursday.

Exchange-traded muni funds reported inflows of $136.257 million, after inflows of $132.646 million in the previous week. Ex-ETFs, muni funds saw inflows of $144.328 million after inflows of $1.562 billion in the prior week.

The four-week moving average remained positive at $1.272 billion, after being in the green at $1.356 billion in the previous week.

Long-term muni bond funds had inflows of $76.066 million in the latest week after inflows of $1.211 billion in the previous week. Intermediate-term funds had inflows of $151.192 million after inflows of $324.204 million in the prior week.

National funds had inflows of $275.471 million after inflows of $1.526 billion while high-yield muni funds reported outflows of $38.564 million in the latest week, after inflows of $380.898 million the previous week.

Muni money market funds see outflow

Tax-exempt municipal money market fund assets increased by $698.6 million, raising their total net assets to $137.12 billion in the week ended Dec. 30, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds increased to 1.07% from 0.84% in the previous week.

Taxable money-fund assets gained $24.27 million in the week ended Dec. 31, bringing total net assets to $3.445 trillion. The average, seven-day simple yield for the 805 taxable reporting funds stayed at 1.28% from the prior week.

Overall, the combined total net assets of the 992 reporting money funds increased by $24.96 billion to $3.582 trillion in the week ended Dec. 31.

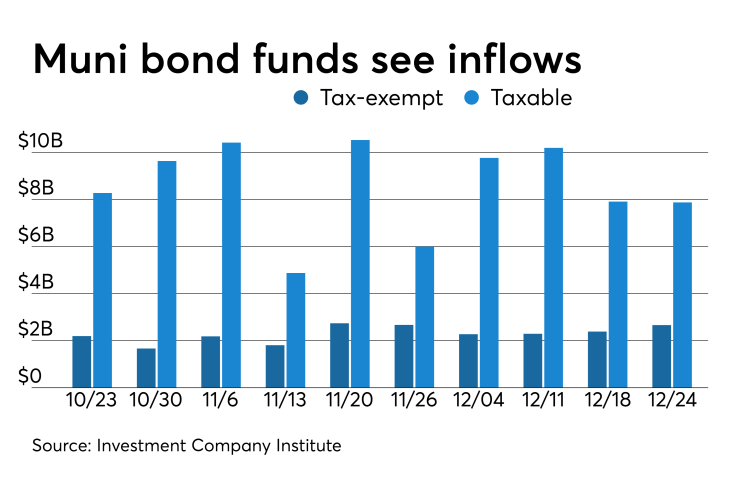

ICI: Muni funds see $2.6B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.661 billion in the week ended Dec. 24, the Investment Company Institute reported on Thursday.

It was the 51st straight week of inflows into the tax-exempt mutual funds and followed an inflow of $2.385 billion in the previous week.

Long-term muni funds alone saw an inflow of $2.387 billion after an inflow of $2.211 billion in the previous week; ETF muni funds alone saw an inflow of $274 million after an inflow of $175 million in the prior week.

Taxable bond funds saw combined inflows of $7.875 billion in the latest reporting week after revised inflows of $7.905 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $6.392 billion after inflows of $9.932 billion in the prior week. Domestic equities was the biggest loser of the latest week with outflows of 6.252 billion.

Previous session's activity

The MSRB reported 29,452 trades Thursday on volume of $7.849 billion. The 30-day average trade summary showed on a par amount basis of $10.85 million that customers bought $5.78 million, customers sold $3.26 million and interdealer trades totaled $1.80 million.

New York, California and Texas were most traded, with the Empire State taking 16.345% of the market, the Golden State taking 13.223% and the Lone Star State taking 9.637%.

The most actively traded CUSIP was the Los Angeles Department of Water and Power revenue taxable 6.574s of 2045, which traded 7 times on a par amount of $35 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.