Municipal bonds were stronger at mid-session as West Virginia came to market with two big competitive sales and the Regents of the University of California’s negotiated deal was priced.

Primary market

West Virginia was back in the market on Wednesday with two competitive deals totaling $632.4 million.

The state sold $302.055 million of Series 2018B Bidding Group 2 GO state road bonds to Bank of America Merrill Lynch, which won the issue with a true interest cost of 3.888%,

Citigroup won the $330.345 million of Series 2018B Bidding Group 1 GO state road bonds with a TIC of 3.3689%.

The deals are rated Aa2 by Moody’s Investors Service, AA-minus by S&P Global Ratings and AA by Fitch Ratings.

On Tuesday, the state sold $167 million of Series 2018A general obligation state road bonds in a negotiated deal priced by BAML.

Since 2010, West Virginia had sold about $1.09 billion of securities, including these sales, with the most issuance before this year occurring in 2015 when it sold $205 million. The Mountain State did not come to market at all in 2012 through 2014 or in 2016.

Also on Wednesday, BAML priced the Regents of the University of California’s $741.47 million of Series 20180 limited project revenue bonds.

BAML is also expected to price the Regents’ $283 million of Series 2018BA taxable general revenue bonds and $95 million of Series 2018P taxable limited project revenue bonds.

The Series BA taxables are rated Aa2 by Moody’s and AA by S&P and Fitch while the Series 0 bonds and Series P taxables are rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Morgan Stanley received the official award on the Georgia Housing and Finance Authority’s $110 million of Series 2018A single-family mortgage bonds.

The deal is rated AAA by S&P.

Morgan Stanley also received the written award on the Houston Independent School District’s remarketing of $196.12 million of variable-rate limited tax schoolhouse and refunding bonds.

The deal is backed by the Permanent School Fund guarantee program and is rated triple-A by Moody’s and S&P.

Wednesday’s bond sales

West Virginia:

California:

Texas:

Georgia:

Bond Buyer 30-day visible supply at $7.52B

The Bond Buyer's 30-day visible supply calendar decreased $2.43 billion to $7.52 billion on Wednesday. The total is comprised of $3.91 billion of competitive sales and $3.61 billion of negotiated deals.

Secondary market

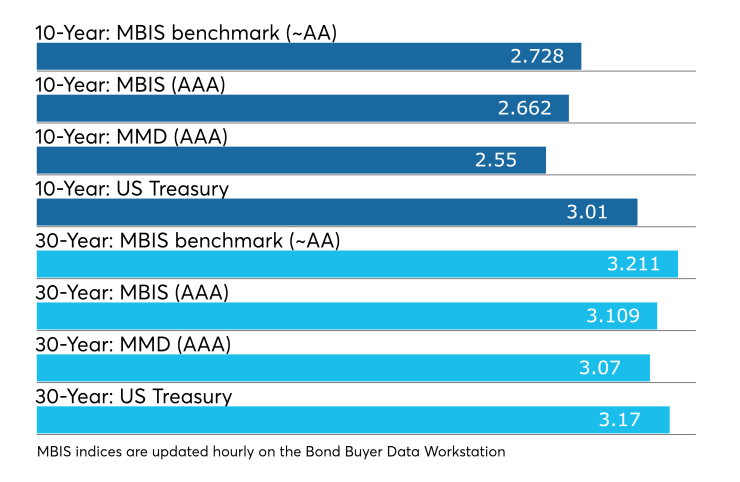

Municipal bonds were stronger on Wednesday, according to a midday read of the MBIS benchmark scale.

Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS’ AAA scale falling as much as two basis points all across the curve.

According to Municipal Market Data’s AAA benchmark scale, municipals strengthened with yields falling from one to three basis points in the 10-year general obligation muni and dropping three to five basis points in the 30-year muni maturity.

Treasury bonds were also stronger as stocks were trading lower.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 83.2% while the 30-year muni-to-Treasury ratio stood at 95.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasuries with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasuries; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,795 trades on Tuesday on volume of $9.33 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 14.907% of the market, the Lone Star State taking 12.719% and the Empire State taking 9.95%.

Treasury auctions $16B re-opened 2-year notes

The Treasury Department Wednesday auctioned $16 billion of one-year 11-month floating rate notes with a high discount margin of 0.028%, at a 0.033%, a price of 100.009127. The bid-to-cover ratio was 3.26.

Tenders at the high margin were allotted 83.23%. The median discount margin was 0.023%. The low discount margin was 0.010%. The index determination date is May 21 and the index determination rate is 1.895%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.