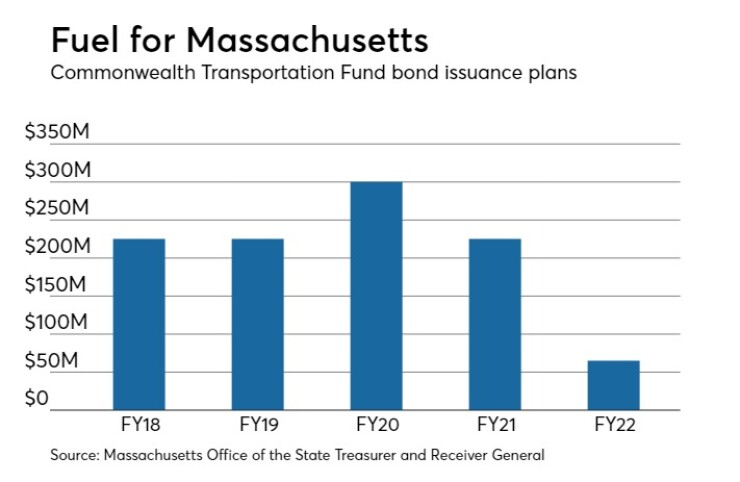

Massachusetts intends to come to market this week with a $225 million sale of Commonwealth Transportation Fund Series 2018A revenue bonds.

The retail and institutional sales are scheduled for Tuesday and Wednesday, respectively, with closing set for June 27.

Bank of America Merrill Lynch and UBS are lead managers. Final maturities are June 1, 2048. Proceeds will benefit the rail enhancement and accelerated bridge programs.

The fund, which state lawmakers established under a 2009 transportation reorganization, secures the bonds. Its primary revenue sources are the motor fuels tax and registry fees.

"CTF is one of the strongest transportation credits in the United States," Sue Perez, the commonwealth's deputy treasurer for debt management, said on a conference call.

S&P Global Ratings and Kroll Bond Rating Agency rate the credit AAA. Moody's Investors Service assigns its Aa1 rating. All three assign stable outlooks.

Pledged revenues, said Kroll, are resilient "and unlikely to decline significantly enough to impair coverage of debt service, even in very adverse economic conditions."

Moody's caps its rating for the fund at its general obligation rating for Massachusetts, given its ties to the commonwealth.

"The ongoing need for annual appropriation of CTF debt service, along with the flow of pledged revenues through the commonwealth via the Department of Revenue and Registry of Motor Vehicles before they are deposited with the bond trustee, connect the payment of debt service to the state," said Moody's.

According to Perez, pledged funds have consistently exceeded $1 billion annually, while the diversity of pledged funds mitigates the effect of potential declines in gasoline consumption though such consumption, she added, has remained "relatively stable" over the past 10 years.

The commonwealth, she said, has increased the CTF pledged revenue base by more than $120 million annually in conjunction with the authorization in 2014 of the rail enhancement program.

PFM is financial manager while Locke Lord LLP is bond counsel. McCarter & English LLP is representing the underwriters.

Related rail projects include the Massachusetts Bay Transportation Authority's four-mile Green Line light-rail extension from Cambridge to Somerville and Medford; improvements to the MBTA's Red and Orange subway lines; the South Coast commuter rail extension from Boston to Taunton, Fall River and New Bedford; and various improvements to the Fairmount commuter rail line which runs between South Station and Hyde Park, both within Boston.

Target bridge projects include Longfellow Bridge between Cambridge and Boston; the Fore River Bridge connecting Quincy and Weymouth; the John Greenleaf Whittier Memorial Bridge, which links Newburyport and Amesbury; the Woods Memorial Bridge between Everett and Medford; the Millbury Bridge over West Main Street in Millbury.

Massachusetts is nearing the end of its fiscal year. Under state law, a conference committee will reconcile the differences between versions of the $41 billion spending plan that the Senate and House of Representatives passed earlier this month and in April, respectively.