Top-shelf municipal bonds were mostly unchanged, according to traders, as the market seems to be settling down and a few larger deals trickled in.

Primary Market

On Thursday, Bank of America Merrill Lynch priced the Los Angeles County Metropolitan Transportation Authority's $513.99 million of measure R senior sales tax revenue bonds for institutional investors, after holding a retail order period on Wednesday. The bonds were priced for institutions to yield from 1.01% with a 5% coupon in 2018 to 3.64% with a 3.50% coupon and to yield 3.24% with a 5% coupon in a split 2039 maturity. The 2017 maturity was offered as a sealed bid. The deal is rated Aa1 by Moody's Investors Service and triple-A by S&P Global Ratings.

Barclays priced the Massachusetts Development Finance Agency's $207.675 million of revenue bonds for Emerson College. The $194.235 million of tax-exempt Series 2016A bonds were priced to yield from 2.81% with a 5% coupon in 2022 to 3.58% with a 5% coupon in 2026. The bonds were also priced to yield from 4.07% with a 5% coupon in 2031 to 4.31% with a 5% coupon in 2036. A term bond in 2042 was priced to yield 4.37% with a 5.25% coupon and a term bond in 2047 was priced to yield 4.51% with a 5% coupon. For the $13.44 million of taxable, pricing information was not immediately available.

Piper Jaffray received the written award on the Sonoma County, Calif., Junior College District's $145.795 million of election 2014 general obligation bonds and GO refunding bonds. The $125 million of GO bonds were priced to yield from 0.90% with a 3% coupon in 2017 to 3.18% with a 5% coupon in 2035. A term bond in 2037 was priced to yield 3.58% with a 4.5% coupon and a term bond in 2041 was priced to yield 3.31% with a 5% coupon.

The $20.795 million of GO refunding bonds were priced to yield 0.90% with a 3% coupon in 2017 and from 2.14% with a 5% coupon in 2024 to 2.83% with a 5% coupon and 3.23% with a 3.25% coupon in a split 2029 maturity. The deal is rated Aa2 by Moody's and AA-minus by S&P.

Morgan Stanley priced Bexar County, Texas's $112.23 million of combination tax and revenue certificates of obligation. The $92.255 million of series 2016A bonds were priced to yield from 1.18% with a 3% coupon in 2018 to 3.31% with a 5% coupon in 2036. A term bond in 2041 was priced to yield 3.41% with a 5% coupon and a term bond in 2045 was priced to yield 3.80% with a 4% coupon.

The $19.975 million of series 2016B bonds were priced to yield from 1.18% with a 5% coupon in 2018 to 3.07% with a 5% coupon in 2031. The deal is rated triple-A by Moody's, S&P and Fitch.

In the competitive arena, Clark County, Nev., sold three issues totaling roughly $366.34 million. The largest deal is $260.66 million of general obligation limited tax refunding bonds was won by JPMorgan with a true interest cost of 2.00%. The bonds were priced to yield from 1.20% with a 5% coupon in 2018 to 2.41% with a 5% coupon in 2024.

There was also a $57.695 million of GO limited tax refunding plus additionally pledged revenue bonds, which were won by JPM with a TIC of 2.71% and $47.985 million of GO limited tax various purpose bonds, which were won by Citi with a TIC of 3.03%. All three deals are rated A1 by Moody's and AA-minus by S&P.

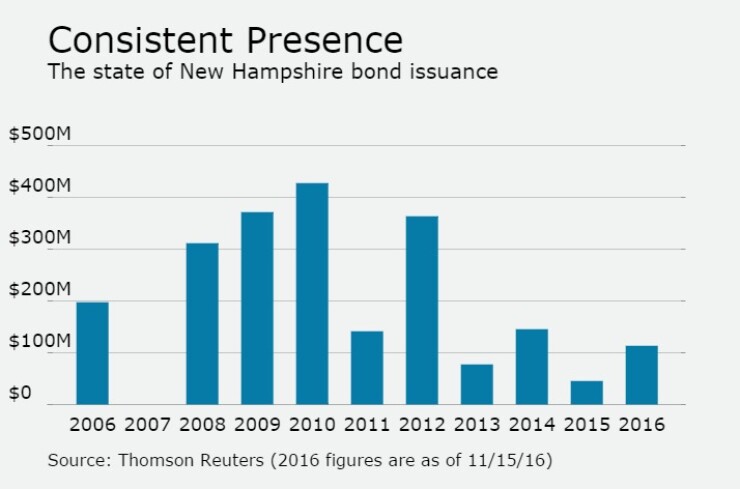

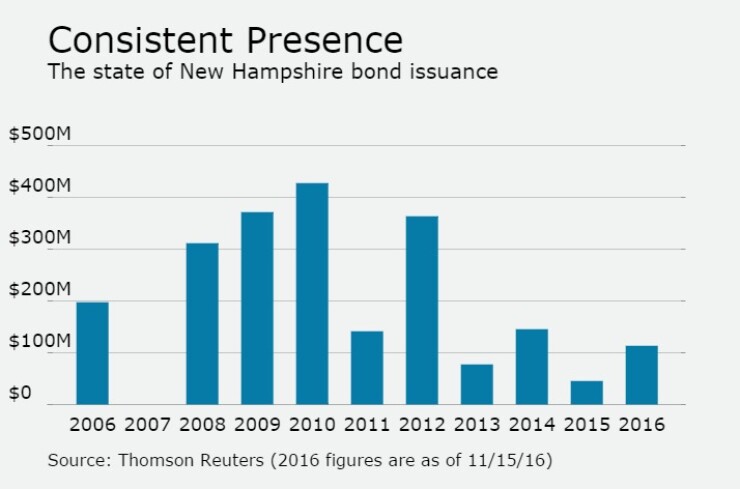

The state of New Hampshire sold a total of $113.52 million in two separate competitive sales. The larger sale consisted of $62.105 million of GO capital improvement bonds, which were won by Wells Fargo with a TIC of 2.77%. The other sale of $51.415 million of GO refunding bonds was won by Citi with a TIC of 1.62%. The deal is rated Aa1 by Moody's, AA by S&P and AA-plus by Fitch.

Since 2006, the Granite State has sold roughly $2.19 billion of securities, with the largest issuance occurring in 2010, when it sold $428 million. New Hampshire did not come to market at all in 2007. The last time the state issued competitive bonds was on Dec. 11, 2014, when Citi won $55 million with a TIC of 2.62%

Secondary Market

Munis were mostly steady on Thursday, as the yield on the 10-year benchmark muni general obligation was steady from 2.21% on Wednesday, while the yield on the 30-year was unchanged at 3.01%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Thursday through midday. The yield on the two-year was up to 1.02% from 1.00% from Wednesday, the 10-year Treasury was higher at 2.25% from 2.22%, while the yield on the 30-year Treasury bond increased to 2.96% from 2.92%.

The 10-year muni to Treasury ratio was calculated at 99.5% on Wednesday compared to 97.9% on Tuesday, while the 30-year muni to Treasury ratio stood at 102.9% versus 101.3%, according to MMD.

Tax-Exempt Money Market Fund Inflows

Tax-exempt money market funds experienced inflows of $303.1 million, bringing total net assets to $129.59 billion in the week ended Nov. 14, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $1.14 billion to $129.29 billion in the previous week.

The average, seven-day simple yield for the 237 weekly reporting tax-exempt funds dropped to 0.15% from 0.16% in the previous week.

The total net assets of the 866 weekly reporting taxable money funds increased $6.51 billion to $2.524 trillion in the week ended Nov. 15, after an inflow of $13.13 billion to $2.517 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.15% from 0.14% from the prior week.

Overall, the combined total net assets of the 1,103 weekly reporting money funds rose $6.81 billion to $2.654 trillion in the week ended Nov. 15 after inflows of $14.27 billion to $2.647 trillion in the prior week.