Municipal bond volume fell from a year earlier for a sixth straight month, as a favorable low-interest rate environment failed to stop a downward spiral in refundings.

Total volume for February dropped 10.5% to $29.85 billion in 896 transactions from $33.36 billion in 1,108 transactions in February 2015, according to data from Thomson Reuters.

A continued pickup in new money deals wasn't enough to outweigh the drop in refundings.

"From a supply standpoint, it was volatile throughout the month," said Dawn Mangerson, managing director and senior portfolio manager at McDonnell Investment Management. "Some weeks we had big issuance and other weeks we had nothing, it is hard to invest when the market is choppy like that."

She said that while demand was inconsistent, it was strong in the 5-7 year part of the yield curve.

"When we saw a deal with more yield, there was participation all across the curve," she said. "Investors have been coming off the sideline when there is a little more yield, but not talking about high-yield."

The supply/demand dynamics may shift somewhat in March as a seasonal uptick in supply approaches, according to BlackRock, which predicts a transition out of a net negative period in January and February into a net positive period of March, April and May.

Mangerson agreed that a seasonal uptick is in issuance is approaching, but said it may come along with a reduction of money coming into muni funds.

"Around tax season we always see outflows, as people will start to pay their taxes," she said. "We have seen a lot more inflows recently than we have outflows, as the inflows are supporting that there is demand for munis. But it is tax season so we will start to see outflows. We might actually see more demand if we get higher yields."

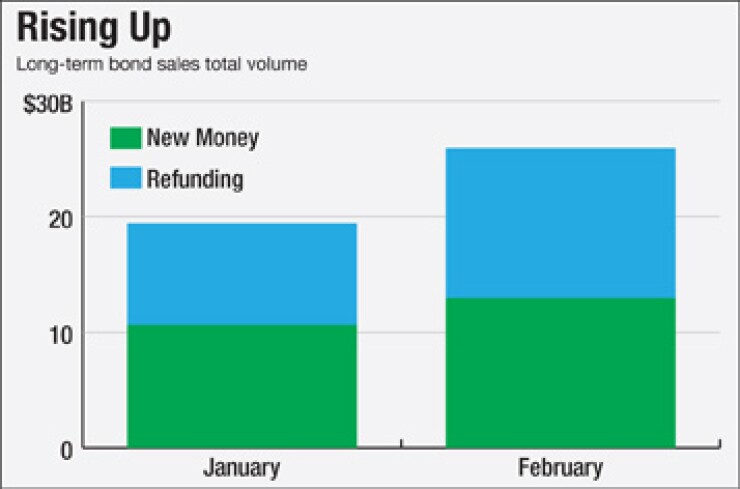

February's new money deals increased 22% to $12.97 billion in 437 deals from $10.62 billion in 452 deals a year earlier.

Refundings tumbled 23.4% to $12.97 billion in 403 deals from $16.93 billion in 570 deals.

"It is unfair to compare the refundings from last February to this past February, as the amount of refundings we got last in February of 2015 and pretty much the whole year, was an anomaly," Mangerson said.

Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, believes that the story is still the same: overall decline of new issuance on a tax-exempt basis.

"I think we will continue to see a situation where we think it will be challenging for issuance to build, especially in the first half of the year," said Heckman.

Combined new-money and refunding issuance dropped by 32.6% to $3.91 billion from $5.81 billion.

Issuance of revenue bonds fell 17.1% to $15.58 billion, while general obligation bond sales declined 2% to $14.27 billion.

Negotiated deals were down 17% to $20.65 billion and competitive sales increased by 21.1% to $9.03 billion.

Taxable bond volume was 49.1% higher to $2.83 billion from $1.89 billion, while tax-exempt issuance declined by 10.6% to $26.59 billion.

Heckman said that pick up in taxable bonds can be contributed to the couple of large deals that came to market, but that he sees the taxable space to continue the trend.

"Taxable bonds will continue to come to market," said Heckman. "Spreads are tight and yields are low, so if there is one area of supply that will pick up, it will be on the taxable side."

Bond insurance dipped 22.3% in February, as the volume of deals wrapped with insurance declined to $1.65 billion in 129 deals from $2.11 billion in 180 deals.

Only four sectors posted year over year increases: Environmental facilities more than doubled to $162 million from $25 million; transportation improved by 12.8% to $3.14 billion from $2.79 billion; utilities increased by 10.2% to $4.14 billion from $3.76; General purpose was 18.8% higher to $8.16 billion from $6.87 billion.

The education sector suffered a year-over-year decline of 15.7%, though it still accounted for the highest amount of bonds of all the sectors with $11.05 billion.

"There are challenges in the education sector that we believe will continue and might even press into a long term trend," said Heckman. "This sector had demographic issues and it's a trend that in the near term isn't going to be in their favor."

Heckman cited specific funding problems, pressure from pensions and increasing costs as just some of the headwinds the sector faces.

"If the economy can continue to add jobs, you might even see some people opt to further their careers in lieu of wanting to going to school and that could impact the sector as well," he said.

When it comes to issuance by state, Texas still finds itself atop the list far outpacing the rest of the top five — California, New York, Florida and Illinois.

The Lone Star State, which led the way the first two months of last year, too, has issued $8.87 billion so far in.

The Golden State is second with $4.67 billion, while the Empire State is third with $4.58 billion.

The Sunshine State captured the fourth spot with $3.31 billion and the Prairie State is close behind with $2.89 billion.

"The demand is out there, especially in the front part of the curve, but people are leery about putting money to work at such low, absolute yields," said Mangerson. "We might see more demand if we see a backup in the market higher yields."