Municipal bond volume fell in January as a drop in refunding outweighed a pickup in new money deals, a trend that analysts predicted would continue through the rest of the year.

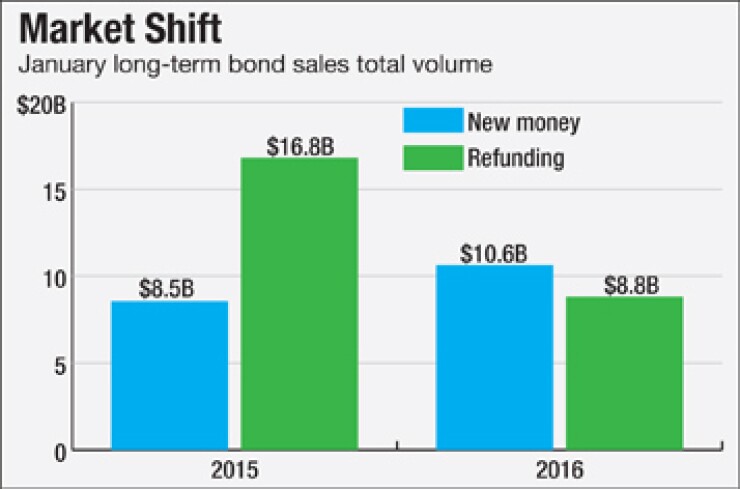

Total volume for the month dropped 18% to $24.11 billion in 741 transactions from $29.45 billion in 834 transactions in January 2015, according to data from Thomson Reuters. Refundings plummeted to $8.82 billion in 309 deals from $16.79 billion in 438 deals a year earlier.

"The month played out pretty close to what we anticipated, as we originally thought we would end up with $26 billion for the month," said Chris Mauro, director of municipal bond research at RBC Capital Markets. "Although volume was down year over year, we finished the month above long-term five-year and 10-year averages for the month."

Mauro said it is almost unfair to compare year over year refunding volume, given the size of last year's wave of deals, as issuers sought to take advantage of record low interest rates. The Federal Open Markets Committee lifted the Federal Reserve's benchmark rate target from near zero to 0.25%-0.50% in December, then signaled at its January meeting that it may slow the pace of increases later this year.

"This past month was continuation from what we saw in the fourth quarter of last year, and that's a firming of new money and a decline in refundings," Mauro said. New money issuance gained 24.4% to $10.62 billion in 382 issues from $8.54 billion in 338 issues.

Mauro said that the first half of this year should be generally favorable for refunding, but that the activity will drop off in the second half.

"The key is how much the move down in rates will boost refunding activity in February," he said.

Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, said though January's supply was a little weaker than he anticipated, there are good signs to take away.

"We are seeing signs that [supply] will pick back up, as there is a strong undertone to the muni market and we think that will continue throughout the first quarter and first half," said Heckman. "The problem is that we aren't seeing enough bonds in comparison to the demand."

Heckman said volume later in the year may be affected by election politics.

Combined new-money and refunding issuance improved by 13.5% to $4.67 billion.

Issuance of revenue bonds fell 32.3% to $12.82 billion, while general obligation bond sales rose 7.4% to $11.29 billion.

Negotiated deals were down 23.3% to $17.34 billion and competitive sales increased by 17.3% to $6.59 billion.

Taxable bond volume was 24.8% lower to $1.26 billion from $1.66 billion, while tax-exempt issuance declined by 17.8% to $22.79 billion. Minimum tax bonds increased 49.2% to $64 million.

Bond insurance started off the year on the right foot, as the volume of deals wrapped with insurance improved 52.5% to $1.66 billion in 113 deals from $1.09 billion in 111 deals.

Only two sectors saw year over year increases, as education jumped up 17% to $9.46 billion in 382 issues from $8.09 billion in 405 issues and electric power more than doubled to $1.05 billion from $398 million.

With one month done and 11 to go, Texas finds itself with the most issuance among states. Rounding out the top five are California, Illinois, Florida and Michigan.

The Lone Star State has issued $3.75 billion so far in 2016 and also led the way after the first month of last year. The Golden State is second with $2.85 billion, while the Prairie State is third with $1.52 billion. The Sunshine State captured the fourth spot with $1.41 billion and the Wolverine State is very close behind with $1.35 billion.

The Federal Open Market Committee did what most economists had expected by holding rates steady in January, and volume may depend on when and how much the committee decides to raise rates in future meetings.

"They have to leave the door open to rate increases. I feel as though they effectively addressed the capital markets volatility and the open door gives them flexibility, which I believe is key," said Heckman.

Heckman said strong economic data in wage gains and employment reports as the year goes on would leave the FOMC will with little choice but to raise rates.

"It's been the same band playing the same song and that is a lack of supply and lots of cash inflows. A lot of managers and individuals have been waiting on Fed actions hoping we would get higher rates, which leaves a lot of cash on the sidelines," said Heckman.

Investors have decided to re-allocate money to fixed income portfolios, he said, but there are too few bonds to meet the demand.

"A lot of people are under-exposed to the muni bond market, as right now spreads are more attractive in other markets."