Municipal bond traders received more deals to work with, as a big deal from a New Jersey issuer hit screens on Wednesday.

Primary Market

On Wednesday, JPMorgan Securities priced the New York City Housing Development Corp.'s $122.94 million of Series 2017 A-1-A multi-family sustainable neighborhood housing bonds.

The $51.61 million of Series 2017 A-1-A bonds were priced at par to yield from 1.45% and 1.50% in a split 2020 maturity to 2.95% in a split 2028 maturity and 3.50% in 2032, 3.80% in 2037, 3.85% in 2042, 3.95% in 2047 and 4.05% in 2052.

The $11.17 million of Series 2017 A-1-B bonds were priced at par to yield 3.80% in 2037, 3.85% in 2042, 3.95% in 2047 and 4.05% in 2052.The $48.88 million of Series 2017 A-2-A bonds were priced at par to yield 1.90% in 2021.

The $11.29 million of Series 2017 A-2-B bonds were priced at par to yield 1.90% in 2021.

The deal is rated Aa2 by Moody's Investors Service and AA-plus by S&P Global Ratings.

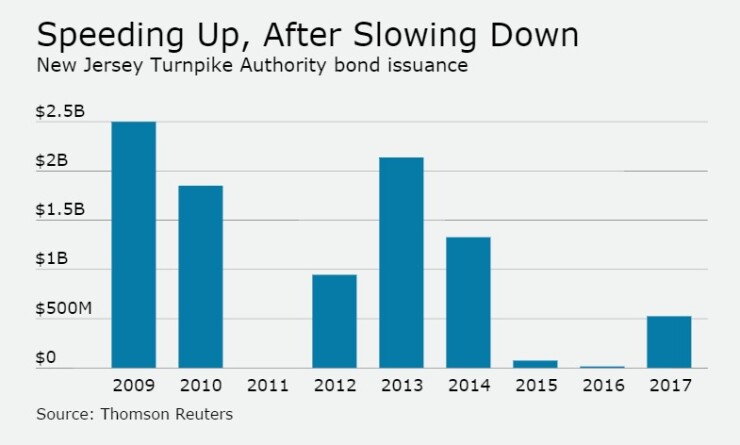

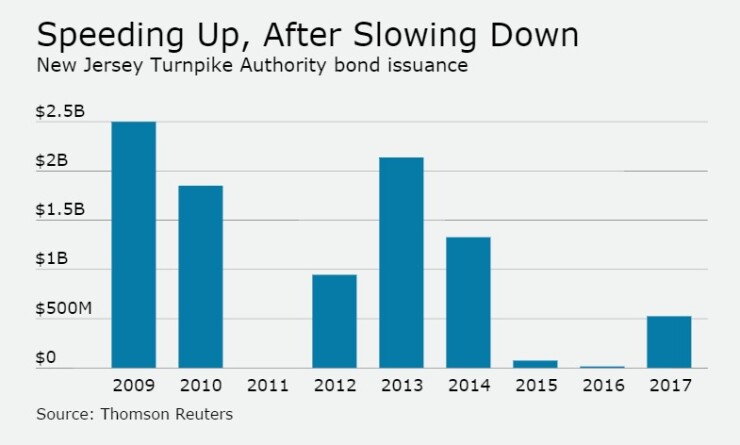

Goldman Sachs priced the New Jersey Turnpike Authority's $525 million of Series 2017A turnpike revenue bonds on Wednesday. The bonds were priced to yield from 2.66% with a 5% coupon in 2027 to 3.75% with a 3.50% coupon in 2036. The deal is rated A2 by Moody's, A-plus by S&P and A by Fitch Ratings.

Since 2009, the authority has sold about $10.2 billion of bonds, with the most issuance occurring in 2009 when it offered $2.49 billion of debt. The turnpike authority did not come to market in 2011.

In the competitive arena on Wednesday, Anne Arundel County, Md., sold $237.745 million of bonds in two separate sales.

The offerings are composed of $173.14 million of Series 2017 consolidated general improvements GOs and $64.61 million of Series 2017 consolidated general improvements refunding GOs.

The larger sale was won by Bank of America Merrill Lynch with a true interest cost of 3.47%. The bonds were priced to yield from 0.83% with a 5% coupon in 2017 to 3.02% with a 5% coupon in 2040. A term bond in 2043 was priced to yield 3.05% with a 5% coupon and a term bond in 2046 was priced to yield 3.08% with a 5% coupon.

Citi won the bidding on the smaller transaction with a TIC of 2.42%. Both deals are rated Aa1 by Moody's and triple-A by S&P.

Late Tuesday, Wells Fargo Securities priced the NYC HDC's $24.5 million of taxable Series 2017 B-1 multi-family housing revenue bonds.

The issue was priced at par to yield from 1.60% in 2018 to 3.814% in 2029. The deal is also rated Aa2 by Moody's and AA-plus by S&P.

Secondary Market

Top-quality municipal bonds were slightly weaker on Wednesday around midday. The yield on the 10-year benchmark muni general obligation was as much as one basis point higher from 2.23% on Tuesday, while the 30-year GO yield was up by as much as one basis point from 3.01%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger at midday on Wednesday. The yield on the two-year dropped to 1.27% from 1.30% on Tuesday, while the 10-year Treasury yield declined to 2.39% from 2.42%, and the yield on the 30-year Treasury bond decreased to 3.00% from 3.02%.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 92.5% compared with 94.9% on Monday, while the 30-year muni to Treasury ratio stood at 99.8%, versus 101.7%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 43,687 trades on Tuesday on volume of $11.57 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $750.4 million to $10.3 billion on Wednesday. The total is comprised of $3.07 billion of competitive sales and $7.23 billion of negotiated deals.