Municipal bonds were weaker at mid-session, traders said, as yields on top-rated maturities strengthened by as much as five basis points.

The market will see an estimated $5.42 billion of new supply next week, according to Ipreo, which will consist of $3.82 billion of negotiated deals and $1.60 billion of competitive sales.

Secondary Market

The yield on the 10-year benchmark muni general obligation was one to three basis points stronger from 1.72% on Thursday, while the 30-year muni yield was three to five basis points stronger from 2.71%, according to a read of Municipal Market Data's triple-A scale.

Treasuries moved lower. The yield on the two-year Treasury rose to 0.87% from 0.83% on Thursday, while the 10-year Treasury yield gained to 2.06% from 2.02% and the 30-year Treasury bond yield increased to 2.84% from 2.80%.

The 10-year muni to Treasury ratio was calculated on Thursday at 83.4% compared to 86.0% on Wednesday, while the 30-year muni to Treasury ratio stood at 96.0% versus 97.0%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 40,581 trades on Thursday on volume of $9.03 billion.

Primary Market

Traders were going through the week's supply, which was calculated at $5.15 billion, according to revised data from Thomson Reuters.

The largest deals came from Washington state, which offered two competitive transactions totaling $672.57 million. JPMorgan Securities won the $528.83 million of Series R-2016B various purpose general obligation refunding bonds with a true interest cost of 2.69%. JPMorgan also won the $143.74 million of Series R-2016C motor vehicle tax GO refunding bonds with a TIC of 2.84%. Both series were rated Aa1 by Moody's Investors Service and AA-plus by Standard & Poor's and Fitch Ratings.

The Florida DOT sold $173.39 million of Series 2016A turnpike revenue refunding bonds. Bank of America Merrill Lynch won the issue with a TIC of 2.87%. The bonds were rated Aa3 by Moody's and AA-minus by Fitch.

The Board of Regents of the University of Houston System sold two deals totaling $285.495 million. Bank of America Merrill Lynch won the $101.145 million of Series 2016A tax-exempt consolidated revenue and refunding bonds with a true interest cost of 2.81%. Raymond James won the $184.350 million of Series 2016B taxable consolidated revenue and refunding bonds with a TIC of 3.14%. Both sales were rated Aa2 by Moody's and AA by S&P.

The University of Kentucky sold two issues totaling $158.11 million. Both series were rated Aa2 by Moody's and AA by S&P. Hutchinson, Shockey won the $109.26 million of Series 2016A general receipts bonds with a TIC of 3.60%. JPMorgan won the $48.85 million of Series 2016B taxable general receipts bonds with a TIC of 2.86%.

The Rosemount-Apple Valley Independent School District No. 196, Minn., sold $121.30 million Series 2016A GO school building bonds under the Minnesota School District enhancement program. Bank of America Merrill Lynch won the bonds with a TIC of 2.09%. The issue was rated Aa1 by Moody's and AA-plus by S&P.

In the negotiated arena, JPMorgan Securities priced the Massachusetts Development Finance Agency's $424.35 million of Series 2016Q revenue bonds for the Partners HealthCare System. The bonds were rated Aa3 by Moody's, AA-minus by S&P and AA by Fitch.

Morgan Stanley priced the DFA's $169.65 million of Series 2016I revenue bonds for the University of Massachusetts Memorial Health Care Obligated Group. That deal was rated triple-B-plus S&P and A-minus by Fitch.

Citigroup priced the New York Triborough Bridge & Tunnel Authority $541.235 million of Series 2016A MTA bridges and tunnels general revenue bonds. The bonds were rated Aa3 by Moody's Investors Service and AA-minus by both Standard & Poor's and Fitch Ratings and AA by Kroll Bond Rating Agency.

Loop Capital Markets priced the District of Columbia Water and Sewer Authority's $385.61 million of Series 2016A public utility subordinate lien revenue refunding bonds. The issue was rated Aa3 by Moody's, AA by S&P and AA-minus by Fitch.

Wells Fargo Securities priced the Aldine Independent School District, Harris County, Texas' $261.76 million of Series 2016 unlimited tax school building and refunding bonds. The bonds were backed by the Permanent School Fund guarantee program and rated triple-A by both Moody's and S&P.

Raymond James priced the Rockwall Independent School District, Texas' $107.96 million of Series 2016 unlimited tax school building bonds. The deal was backed by the PSF and rated triple-A by Moody's and S&P.

JPMorgan priced the Indiana Finance Authority's $163.40 million of Series 2016A hospital revenue refunding bonds for the Indiana University Health Obligated Group. The issue was rated Aa3 by Moody's, AA-minus by S&P and AA by Fitch.

Citi priced the Vermont Educational and Health Buildings Financing Agency's $176.56 million of revenue bonds for the University of Vermont Medical Center Project. The deal was rated A3 by Moody's and A-minus by both S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar rose $347.6 million to $8.52 billion on Friday. The total is comprised of $2.79 billion competitive sales and $5.73 billion of negotiated deals.

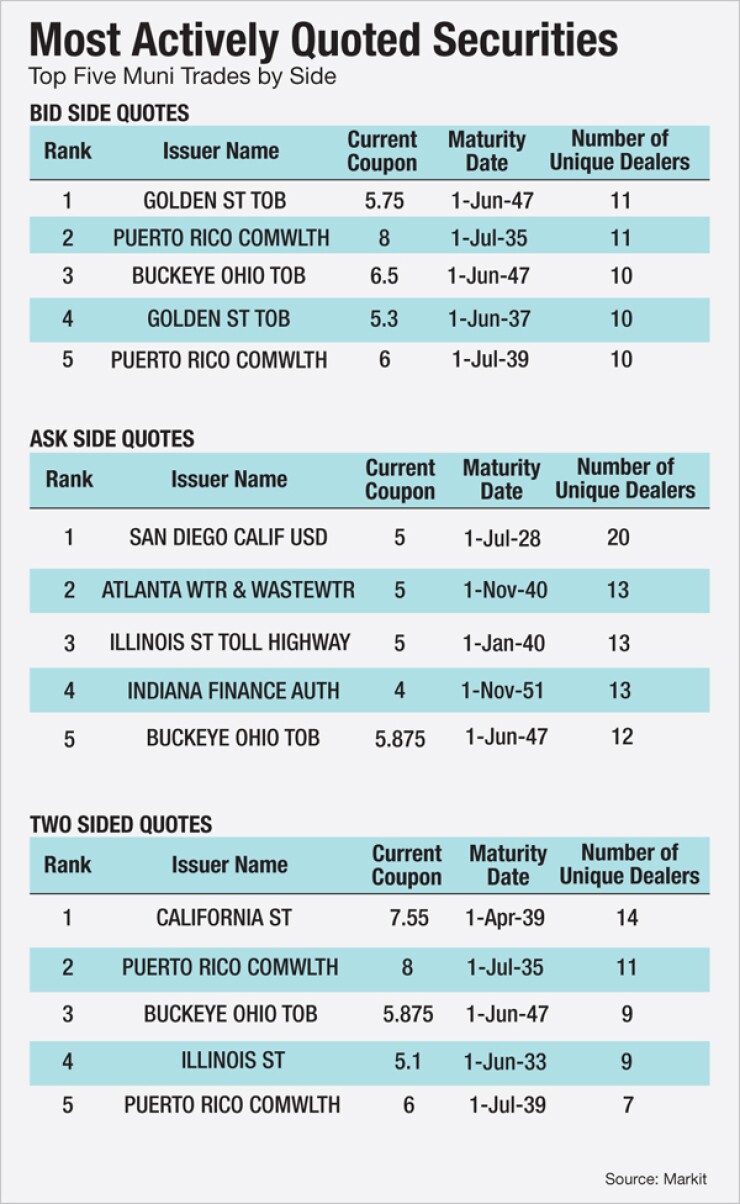

The Week's Most Actively Quoted Issues

California was among some of the most actively quoted names in the week ended Jan. 22, according to data released by Markit.

On the bid side, the California Golden State Tobacco Securitization Corp. revenue 5.75s of 2047 were quoted by 11 unique dealers. On the ask side, the San Diego Unified School District, Calif. GO 5s of 2028 were quoted by 20 unique dealers. And among two-sided quotes, the state of California taxable 7.55s of 2039 were quoted by 14 dealers.

The Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Jan. 22 were in Puerto Rico, Indiana and Illinois,

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 30 times. In the revenue bond sector, the Indiana Finance Authority 4s of 2051 traded 83 times. And in the taxable bond sector, the Illinois state 5.1s of 2033 traded 22 times, Markit said.

Municipal Bond Funds See Inflows for 16th Straight Week

Municipal bond funds reported inflows for the 16th week in a row, according to Lipper data released on Thursday.

Weekly reporting funds said they had $529.687 million of inflows in the week ended Jan. 20, after inflows of $994.911 million in the previous week, Lipper said.

The four-week moving average remained positive at $954.206 million after being in the green at $2.024 billion in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $91.669 million in the latest week, on top of inflows of $667.366 million in the previous week. Intermediate-term funds had inflows of $502.939 million after inflows of $251.084 million in the prior week.

National funds saw inflows of $475.167 million after inflows of $920.013 million in the prior week. High-yield muni funds reported inflows of $231.066 million in the latest reporting week, after an inflow of $399.087 million the previous week.

Exchange traded funds saw inflows of $107.761 million, after inflows of $165.154 million in the previous week.

In the week ended Jan. 13, long-term, long-term municipal bond funds saw inflows, according to the Investment Company Institute. Muni funds saw $1.319 billion of inflows after $1.382 billion of inflows in the previous week, ICI reported.