Top-shelf municipal bonds were weaker at mid-session, traders said, as new supply surged into the market.

The yield on the 10-year benchmark muni general obligation was one to three basis points stronger from 1.63% on Monday while the 30-year muni yield was as much as two basis points stronger from 2.43%, according to a midday read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 0.92% from 0.89% on Monday, while the 10-year Treasury yield gained to 1.87% from 1.83% and the yield on the 30-year Treasury bond increased to 2.66% from 2.63%.

The 10-year muni to Treasury ratio was calculated at 88.7% on Monday compared to 88.3% on Friday, while the 30-year muni to Treasury ratio stood at 92.5% versus 92.2%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 37,889 trades on Monday on volume of $8.30 billion.

Primary Market

Bank of America Merrill Lynch priced the state of Connecticut's $512.88 million of Series 2016B general obligation refunding bonds for institutions on Tuesday after holding a one-day retail order period.

The issue was priced to yield from 1.25% with 4% and 5% coupons in a split 2019 maturity to 2.45% with 4% and 5% coupons in a split 2027 maturity. A 2018 maturity was offered as a sealed bid.

On Monday, the issue was priced for retail to yield from 1.14% with 4% and 5% coupons in a split 2019 maturity to 2.35% with 4% and 5% coupons in a split 2027 maturity. The 2018 maturity was offered as a sealed bid.

Connecticut's GOs are rated Aa3 by Moody's Investors Service, AA-minus by S&P Global Ratings and Fitch Ratings, and AA by Kroll Bond Rating Agency.

PNC Capital Markets priced the Pennsylvania Turnpike Commission's $643 million of second series of 2016 subordinate revenue refunding bonds.

The issue was priced to yield from 1.58% with a 5% coupon in 2021 to 2.74% with a 5% coupon in 2029 and from 3.12% with a 3% coupon in 2031 to 3.10% with a 5% coupon in 2036; a 2039 maturity was priced as 5s to yield 3.19%.

The deal is rated A3 by Moody's and A-minus by Fitch.

RBC Capital Markets priced Miami-Dade County, Fla.'s $335.22 million of GOs for the building better communities program as a remarketing.

The $110.75 million of Series 2014A GOs were priced as a remarketing as 5s to yield from 2.46% in 2034 to 2.61% in 2037; a 2043 term bond was priced as 5s to yield 2.73%.

The $224.47 million of Series 2015D GOs were priced as a remarketing to yield from 0.79% with a 4% coupon in 2018 to 2.61% with a 5% coupon in 2037. A 2041 split term was priced as 3s to yield 3.10% and as 5s to yield 2.71%; a 2045 term was priced as 5s to yield 2.75%. A 2017 maturity was offered as a sealed bid.

The bonds are rated Aa2 by Moody's and AA by S&P.

In the competitive arena, the Florida Board of Education sold $241.69 million of Series 2016A lottery revenue refunding bonds.

JPMorgan Securities won the bonds with a true interest cost of 1.59%. Pricing information was not immediately available. The deal is rated A1 by Moody's, AAA by S&P and AA by Fitch.

The Brookland Cayce School District No. 2 of Lexington County, S.C., competitively sold $100 million of Series 2016 GOs.

Wells Fargo Securities won the deal with a TIC of 2.99%. The issue was priced to yield from 0.64% with a 5% coupon in 2017 to approximately 3.166% with a 3% coupon in 2040. The deal is backed by the South Carolina School District Credit Enhancement Program and is rated Aa1 by Moody's and AA by S&P.

Denton, Texas, competitively sold $112.19 million of securities in two separate sales.

Robert W. Baird won the $83.23 million of Series 2016 certificates of obligation with a TIC of 2.98%. Citigroup won the $28.96 million of Series 2016 GO refunding and improvement bonds with a TIC of 2.34%. Both deals are rated AA-plus by S&P and Fitch.

On Wednesday, the biggest deal of the week will be coming from the San Diego Public Facilities Financing Authority. JPMorgan Securities is expected to price the $567.96 million of Series 2016A and 2016B subordinated water revenue bonds. The deal is rated Aa3 by Moody's and AA-minus by Fitch.

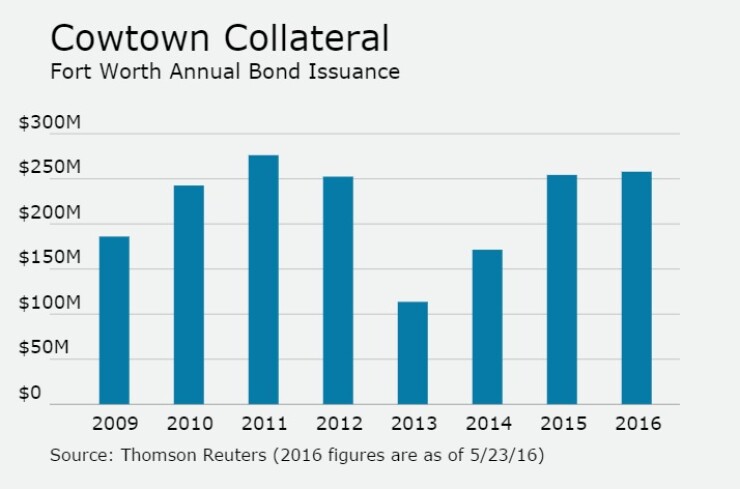

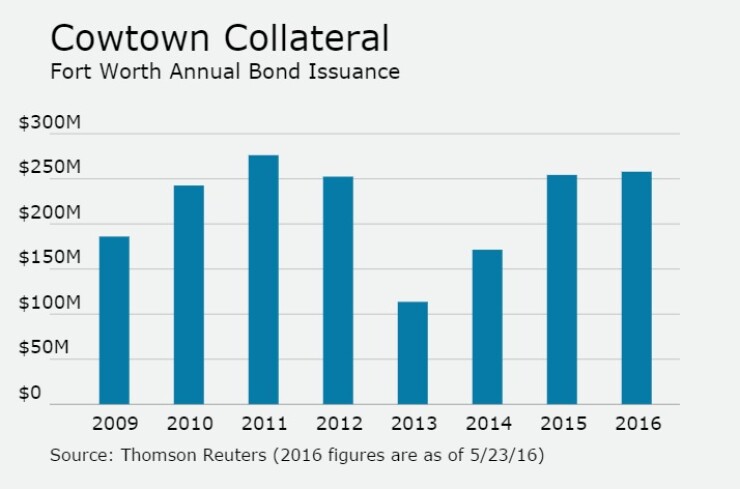

In the competitive sector on Wednesday, Fort Worth, Texas is selling $257.97 million of bonds in three separate sales. The offerings consist of $164.55 million of Series 2016 general purpose refunding and improvement bonds, rated Aa2 by Moody's and AA-plus by S&P and Fitch; $75.89 million of Series 2016 water and sewer system revenue refunding and improvement bonds, rated Aa1 by Moody's, AA-plus by S&P and AA by Fitch; and $17.53 million of Series 2016 drainage utility system revenue refunding bonds, rated AA-plus by S&P and Fitch.

Since 2009, Fort Worth has issued about $1.49 billion of debt, with the largest issuance occurring in 2011 when it sold $276 million of securities. Cowtown saw a low year of issuance in 2013, when it issued just $114 million.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $1.19 billion to $15.00 billion on Tuesday. The total is comprised of $7.92 billion of competitive sales and $7.08 billion of negotiated deals.

RBC: No End in Sight to Muni Bond Fund Inflows

Weekly reporting municipal bond funds saw $1.245 billion of inflows in the week ended May 18, after experiencing inflows of $1.212 billion in the previous week, according to Lipper data. This was the 33rd straight week of inflows in the funds and the third week of the last four where inflows topped $1 billion.

"With last week's big inflow, municipal funds have nearly erased all of the 2013 outflows," Chris Mauro, Head of U.S. Municipals Strategy at RBC, writes in a report released Tuesday. "With the large summer reinvestment approaching, we see no reason to believe that these heavy inflows will recede anytime soon. In addition to the large coupon payments in June and July, municipal funds are benefiting from continued outflows in equity funds, and from a relatively benign credit backdrop - recent notable announcements of state budget deficits notwithstanding."

Mauro sees investors continuing to put money into the funds.

"In the absence of a credit or rate shock, the current trend of sizable municipal fund inflows should continue through at least the summer months," Mauro says.