Top-shelf municipal bonds were stronger at mid-session, according to traders, ahead of next week's $7.9 billion new issue calendar.

Total volume for next week is estimated by Ipreo at $7.88 billion, down from a revised total of $8.12 billion this week, according to Thomson Reuters data.

Next week's calendar is divided up into $6.02 billion of negotiated deals and $1.86 billion of competitive sales.

Secondary Market

The yield on the 10-year benchmark muni general obligation on Friday was as much as one basis point weaker from 1.58% on Thursday, while the 30-year muni yield was as much as two basis points weaker from 2.51%, according to the midday read of Municipal Market Data's triple-A scale.

Yields have trended downward this week. On Friday, April 29, the yield on the 10-year muni stood at 1.61% while the 30-year muni was at 2.58%.

U.S. Treasuries were mixed on Friday. The yield on the two-year Treasury slipped to 0.70% from 0.72% on Thursday, while the 10-year Treasury yield was flat from 1.75% and the yield on the 30-year Treasury bond increased to 2.62% from 2.61%.

The 10-year muni to Treasury ratio was calculated at 90.6% on Thursday compared with 88.6% on Wednesday, while the 30-year muni to Treasury ratio stood at 96.4% versus 95.7%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 42,021 trades on Thursday on volume of $14.75 billion.

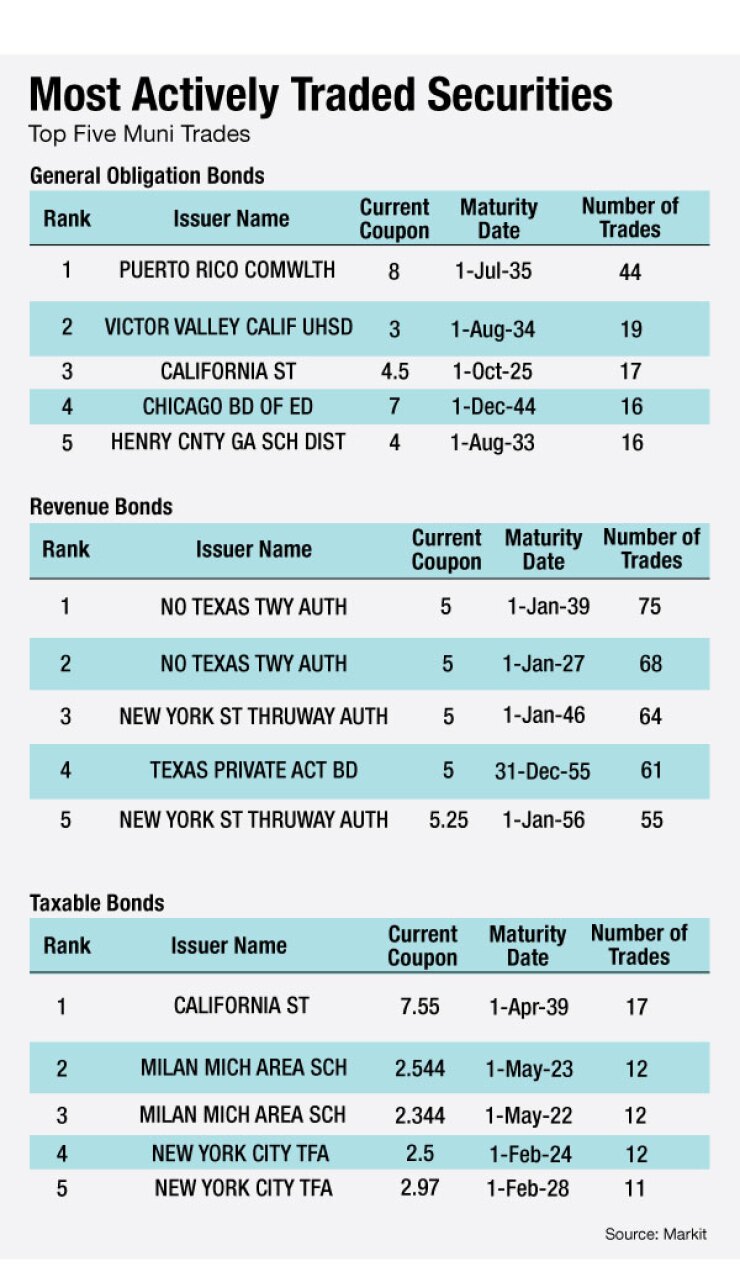

The Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended May 6 were from Puerto Rico, Texas and California issuers, according to data released by

In the GO bond sector, the Puerto Rico 8s of 2035 traded 44 times. In the revenue bond sector, the North Texas Tollway Authority 5s of 2039 traded 75 times. And in the taxable bond sector, the California 7.55s of 2039 traded 17 times, Markit said.

The Week's Most Actively Quoted Issues

California, Texas and Oho issues were among the most actively quoted names in the week ended May 6, according to Markit.

On the bid side, the California taxable 7.3s of 2039 were quoted by 14 unique dealers. On the ask side, the Houston GO 5s of 2025 were quoted by 21 unique dealers. And among two-sided quotes, the Buckeye Tobacco Settlement Financing Authority, Ohio revenue 5.875s of 2047 were quoted by eight dealers.

Primary Market

The municipal bond market was taking a pause Friday after seeing a rather hefty supply of new issues priced in the primary this week. The week's new issue slate was dominated by big transportation issues.

JPMorgan Securities priced the North Texas Tollway Authority's $987.79 million of Series 2016A system first-tier revenue refunding bonds. The deal is rated A1 by Moody's Investors Service and A by Standard & Poor's. Both rating agencies give the credit a stable outlook.

The deal was nine times oversubscribed, NTTA's chief financial officer Horatio Porter told The Bond Buyer, who admitted the team was pleasantly surprised with how much demand there was for the bonds.

Citigroup priced the New York State Thruway Authority's $850 million of Series 2016A general revenue junior indebtedness obligations. The deal is rated A3 by Moody's and A-minus by S&P.

Proceeds of the sale are being used to fund part of the Tappan Zee Bridge replacement project, as well as for various other expenses.

Ramirez priced the Port Authority of New York and New Jersey's $512.62 million of 195th and 196th series of consolidated bonds. The deal, which is subject to the alternative minimum tax, is rated Aa3 by Moody's and AA-minus by S&P and Fitch Ratings.

The Virginia Transportation Board competitively sold $275.99 million of Series 2016 transportation capital projects revenue bonds.

Bank of America Merrill Lynch won the deal with a true interest cost of 2.77%. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Elsewhere in the competitive arena, Seattle, Wash., sold three separate issues totaling $146.47 million.

BAML won the $103.66 million of Series 2016A limited tax general obligation improvement and refunding bonds with a true interest cost of 2.18%. BAML also won the $36.74 million of Series 2016 unlimited tax GO improvement bonds with a TIC of 3.08% while Janney won the $6.07 million of Series 2016B taxable limited tax GO improvement bonds with a TIC of 1.76%.

The Series 2016A and Series 2016B bonds are rated Aa1 by Moody's and triple-A by S&P and Fitch and the Series 2016 bonds are rated triple-A by Moody's, S&P and Fitch.

JPMorgan Securities won the Dallas Community College District, Texas' $122.42 million of Series 2016 limited tax GO refunding bonds with a TIC of 1.61%. The deal is rated triple-A by Moody's, S&P and Fitch.

BAML won the Missouri Board of Public Buildings' $100 million of Series 2016A special obligation bonds with a TIC of 2.29%. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Milwaukee sold $293.77 million of notes and bonds in three separate sales. Bank of America Merrill Lynch won the won the $176.24 million deal with a TIC of 2.06%. FTN Financial won the $27.53 million of Series 2016T4 taxable GO corporate purpose bonds with a TIC of 2.32%. Both deals are rated Aa3 by Moody's and AA by S&P and Fitch. Morgan Stanley won $90 million of Series 2016R1 revenue anticipation notes with a bid of 1.50% and premium of $512,100, an effective rate of 0.521490%. The RANs are rated MIG1 by Moody's, SP1-plus by S&P and F1-plus by Fitch.

Back in the negotiated sector, RBC Capital Markets priced the Dormitory Authority of the State of New York's $219.29 million of Series 2016 A, B, C and D school district revenue bond financing program revenue bonds. The Series A bonds are rated A-plus by S&P and AA-minus by Fitch except for the 2034-2036 and 2039 BAM-insured maturities which are rated AA by S&P. The Series B bonds are rated Aa3 by Moody's and AA-minus by Fitch; the Series C bonds are rated AA-minus by S&P and Fitch; and the Series D BAM-insured bonds are rated AA by S&P and AA-minus by Fitch.

Citigroup priced the Louisiana Public Facilities Authority's $155.66 million of Series 2016 revenue refunding bonds for the Ochsner Clinic Foundation Project. The deal is rated Baa1 by Moody's and A-minus by Fitch.

BAML priced Whiting, Ind.'s $101.95 million of environmental facilities revenue bonds for the BP Products North America Inc. project. The bonds, which are subject to the alternative minimum tax, are rated A2 by Moody's and A-minus by S&P.

Siebert Brandford Shank priced the Los Angeles Department of Water and Power's $275 million of Series 2016A power system revenue bonds. The deal is rated Aa2 by Moody's, AA-minus by S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $1.56 billion to $12.79 billion on Friday. The total is comprised of $5.49 billion of competitive sales and $7.30 billion of negotiated deals.

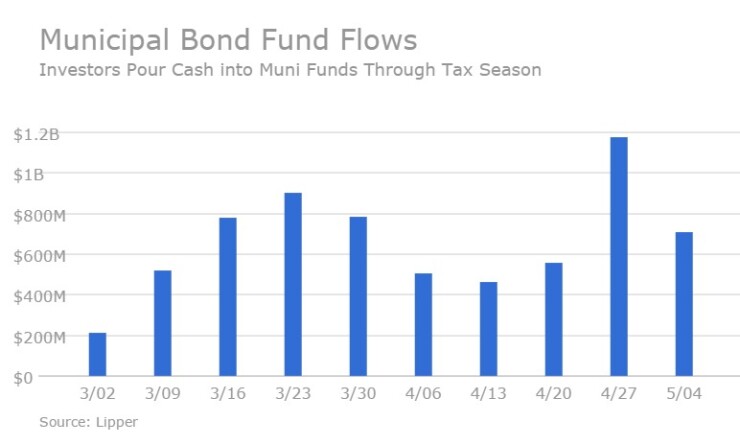

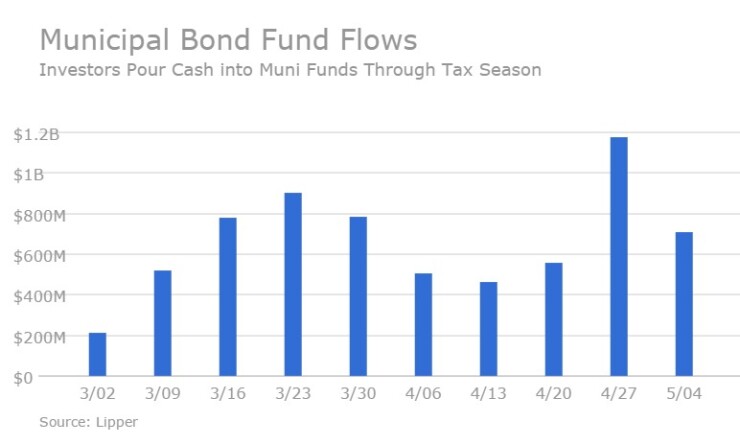

Muni Bond Funds See Inflows for 31st Straight Week

For the 31st week in a row, municipal bond funds reported inflows, according to Lipper data released Thursday. Weekly reporting funds saw $709.727 million of inflows in the week ended May 4, after inflows of $1.173 billion in the previous week, Lipper said.

The four-week moving average remained positive at $725.712 million after being in the green at $674.752 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.