Municipals were strengthening in early activity, according to traders, with yields on some maturities weakening by as much as five basis points.

The week's biggest competitive sales are on tap for Wednesday, with a big bond deal from Massachusetts and a large note sale from Colorado.

Secondary Market

The yield on the 10-year benchmark muni general obligation was three to five basis points weaker from 1.85% on Tuesday, while the 30-year muni yield was three to five basis points weaker from 2.77%, according to an early read of Municipal Market Data's triple-A scale.

U.S. Treasuries were higher on Wednesday. The yield on the two-year Treasury declined to 1.01% from 1.02% on Tuesday, while the 10-year Treasury yield dropped to 2.19% from 2.24% and the 30-year Treasury bond yield decreased to 2.95% from 3.00%.

The 10-year muni to Treasury ratio was calculated on Tuesday at 82.4% compared with 83.5% on Monday, while the 30-year muni to Treasury ratio stood at 92.1% versus 92.8%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 42,729 trades on Tuesday on volume of $9.01 billion.

Primary Market

In the competitive arena on Wednesday, the Massachusetts School Building Authority will sell $150 million of Series 2016A senior dedicated sales tax bonds. The deal is rated Aa2 by Moody's Investors Service and AA-plus by Standard & Poor's and Fitch Ratings.

On the short-term slate, Colorado will sell by competitive bid $339 million of Series 2015B education loan program tax and revenue anticipation notes. The TRANS, which are selling on Wednesday, are due June 29.

Also on Wednesday, Wells Fargo Securities is expected to price the New Jersey Healthcare Facilities Authority's $200 million of bonds for the Princeton Healthcare System. The issue is rated Baa2 by Moody's and triple-B by Fitch.

The Board of Regents of the University of Texas system is coming to market this week with two negotiated deals totaling $450 million.

Bank of America Merrill Lynch on Tuesday priced the Board's $200 million of Series 2016B revenue financing system green bonds for retail investors. The issue was structured with step coupons that increase over the life of the deal; it was priced for retail at par to yield 2.50% in 2036 and 2046.

BAML is also set to price the Board's $250 million of Series 2016A taxable revenue financing system bonds. Both series are rated triple-A by Moody's, S&P and Fitch.

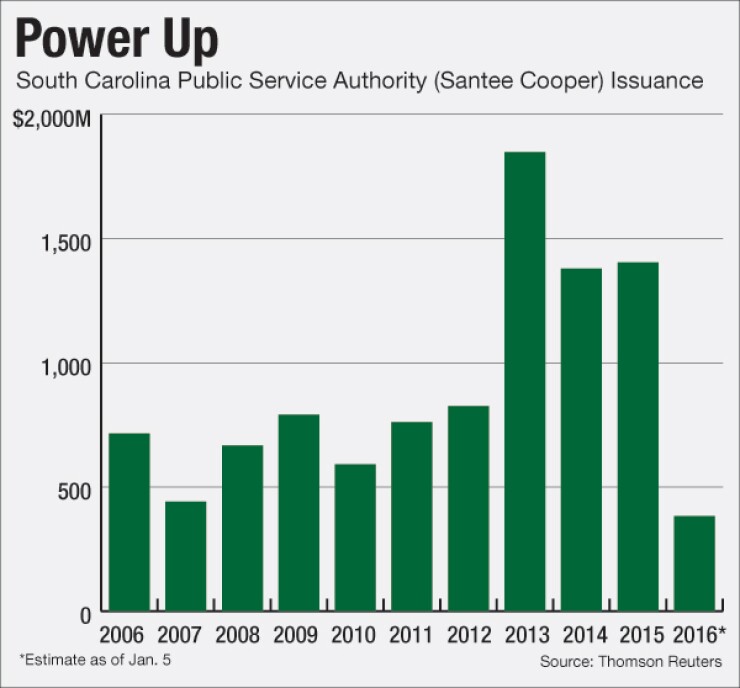

On Thursday, BAML is expected to price the South Carolina Public Service Authority's $382 million of revenue obligation Series 2016A tax-exempt refunding bonds.

Since 2006, Santee Cooper has sold about $9.8 billion of debt. The most issuance occurred in 2013 and 2015 when it offered $1.85 billion and $1.40 billion of bonds, respectively. It offered the least amount of debt in 2007 and 2010 when it sold $440.5 million and $591.1 million, respectively.

BAML is also slated to price the city of Tallahassee, Fla.'s $150 million of Series 2016A project healthcare facilities revenue bonds for Tallahassee Memorial Healthcare Inc. The issue is rated Baa1 by Moody's.

Stifel is set to price Orange County, Calif.'s $334.31 million of taxable Series 2016A pension obligation bonds on Thursday. The issue is rated AA by S&P and Fitch.

And JPMorgan Securities is set to price on Thursday the KU Central Development Corp.'s $333.18 million of Series 2016 lease revenue bonds, which are being issued through the Wisconsin Public Finance Authority. The issue is rated Aa2 by Moody's.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar rose $810.7 million to $9.50 billion on Wednesday. The total is comprised of $4.57 billion competitive sales and $4.93 billion of negotiated deals.