Top rated municipal bonds were stronger on Friday, according to traders, as yields fell by as much as four basis points in an abbreviated trading session.

The market will close at 2 p.m., EDT, ahead of Monday's full market close for Independence Day. Trading will resume on Tuesday, July 5.

Secondary Market

The yield on 10-year benchmark muni general obligation dropped as much as two basis points from 1.35% on Thursday, while the 30-year muni yield fell two to four basis points from 2.02%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Friday as equities continued to rise.

The yield on the two-year Treasury dropped to 0.56% from 0.58% on Thursday, while the 10-year Treasury yield fell to 1.42% from 1.47% and the yield on the 30-year Treasury bond decreased to 2.21% from 2.28%.

Stocks were slightly higher for the fourth day in a row. The Dow Jones Industrial Average was up about 0.2%, the S&P 500 was around 0.2% higher and the Nasdaq gained about 0.4%.

The 10-year muni to Treasury ratio was calculated at 91.0% on Thursday compared to 90.4% on Wednesday, while the 30-year muni to Treasury ratio stood at 87.7% versus 88.1%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 34,801 trades on Thursday on volume of $11.54 billion.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended July 1 were from Puerto Rico, New York and Massachusetts, according to Markit.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 were traded 45 times. In the revenue bond sector, the N.Y. MTA 4s of 2036 were traded 82 times. And in the taxable bond sector, the Massachusetts 3.277s of 2046 were traded 80 times.

Week's Most Actively Quoted Issues

California and Texas issues were among the most actively quoted names in the week ended July 1, according to Markit.

On the bid side, the California taxable 7.55s of 2039 were quoted by 14 unique dealers. On the ask side, the Harris County, Texas revenue 5s of 2034 were quoted by 16 unique dealers. And among two-sided quotes, the California taxable 7.6s of 2040 were quoted by 14 dealers.

Week's Primary Market

The market was filled with deals ahead of a holiday week.

The commonwealth of Massachusetts led the negotiated slate with three separate negotiated deals, totaling over $1.1 billion.

Bank of America Merrill Lynch priced the state's $728.14 million of Series 2016B general obligation refunding bonds for institutions following a one-day retail order period. The deal was upsized from $676.79 million on Wednesday morning and $521.91 million on Tuesday. BAML also priced the state's $250 million of GO consolidated loan of 2016 Series F taxable GO green bonds.

Barclays Capital priced Massachusetts' $200 million of GO consolidated loan of 2014 Series D multi-modal bonds and Subseries D-1 bonds as a remarketing. The bonds were priced at par to yield 1.05% in 2043 with a mandatory tender in 2020.

All the issues are rated Aa1 by Moody's Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

"We are very pleased with the results of the three sales. The Green deal saw three times as many orders as bonds, allowed us to pick up new investors, and price at aggressive levels," the Massachusetts Treasurer's office told The Bond Buyer. "The refunding transaction was upsized to $730 million and resulted in $103 million in present value savings -- that's over 13% of refunded par. The 2014 D-1 conversion allowed us to lock in four-year fixed rate put bonds at 1.05%."

In the competitive arena, Washington state competitively sold four separate issues totaling $1.2 billion.

Bank of America Merrill Lynch won the $531.28 million of Series R-2017A various purpose general obligation refunding bonds with a true interest cost of 2.24%. BAML also won the $271.59 million of Series R-2017B motor vehicle fuel tax GO refunding bonds with a TIC of 2.39%.

JPMorgan Securities won the $389.97 million of Series 2017A various purpose GOs with a TIC of 3.08%. JPMorgan also won the $101.7 million of Series 2017T taxable GOs with a TIC of 1.46%.

All of the deals are rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Washington County, Tenn., competitively sold over $118 million of GOs in two issues. Citigroup won the $113.82 million of Series 2016A GO refunding bonds with a TIC of 2.45%. Robert W. Baird won the $4.46 million of taxable Series 2016B GO refunding bonds with a TIC of 1.43%. Both deals are rated Aa2 by Moody's and AA by S&P.

In the negotiated sector, Barclays priced the South Carolina Public Service Authority's $823.85 million of Series 2016 revenue obligations consisting of $501.2 million of Series B tax-exempts and $322.65 million of Series 2016D taxables. The deal is rated A1 by Moody's, AA-minus by S&P and A-plus by Fitch.

BAML priced San Antonio, Texas' $544.31 million of Series 2016 electric and gas system revenue refunding bonds. The deal is rated Aa1 by Moody's, AA by S&P and AA-plus by Fitch.

Morgan Stanley priced the Board of Regents of the Texas A&M University System's $208.71 million of Series 2016C revenue financing system revenue bonds. And Wells Fargo Securities priced the Board's $176.46 million of Series 2016D taxable revenue financing system revenue bonds. Both A&M deals are rated triple-A by Moody's, S&P and Fitch.

JPMorgan priced the New Jersey Educational Facilities Authority's $203.12 million of Series 2016A revenue and refunding bonds for Stockton University. The deal is rated Baa1 by Moody's and A by Fitch except for the 2020 and 2034-2037 maturities which are insured by Assured Guaranty Municipal and rated A2 by Moody's and AA by S&P.

JPMorgan priced Utah County, Utah's $185 million of Series 2016B hospital revenue bonds for IHC Health Services. The deal is rated Aa1 by Moody's and AA-plus by S&P.

Piper Jaffray priced the California School Cash Reserve Program Authority's $176.97 million of 2016-2017 bonds. The deal is rated SP1-plus by S&P Global Ratings.

RBC Capital Markets priced the Cleburne Independent School District, Johnson County, Texas' $108.98 million of Series 2016 unlimited tax school building bonds. The deal is backed by the Permanent School Fund guarantee program, and rated triple-A by Moody's.

JPMorgan priced on the state of Texas' $149.54 million of GOs. The deal is rated triple-A by Moody's, S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $477.4 million to $5.65 billion on Friday. The total is comprised of $3.20 billion of competitive sales and $2.44 billion of negotiated deals.

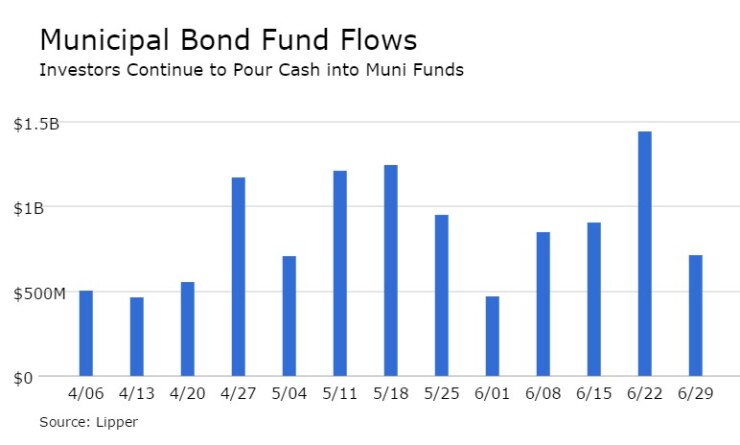

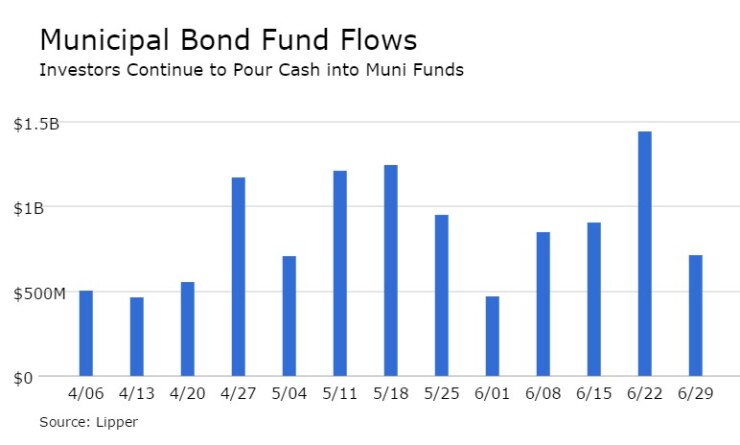

Muni Bond Funds Again See Inflows

For the 39th straight week, municipal bond funds reported inflows, according to Lipper data released Thursday. Weekly reporting funds saw $716.009 million of inflows in the week ended June 29, after inflows of $1.442 billion in the previous week, Lipper said.

The four-week moving average remained positive at $978.741 million after being in the green at $918.028 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $671.567 million in the latest week after inflows of $1.039 billion in the previous week. Intermediate-term funds had inflows of $124.510 million after inflows of $240.123 million in the prior week.

National funds had inflows of $614.091 million on top of inflows of $1.304 billion in the previous week. High-yield muni funds reported inflows of $380.466 million in the latest reporting week, after inflows of $321.166 million the previous week.

Exchange traded funds saw inflows of $66.835 million, after inflows of $184.881 million in the previous week.