Top quality municipal bonds finished stronger on Wednesday, according to traders, who saw a substantial wave of new issuance hit the screens, led by deals from New York State's TSASC, the U.S. Virgin Islands, and the state of Wisconsin.

"Deals are definitely getting done," said one New York trader. "Municipals are much in demand."

Another trader agreed, saying in an email that the "reception of the new issue calendar has been solid so far, supported by stronger Treasury markets (and successful 10-year auction) as well as by backlog in demand due to very light calendar we had for three straight weeks over the holidays."

Secondary Market

The 10-year benchmark muni general obligation yield fell three basis points to 2.19% from 2.22% on Tuesday, while the yield on the 30-year GO dropped five basis points to 2.92% from 2.97%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Wednesday. The yield on the two-year Treasury dropped to 1.18% from 1.19% on Tuesday, while the 10-year Treasury yield decreased to 2.37% from 2.38%, and the yield on the 30-year Treasury bond declined to 2.96% from 2.97%.

The 10-year muni to Treasury ratio was calculated at 92.5% on Wednesday compared with 93.3% on Tuesday, while the 30-year muni to Treasury ratio stood at 98.8%, versus 100.0%, according to MMD.

Primary Market

A Midwest trader said heavy demand plus dropping yields prompted a lot of issuers to jump into the market before the Trump administration takes over the government on Jan. 20.

"I think with so much uncertainty with the new administration starting soon, people might think the market could get choppy. They saw an opportunity they didn't want to pass up."

Jefferies priced TSASC, Inc.'s $653.07 million of tobacco settlement bonds. The deal at over $1 billion was slated to price the week of Nov. 14 and had been on the day-to-day calendar after market volatility caused yields to soar in the wake of the U.S. presidential election.

In conjunction with the sale, TSASC said it also placed $450 million of subordinate turbo term bonds with holders of existing TSASC bonds. The subordinate turbo term bonds have a 5% coupon and a turbo redemption feature which allows TSASC to redeem the bonds before their stated maturities in 2045 and 2048.

The $613.37 million of Fiscal 2017 Series A senior bonds were priced to yield from 1.22% with a 2% coupon in 2017 to 4.14% with a 5% coupon in 2036; a 2041 maturity was priced as 5s to yield 4.43%. The $39.7 million of Fiscal 2017 Series B subordinated bonds were priced as 5s to yield from 2.02% in 2018 to 3.76% in 2025.

The senior bonds carry ratings from S&P Global Ratings that range from A in 2017 to BBB-plus in 2041 while the subordinate bonds carry ratings from S&P that range from BBB-plus in 2018 to BBB in 2025.

Morgan Stanley priced the U.S. Virgin Islands Public Finance Authority's $221.92 million of Series 2016A senior lien working capital bonds and Series 2016B subordinate lien working capital bonds.

The $147.47 million of Series 2017A senior lien bonds were priced as a 2036 bullet maturity as 6 1/2s to yield 7.50%. The $74.45 million of Series 2017B subordinate lien bonds were priced as a 2034 bullet maturity as 6 3/4s to yield 7.75%.

One market participant said yields on the deal came in wider than expected.

"That is quite a bit wider than where the name has been trading in the secondary," said one market source, who estimated that "some of the longer maturities have been trading in the +400/+425 range."

The yields were about 469 basis points above Wednesday's MMD triple-A scale read for 2036 and 503 basis points above the MMD scale for 2034. The senior liens are rated BB by S&P and Fitch Ratings and the subordinate liens are rated BB-minus by S&P and BB by Fitch.

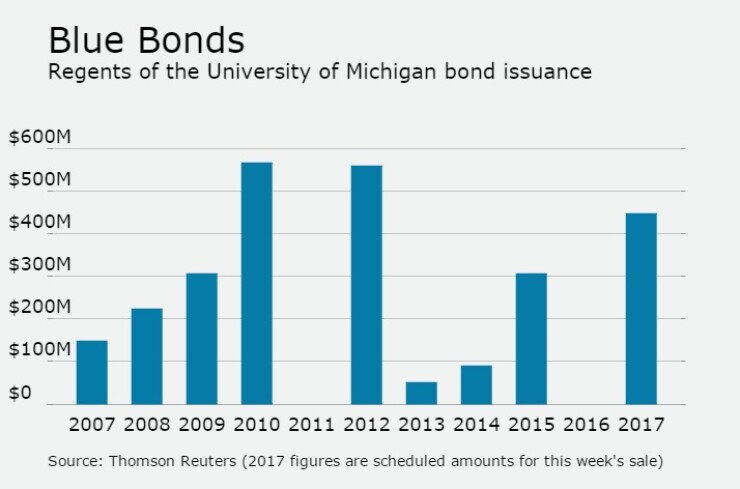

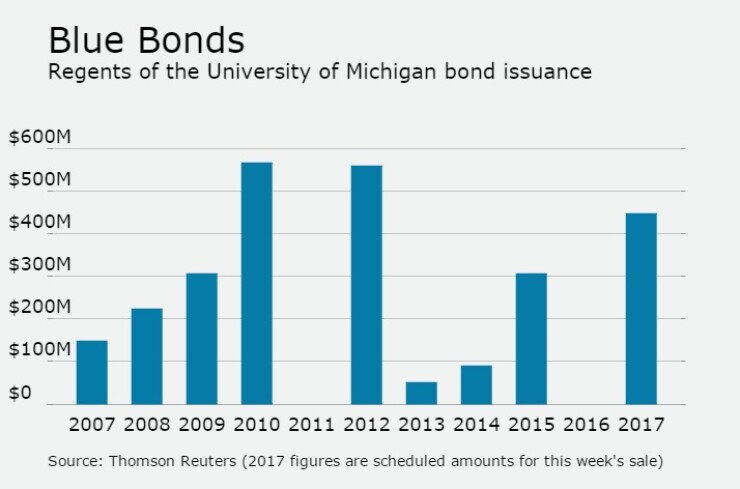

Morgan Stanley also priced the Regents of the University of Michigan's $469.03 million of Series 2017A general revenue bonds.

The issue was priced to yield from 0.95% with a 5% coupon in 2018 to 2.97% with a 5% coupon in 2037. A term bond in 2042 was priced to yield 3.05% with a 5% coupon and a term bond in 2047 was priced to yield 3.10% with a 5% coupon in 2047. The deal is rated triple-A by Moody's Investors Service and S&P.

Since 2007, the University of Michigan Regents has issued about $2.71 billion of debt, with the largest issuance occurring in 2010 when it sold roughly $567 million of debt. The school did not come to market at all in 2011 or 2016. Wednesday's sale will mark the highest issuance since 2012.

Ramirez & Co. priced Wisconsin's $427 million of taxable Series 2017A general fund annual appropriation bonds.

The issue was priced at par to yield 1.866% in 2020 to 3.718% in 2033 and 3.954% in 2036. The issue is rated Aa3 by Moody's and AA-minus by S&P and Fitch.

Bank of America Merrill Lynch priced the Illinois Finance Authority's $197.49 million of Series 2017A revenue bonds for Edward-Elmhurst Healthcare.

The issue was priced to yield from 1.95% with a 4% coupon in 2019 to 4.02% with a 5% coupon in 2037; a 2040 maturity was priced as 4s to yield 4.20%. A 2018 maturity was offered as a sealed bid. The deal is rated A by S&P and Fitch.

BAML also priced the Orange County Water District, Calif.'s $118.62 million of Series 2017A tax-exempt and Series 2017B taxable refunding revenue bonds.

The $93.34 million of Series 2017A tax-exempts were priced to yield from 0.85% with a 3% coupon in 2017 to 3.38% with a 4% coupon in 2037; a 2041 maturity was priced as 4s to yield 3.45%. The $25.28 million of Series 2017B taxables were priced at par to yield from 0.82% in 2017 to 3.77% in 2031, 3.96% in 2036 and 4.06% in 2041. The deal is rated triple-A by S&P and Fitch.

Barclays Capital priced the California Statewide Community Development Authority's $135 million of Series 2006 C&D pollution control refunding revenue bonds as a remarketing.

The $67.5 million of Series 2006C bonds were priced at par to yield 2.625% in 2033. The $67.5 million of Series 2006D bonds were priced at par to yield 2.625% in 2033. The deal is rated Aa3 by Moody's, A by S&P and A-plus by Fitch.

RBC Capital Markets priced $203.67 million Aurora Public Schools, Joint School District No. 28J in Adams and Arapahoe Counties, Colo., Series 2017A GOs and Series 2017B GOs.

The $200 million of Series 2017A GOs were priced to yield from 0.93% with a 4% coupon in 2017 to 2.58% with a 5% coupon in 2028 and as 5s to yield from 2.73% in 2030 to 3.09% in 2036. The $3.67 million of Series 2017B GO refunding bonds were priced as 5s to yield 1.61% in 2020.

The deal, backed by the Colorado state intercept program, is rated Aa2 by Moody's and AA by Fitch.

RBC also priced the Pennsylvania Housing Finance Agency's $239.65 million of Series 2017-122 single-family mortgage revenue bonds, not subject to the alternative minimum tax.

The issue was priced at par to yield from 2.05% in 2021 to 3.15% and 3.25% in a split 2028 maturity; a 2032 maturity yields 3.65%, and a 2036 maturity yields 3.90%. A 2046 maturity was priced as 4s to yield about 2.47% as a PAC bond with an average life of 4.5 years. The deal is rated Aa2 by Moody's and AA-plus by S&P.

Raymond James priced the Klein Independent School District, Texas' $145.89 million of Series 2017 unlimited tax schoolhouse bonds.

The issue was priced to yield from 1.05% with a 3% coupon in 2018 to 3.14% with a 5% coupon in 2041; a 2046 maturity was priced as 4s to yield 3.67%. The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody's and S&P.

In the competitive sector, the Highline School District No. 401, Wash., sold $212.69 million of Series 2017 unlimited tax general obligation bonds. Bank of America Merrill Lynch won the bonds with a true interest cost of 3.29%.

The issue was priced as 5s to yield 0.90% in 2017 and 1.17% in 2018 and from 2.07% with a 5% coupon in 2023 to 3.41% with a 4% coupon in 2036.

The deal, backed by the Washington state credit enhancement program, is rated Aa1 by Moody's and AA-plus by S&P.

Seattle, Wash., competitively sold $189.67 million of Series 2017 water system improvement and refunding revenue bonds.

Citigroup won the bonds with a TIC of 3.28%. The bonds were priced to yield from 1.05% with a 5% coupon in 2018 to 3.52% with a 4% coupon in 2042. A term bond in 2044 was priced to yield 3.54% with a 4% coupon and a term bond in 2046 was priced to yield 3.56% with a 4% coupon. The deal is rated Aa1 by Moody's and AA-plus by S&P.