Prices on top-shelf municipal bonds continued to weaken for a second straight session, traders said, as yields on some maturities strengthened by as much as four basis points by mid-session.

Meanwhile, New York City was in the market with separate negotiated and competitive deals totaling about $916 million.

Secondary Market

Prices of top-rated munis were lower. The yield on the 10-year benchmark muni general obligation was up from two to four basis points from 2.22% on Monday, while the yield on the 30-year GO was from two to four basis points higher from 3.19%, according to a read of Municipal Market Data's triple-A scale.

Treasury prices were also lower on Tuesday as the yield on the two-year Treasury note increased to 0.66% from 0.64% on Monday, while the 10-year yield rose to 2.26% from 2.19% and the 30-year yield increased to 3.02% from 2.94%.

The 10-year muni to Treasury ratio was calculated on Monday at 101.4% versus 102.0% on Friday, while the 30-year muni to Treasury ratio stood at 108.2% compared to 109.7%, according to MMD.

Primary Market

JPMorgan priced the Big Apple's $615.67 million of Fiscal 2015 Series F, Subseries F-1 and Fiscal 2015 Series 1 GOs for institutions on Tuesday following a two-day retail order period.

The $300 million of Series F Subseries F-1 tax-exempts were priced as 3s and 5s to yield 1.23% in a split 2018 maturity and as 2s and 5s to yield 1.97% in a split 2021 maturity; as 4s and 5s to yield 2.49% in a split 2024 maturity and as 5s to yield 2.78% in 2026. The bonds were also priced to yield from 3.64% with a 3.5% coupon in 2033 to 3.82% with a 3.75% coupon in 2037. The 2017 maturity was offered as a sealed bid.

The $315.67 Series 1 tax-exempts were priced as 2s, 4s and as 5s to yield 1.27% in a triple split 2018 maturity and as 5s to yield 2.51% in 2024. The 2016 and 2017 maturities were offered as sealed bids.

The $300 million of Series F Subseries F-1 tax-exempts were priced for retail on Monday as 3s and 5s to yield 1.21% in a split 2018 maturity and as 5s to yield 1.97% in 2021; as 4s to yield 2.50% in 2024; as 5s to yield 2.63% in 2025; as 5s to yield 2.79% in 2026. The bonds were also priced to yield from 3.65% with a 3.5% coupon in 2033 to 3.85% with a 3.75% coupon in 2037. No retail orders were taken for the 2034 and 2035 maturities while the 2017 maturity was offered as a sealed bid.

The $316.79 Series 1 tax-exempts were priced for retail on Monday to yield from 1.27% with a 4% coupon in 2018 to 2.52% with a 5% coupon in 2024. The 2016 and 2017 maturities were offered as sealed bids.

In the competitive arena on Tuesday, New York City offered two separate sales totaling $300 million.

Citi won the $200 million Fiscal 2015 Subseries F-3 taxable GOs with a true interest cost of 3.99%. The issue was priced to yield from 3.40% with a 4% coupon to 4.13% at par in 2032.

JPMorgan won the city's $100 million of Fiscal 2015 Subseries F-2 taxable GOs with a TIC of 2.72%. Pricing information was not immediately available.

All the city issues were rated Aa2 by Moody's Investors Service and AA by Standard & Poor's and Fitch Ratings.

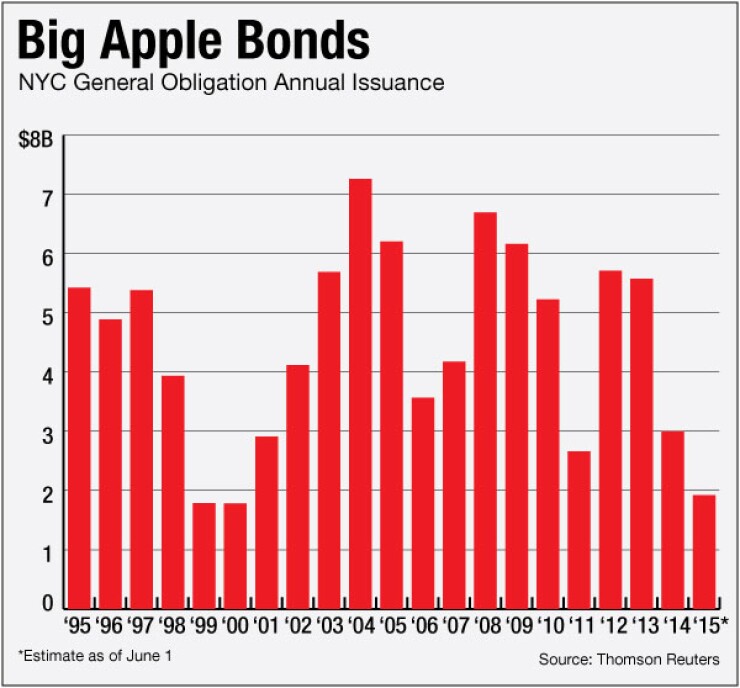

Since 1995, the Big Apple has sold about $94 billion of general obligation bonds. The largest issuance occurred in 2004 and 2008 when the city sold $7.3 billion and $6.6 billion, respectively. The city issued the least amount of bonds in 1999 and 2009, selling $1.8 billion in each of those years.

Also on Tuesday, the East Bay Municipal Utility District, Calif., sold two separate issues totaling $183.06 million. Both issues were rated Aa1 by Moody's triple-A by S&P and AA-plus by Fitch.

Wells Fargo Securities won the MUD's $110.72 million of Series 2015B water system revenue green bonds with a TIC of 3.72%. The issue was priced to yield from 2.11% with a 5% coupon in 2034 to 3.75% with a 4% coupon in 2040; a 2045 term bond was priced as 4s to yield 3.85%.

Wells also won the MUD's $72.34 million of Series 2015B water system revenue green bonds with a TIC of 3.71%. The issue was priced to yield from 1.97% with a 5% coupon in 2023 to 3.65% with a 4% coupon in 2038; a 2045 term bond was priced as 4s to yield 3.85%

And Citi won the Broward County School District, Fla.'s $158.91 million of Series 2015 GO school bonds with a TIC of 3.64%. Pricing information was not immediately available. The issue was rated Aa3 by Moody's, A-plus by S&P and AA-minus by Fitch.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 41,099 trades on Monday on volume of $10.274 billion.

The most active bond, based on the number of trades, was the Franklin County, Ohio, Series 2015A hospital improvement revenue bonds for the Nationwide Children's Hospital 4s of 2045, which traded 187 times at an average price of 98.915 with an average yield of 4.062%. The bonds were initially priced at 96.579 to yield 4.20%.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $732.1 million to $14.50 billion on Tuesday. The total is comprised of $6.02 billion competitive sales and $8.48 billion of negotiated deals.