Municipal bond traders are waiting to see more volume hit the market on Tuesday, led by the institutional pricing of Connecticut's general obligation bonds.

Secondary Market

U.S. Treasuries were narrowly mixed on Tuesday. The yield on the two-year Treasury rose to 0.91% from 0.89% on Monday, while the 10-year Treasury yield gained to 1.84% from 1.83% and the yield on the 30-year Treasury bond was unchanged at 2.63%.

Top-quality municipal bonds finished flat on Monday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.63% on Friday while the 30-year muni yield was steady at 2.43%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 88.7% on Monday compared to 88.3% on Friday, while the 30-year muni to Treasury ratio stood at 92.5% versus 92.2%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 37,889 trades on Monday on volume of $8.30 billion.

Primary Market

Bank of America Merrill Lynch is set to price the state of Connecticut's $512.88 million of Series 2016B general obligation refunding bonds for institutions on Tuesday after holding a one-day retail order period.

The issue was priced for retail to yield from 1.14% with 4% and 5% coupons in a split 2019 maturity to 2.35% with 4% and 5% coupons in a split 2027 maturity. A 2018 maturity was offered as a sealed bid.

Connecticut's GOs are rated Aa3 by Moody's Investors Service, AA-minus by S&P Global Ratings and Fitch Ratings, and AA by Kroll Bond Rating Agency.

On Tuesday, PNC Capital Markets is set to price the Pennsylvania Turnpike Commission's $545.14 million of second series of 2016 subordinate revenue refunding bonds. The deal is rated A3 by Moody's and A-minus by Fitch.

RBC Capital Markets is expected to price the Massachusetts Educational Financing Authority's $340 million of Series 2016 Issue J education loan revenue bonds, subject to the alternative minimum tax. The deal is rated AA by S&P and A by Fitch.

RBC is also set to price Miami-Dade County, Fla.'s $339.34 million of GOs for the building better communities program. The bonds are rated Aa2 by Moody's and AA by S&P.

In the competitive arena on Tuesday, the Florida Board of Education is selling $241.69 million of Series 2016A lottery revenue refunding bonds. The deal is rated A1 by Moody's, triple-A by S&P and AA by Fitch.

Denton, Texas, is selling $112.19 million of securities in two separate sales consisting of $83.23 million of Series 2016 certificates of obligation and $28.96 million of Series 2016 GO refunding and improvement bonds. Both deals are rated AA-plus by S&P and Fitch.

The biggest deal of the week is coming from the San Diego Public Facilities Financing Authority on Wednesday. JPMorgan Securities is expected to price the $567.96 million of Series 2016A and 2016B subordinated water revenue bonds. The deal is rated Aa3 by Moody's and AA-minus by Fitch.

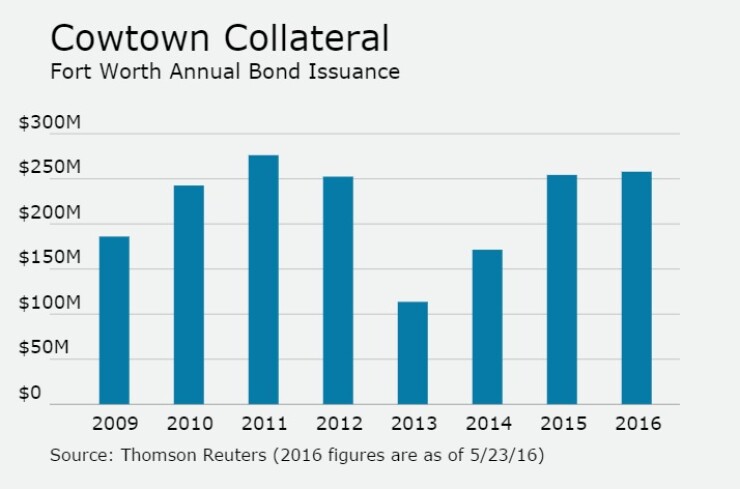

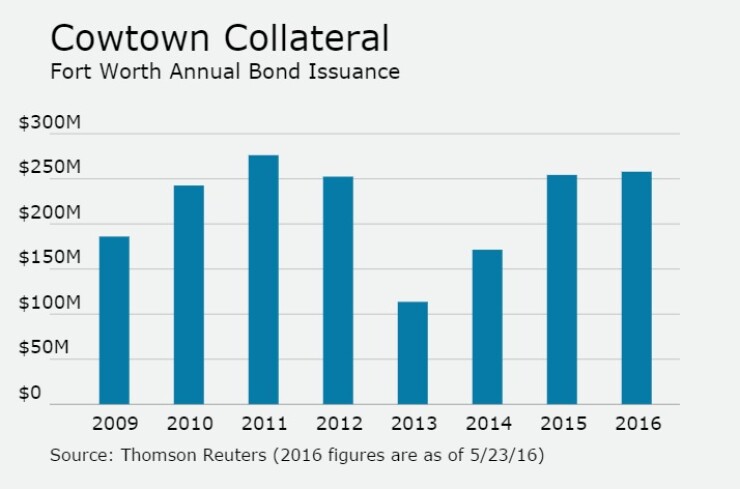

In the competitive sector on Wednesday, Fort Worth, Texas is selling $257.97 million of bonds in three separate sales. The offerings consist of $164.55 million of Series 2016 general purpose refunding and improvement bonds, rated Aa2 by Moody's and AA-plus by S&P and Fitch; $75.89 million of Series 2016 water and sewer system revenue refunding and improvement bonds, rated Aa1 by Moody's, AA-plus by S&P and AA by Fitch; and $$17.53 million of Series 2016 drainage utility system revenue refunding bonds, rated AA-plus by S&P and Fitch.

Since 2009, Fort Worth has issued about $1.49 billion of debt, with the largest issuance occurring in 2011 when it sold $276 million of securities. The city saw a low year of issuance in 2013, when it issued just $114 million.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $1.19 billion to $15.00 billion on Tuesday. The total is comprised of $7.92 billion of competitive sales and $7.08 billion of negotiated deals.