Prices of top-rated municipal bonds were weaker at mid-session, traders said, with yields on some maturities rising by as much as four basis points.

In the primary market, traders faced another day of hefty issuance, as JPMorgan began taking retail orders on the large electric bond deal from Energy Northwest.

Secondary Market

Prices of top-shelf municipal bonds fell. The yield on the 10-year benchmark muni general obligation rose by as much as three basis points from 1.95% on Tuesday, while the yield on the 30-year GO increased was up by as much as four basis points from 2.86%, according to a read of Municipal Market Data's triple-A scale.

Treasury prices were lower on Wednesday as the yield on the two-year Treasury note rose to 0.54% from 0.52% on Tuesday, while the 10-year yield increased to 1.96% from 1.91% and the 30-year yield rose to 2.64% from 2.59%.

The 10-year muni to Treasury ratio was calculated on Tuesday at 100.3% versus 102.6% on Monday, while the 30-year muni to Treasury ratio stood at 109.6% compared to 110.9%.

Primary Market

JP Morgan priced for retail $514.86 million of Energy Northwest's electric revenue and refunding bond deal.

The $114.23 million of Series 2015-A Project 1 electric revenue refunding bonds were priced as 5s to yield 1.86% in a 2027 split maturity; no retail orders were taken for the other half of the 2027 maturity or for the 2028 maturity.

The $321.51 million of Series 2015-A Columbia Generating Station electric revenue and refunding bonds were priced to yield from 1.59% with a 5% coupon in 2021 to 2.13% with a 5% coupon in 2024; the bonds were also priced as 5s to yield 2.24% in a 2032 split maturity and as 5s to yield 3.07% in a 2035 split maturity. The other halves of the 2032 and 2035 maturities, as well as the 2029-2031, 2033, 2034 and a term bond in 2038 were not offered to retail.

The $79.12 million of Series 2015-A Project 3 electric revenue refunding bonds, were priced as 3s to yield 0.64% in 2017 and as 4s to yield 0.96% in 2018. A 2025 split maturity was priced as 4s and 5s to yield 2.26%. No retail orders were taken for the 2026 maturity.

The bonds are rated Aa1 by Moody's Investors Service, AA-minus by Standard and Poor's and AA by Fitch Ratings.

"The bond ratings reflect the credit quality of the full Federal Columbia River Power and Transmission System as the bonds are supported by revenues generated by Columbia Generating Station, 31 federal dams, and 15,000 miles of high-voltage transmission lines," said Jeff Windham, Energy Northwest's Assistant Treasurer.

He added market timing was key to the pricing of the new deal.

"We also wanted to time the transaction based on expected need to obtain funding for capital related expenses at Columbia beginning July 1, 2015; to time the extension of bonds prior to their current maturity of July 1, 2015; and to obtain significant net present value savings on existing bonds that can be refinanced for savings," said Windham.

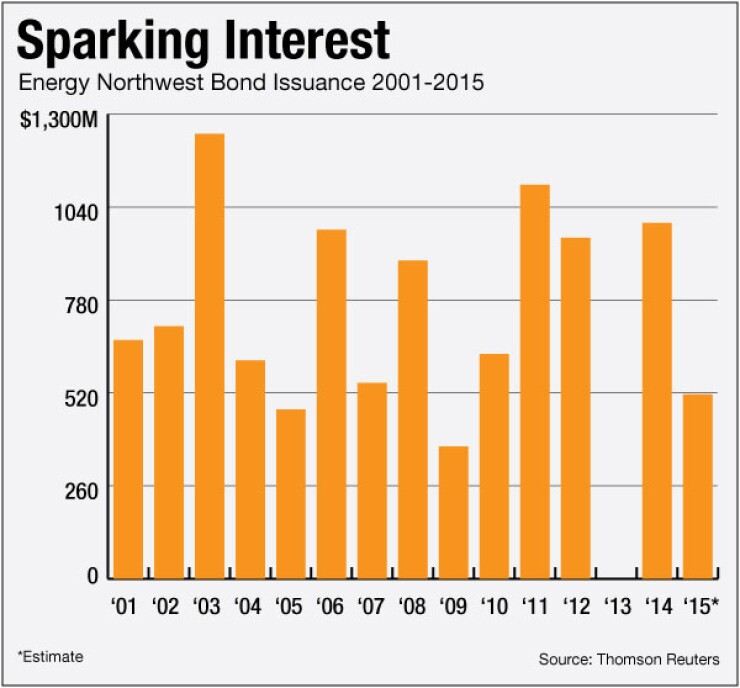

Since 2001, Energy Northwest has issued over $10 billion of debt, with the highest years of issuance occurring in 2003 and 2011 when they sold $1.245 billion and $1.103 billion of bonds, respectively. They did not issue any debt in 2013 and sold only $370.6 million of bonds in 2010.

"Energy Northwest net billed project bonds are secured by payments of the Bonneville Power Administration," said Windham. "Bonneville payments to Energy Northwest are made as an operating expense, which take priority over repayment of U.S. Treasury and Federal appropriation obligations. It is our belief that the highly rated bonds are reflective of a long standing history of on-time and in-full repayment related to these net billed projects.

Meanwhile on Earth Day, the state of Connecticut was coming to market with $250 million of green bonds to be priced by Goldman, Sachs. The deal is rated triple-A by Moody's Investors Service, Standard & Poor's and Fitch Ratings.

In what is the Nutmeg State's first all-green bond sale, the offering will finance wastewater and drinking water infrastructure projects statewide. Wednesday's sale follows the state's first issuance of $60 million of green bonds in the Autumn of 2014, which was just a part of an overall $300 million GO sale.

According to state Treasurer Denise Nappier, Connecticut is following the process guidelines as specified by the green bond principles, a voluntary standard that a group of environmental finance experts and active banks established last year. She said green bond offerings are designed to meet the needs of an expanding investor group with mandates to invest in sustainable projects.

Elsewhere, Citi is slated to price the Sacramento Municipal Utility District's $195 million of electric revenue bonds on Wednesday. The deal is rated Aa3 by Moody's and A-minus by S&P.

Raymond James & Associates priced the Board of Supervisors of the Louisiana State University and Agricultural and Mechanical College's $114.48 million Series 2015 auxiliary revenue and refunding bonds. The bonds were priced to yield from 0.25% with a 2% coupon in 2015 to 3.68% with a 3.50% coupon in 2035; a 2039 term bond was priced as 5s to yield 3.47% and a 2045 term was priced as 5s to yield 3.57%. The issue is rated A1 by Moody's and AA-minus by Fitch.

On Tuesday, the Chicago Board of Education came to market with $295.68 million of unlimited tax GOs, consisting of $275.68 million of Series 2015C project bonds and $20 million of Series 2015E green bonds, backed by dedicated alternative revenues.

PNC Capital Markets priced the Series 2015C bonds as a split maturity in 2035 as 5 1/4s to yield 5.53% and as 6s to yield 5.38%; a 2039 maturity was priced as 5 1/4s to yield 5.63%. The green bonds were priced as a 2032 bullet maturity as 5 1/8s to yield 5.42%.

The bonds were oversubscribed with more than 100 buyers participating, according to finance team members. The issue is rated A-minus by S&P, BBB-minus by Fitch and BBB-plus by Kroll Bond Rating Agency.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $2.268 billion to $9.482 billion on Wednesday. The total is comprised of $2.908 billion competitive sales and $6.574 billion of negotiated deals.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 42,418 trades on Tuesday on volume of $10.956 billion.

The most active bond, based on the number of trades, was the Pennsylvania State Turnpike Commission's Subordinate 2008 Series B-1 revenue 5 5/8s of 2030, which traded 146 times at an average price of 112.964 with an average yield of 1.345%. The bonds were initially priced at 102.458.

—Paul Burton contributed to this report