Prices of top-rated municipal bonds were mixed at mid-session, according to traders, as yields were unchanged to up as much as two basis points in spots.

While watching muni yields closely, the market is also looking ahead to another week of heavy new issuance, when large offerings from California and Maryland issuers have been slated.

Secondary Market

The yield on the 10-year benchmark muni general obligation was unchanged from 2.02% on Thursday, while the yield on 30-year GO was up as much as two basis points from 2.85%, according to a read of Municipal Market Data's triple-A scale.

Treasury prices were slightly lower on Friday. The yield on the two-year Treasury note rose to 0.63% from 0.60% on Thursday, while the 10-year yield increased to 2.01% from 2.00% and the 30-year yield was up to 2.61% from 2.60%.

On Thursday, the 10-year muni to Treasury ratio was calculated at 100.3% versus 103.5% on Tuesday, while the 30-year muni to Treasury ratio stood at 109.3% compared to 111.3%.

Primary Market

New issue volume for next week is estimated at $8.947 billion, according to Ipreo and The Bond Buyer. That total is up from a revised $7.532 billion sold this week, according to Thomson Reuters.

There are $6.965 billion of negotiated deals slated for next week and $1.982 billion competitive sales scheduled.

On the negotiated slate, Bank of America Merrill Lynch and Morgan Stanley are scheduled to price California's $1.9 billion of general obligation bonds for retail investors on Tuesday followed by the institutional pricing on Wednesday. The deal is rated Aa3 by Moody's Investors Service and A-plus by both Standard & Poor's and Fitch Ratings.

Bank of America Merrill Lynch is also expected to price the Los Angeles Department of Water and Power, Calif.'s $495 million power system revenue bonds.

On the competitive side, Maryland is scheduled to auction two issues totaling about $922 million on Wednesday. The sales consist of $518 million tax-exempt First Series A State and Local Facilities Loan of 2015 GOs and $404 million First Series B State and Local Facilities Loan of 2015 refunding GOs. The issues are rated triple-A by Moody's, S&P and Fitch.

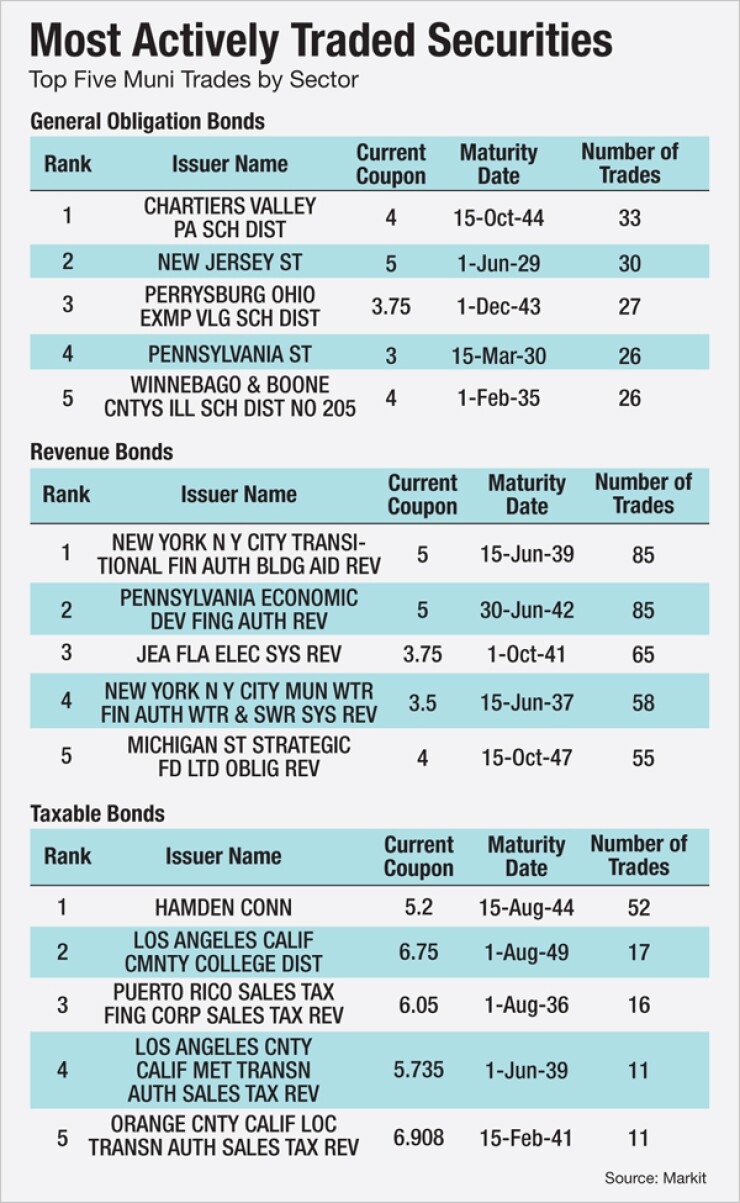

The Week's Most Actively Quoted Issues

California, Oregon and Puerto Rico names were among the most quoted issues in the week ended Feb. 27, according to data released by Markit.

Among bid-side quotes, the state of California 7 1/2s of 2034 were quoted by 10 unique dealers. Among ask-side quotes, the Oregon Department of Transportation highway user tax revenue 5s of 2030 were quoted by 14 dealers. And among two-sided quotes, the Puerto Rico Sales Tax Financing Corp. 6.05s of 2036 were quoted by 13 dealers, Markit said.

Tax-Exempt Bond Funds See Inflows

Municipal bond funds which report weekly posted $429.330 million of inflows in the week ended Feb. 25, after experiencing inflows of $59.047 million in the week ended Feb. 18, according to the latest Lipper data.

The four-week moving average remained positive at $384.441 million in the latest week after being in the green at $500.240 million in the prior week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Muni bond funds so far have experienced inflows in each week of 2015, according to Lipper data. Inflows for the year total about $5.25 billion.

Long-term muni bond funds saw inflows of $308.995 million in the latest week, after experiencing outflows of $118.225 million in the previous week.

High-yield muni funds recorded inflows of $120.709 million in the latest reporting week, after seeing outflows of $219.980 million in the prior week. Exchange-traded funds had inflows of $149.114 million, after recording outflows of $33.536 million in the previous week.

In contrast, long-term municipal bond mutual funds saw $274 million of inflows in the week ended Feb. 18, according to the Investment Company Institute. ICI reported that inflows into long-term funds were $693 million in the previous week.

Tax-Exempt Money Market Funds See Inflows

Tax-exempt money market funds rose $1.98 billion, bringing total net assets to $261.14 billion in the period ended Feb. 23, according to The Money Fund Report, a service of iMoneyNet.com. This follows an outflow of $1.25 billion in the previous week.

The average, seven-day simple yield for the 396 weekly reporting tax-exempt funds remained unchanged at 0.01% for the 95th straight week.

The total net assets of the 991 weekly reporting taxable money funds rose $8.75 billion to $2.441 trillion in the period ended Feb. 24, after seeing an outflow of $21.95 billion in the prior week.

The average, seven-day simple yield for the taxable money funds remained at 0.02% for the sixth consecutive week.

Overall, the combined total net assets of the 1,387 weekly reporting money funds increased $10.73 billion to $2.702 trillion in the period ended Feb. 17, which followed an outflow of $23.20 billion in the prior period.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $2.161 billion to $12.169 billion on Friday. The total is comprised of $3.219 billion competitive sales and $8.949 billion of negotiated deals.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 39,922 trades on Thursday on volume of $15,128 billion. Most active on Thursday, based on the number of trades, was the Little Rock, Ark., Series 2015 sewer revenue refunding 3 1/2s of 2037, which traded 190 times at an average price of 98.553, with an average yield of 3.579%.