The New York City Municipal Water Financing Department's frequency in the market led to relatively cheap pricing for a $200 million issue Wednesday, traders said. The department comes to market nearly once a month, making the paper less valuable to investors looking for diversity among other smaller New York issuers.

The water department's bullet maturity revenue bond was priced to yield 3.90% on a 4% coupon in 2045, according to data provided by Ipreo. The bonds are rated Aa2 by Moody's and AA-plus by S&P and Fitch, and have an optional call at par in 2024.

Because of the issuer's constant presence in the marketplace, investors often shrug off the deals, requiring debt be priced more attractively to lure skeptics, a New York based trader said. New York is a high tax state, which has created the demand for many state-specific funds, and lesser known credits may be the most attractive.

"If you're, say, the Fidelity New York muni bond fund, you probably already have a lot of New York City, TFA, water sewer and DASNY bonds because they're continually issuing," a Midwest based trader said. "Portfolio managers of those kinds of funds are going to be more inclined to diversify out into other, smaller issuers that don't come to market as often, something like a Westchester County."

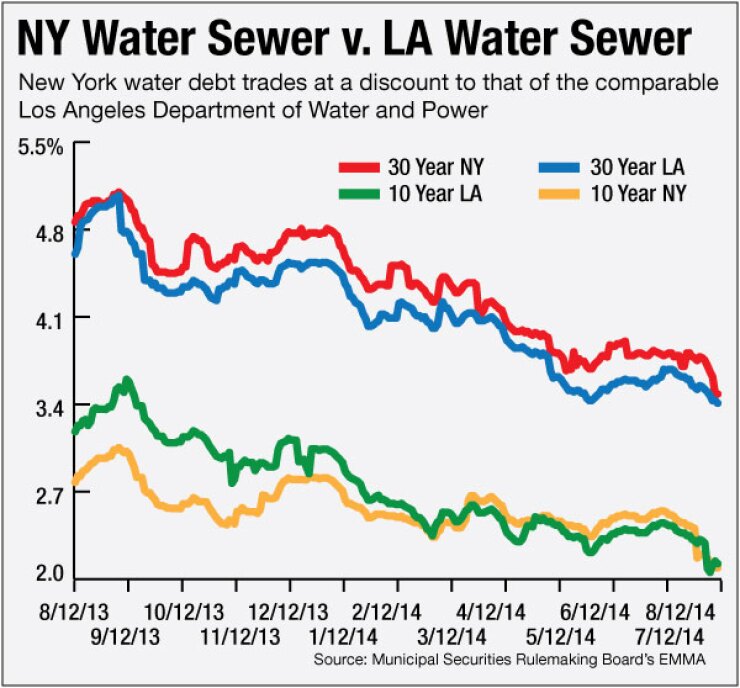

One trader pointed to the relationship between the New York City water department and that of Los Angeles to demonstrate investors' attitude about the Big Apple. The water utilities are both rated in the double A range and both serve stable metropolitan cities. Yet New York trades at a consistent discount to Los Angeles, as seen in the chart.

"I've been buying and trading the big New York issuer paper for 20 years; it never tightens the way you want it to," said the New York based trader.

YIELDS RISE IN THE SECONDARY

The secondary market weakened on Wednesday, with bonds reporting softening across sectors, regions and size. Yields on Golden State Tobacco's 5.75s of 2047 rose four basis points to 7.22% from 7.18%, while yields on the commonwealth of Pennsylvania GO's 5s of 2022 climbed two basis points to 2.18% from 2.16%, according to data provided by Markit.

Yields on Texas's Grand Parkway Toll Road subordinated revenue bonds weakened three basis points to 3.69% from 3.93%, while the Illinois State GOs 5.1% of 2033 rose two basis points to 5.26% from 5.24%, according to data provided by Markit.

WAR THREATENS THE MARKETS

As threats of a U.S. intervention with Islamic extremists in the Middle East escalated, municipal market scales weakened across the curve, echoing softness felt in the Treasury market.

The middle to long end of the municipal yield curve saw the most drastic shifts, with bonds maturing in 2023 through 2025 weakening five basis points, according to the Municipal Market Data triple-A 5% curve provided by TM3. Bonds maturing in 2022, 2026 through 2028, and 2044 all rose three basis points, while bonds maturing between 2020 through 2021 and 2029 through 2043 softened three basis point.

Bonds maturing in 2015 and 2016 were unchanged, while those maturing in 2017 and 2018 were cut one basis point and bonds maturing in 2019 rose two basis points, according to the MMD triple-A scale.

According to the Municipal Market Advisor's triple-A 5% scale, the two-year note weakened one basis point to 0.31%, the 10-year rose four basis points to 2.19%, and the 30-year rose to 3.33%.

The Treasury market weakened on Wednesday, with the 10-year closing at a four basis point softening to 5.54% compared to Tuesday's close. The two-year note rose one basis point to 0.57% while the 30-year climbed three basis points to 3.26%.