The primary market will be relatively quiet on Wednesday as market participants will be waiting for the Federal Open Market Committee's announcement on interest rates.

Secondary Market

U.S. Treasuries were mostly higher on Wednesday morning. The yield on the two-year Treasury was unchanged from 0.75% on Tuesday, as the 10-year Treasury yield was lower at 1.55% from 1.56% and the yield on the 30-year Treasury bond slid to 2.26% from 2.28%.

Top-quality municipal bonds were mostly steady Tuesday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.45% on Monday, while the yield on the 30-year muni was flat from 2.15%, according to a final read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 93.0% compared to 92.1% on Monday, while the 30-year muni to Treasury ratio stood at 94.3% versus 93.8%, according to MMD.

Primary Market

After the busiest day of the week, the primary market will be quieter on Wednesday, as the FOMC concludes its two-day meeting, with a monetary policy announcement around 2 pm. Rates are expected to be unchanged.

Recent economic data have been encouraging and the Brexit fallout seems to be benign, said Randy Smolik, senior market analyst at MMD. "Although the markets do not expect any policy change, the Wednesday FOMC statement may hint to higher rates."

The primary was supposed to see the second largest deal of the week price Wednesday, but the California Health Facilities Financing Authority's $850 million offering was priced a day earlier than expected.

"There were a few deals schedule to price today; one of those deals came yesterday and I wouldn't be surprised to see another one not go until Thursday," said one New York trader. "Issuers typically don't like to go on FOMC announcement day."

An exception is a $200 million sale by the state of North Carolina, which is competitive and "should go as planned," he said. The Tar Heel's state general obligation public improvement bonds for Connect NC are rated triple-A by Moody's Investors Service, S&P Global Ratings and Fitch Ratings.

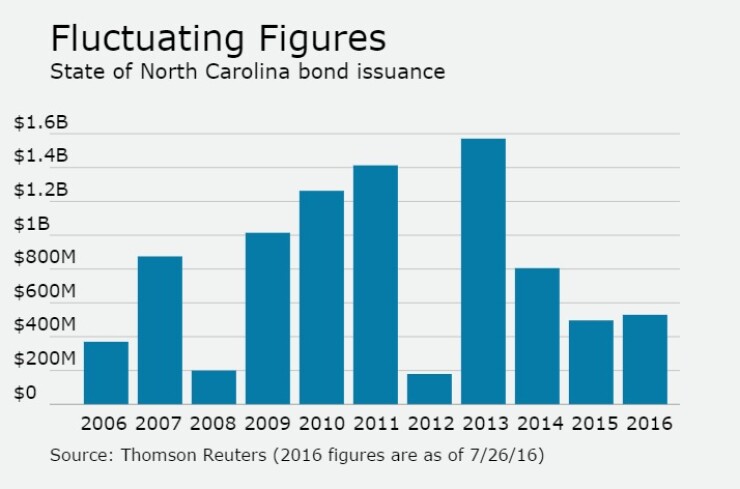

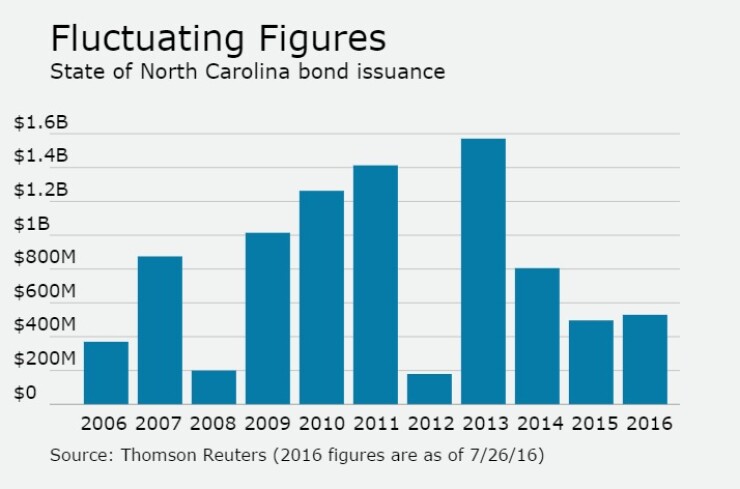

Since 2006, the state of North Carolina has issued about $8.7 billion of debt, with the largest issuance occurring in 2013 when it sold $1.6 billion of securities.

The state of Wisconsin's $317 million of GO refunding bonds was to be priced on Monday, according to the Dalcomp calendar, but sources are saying the deal will be priced by RBC Capital Markets on "Wednesday or Thursday."

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 34,692 trades on Tuesday on volume of $9.83 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $529.1 million to $11.91 billion on Wednesday. The total is comprised of $5.12 billion of competitive sales and $6.79 billion of negotiated deals.