Top shelf municipal bonds finished stronger on Thursday, traders said, as big sales for Detroit and from Wisconsin topped activity in a market hungry for supply.

Barclays Capital priced the $608.9 million Michigan Finance Authority issue of taxable and tax-exempt bonds for the city of Detroit under the Local Government Loan Program, (distributable state aid refunding local project bonds).

The $239.3 million of taxable Series 2016C-1 revenue bonds, first lien limited tax general obligation bonds, were priced to yield between about 75 basis points over the comparable Treasury security in 2019 and around 137.50 basis points above the comparable Treasury in 2035.

The $125.9 million of taxable Series 2016C-2 revenue bonds, third lien LTGO bonds were priced to yield between about 95 basis points over the comparable Treasury in 2018 and around 212.5 basis points above the comparable Treasury in 2032.

The $223.8 million of tax-exempt Series 2016C-3 revenue bonds, fourth lien unlimited tax GOs, were priced to yield from 0.85% with a 4% coupon in 2017 to 2.59% with a 5% coupon in 2028.

The $19.9 million of taxable Series 2016C-4 revenue bonds, fourth lien ULTGO bonds, were priced to yield between about 140 basis points over the comparable Treasury in 2018 and around 215 basis points above the comparable Treasury in 2028.

The Series 2016C-1 taxables are rated Aa2 by Moody's Investors Service and AA by S&P Global Ratings; the Series 2016C-2 taxables are rated A1 by Moody's and A-plus by S&P; the Series 2016C-3 tax-exempts and the Series 2016C-4 taxables are rated A2 by Moody's and A-minus by Fitch.

For the Series 2016C-3 tax-exempts, the 10-year yield landed at 2.34% with a 5% coupon, which brought it in at 92 basis points over Municipal Market Data's top-rated benchmark and 40 basis points over a comparable A-rated credit. The 12-year bond was yielding 2.59% with a 5% coupon, 99 basis points over the MMD triple-A and 42 basis points over the A rated credit.

Market participants said the deal was met with good demand from buyers.

"People are hungry for some yield and were willing to overlook the idea of Detroit relapsing into bankruptcy and possibly having a different outcome than they did in the first bankruptcy," said Howard Cure, director of municipal bond research for Evercore Wealth Management. "The city is not the school district and the city has shown that at least in the first bankruptcy that this type of debt has been protected."

Also on Thursday, RBC Capital Markets priced the state of Wisconsin's $372.27 million of GO refunding bonds of 2016, Series 2.

The issue was priced to yield from 1% with 3% and 5% coupons in a split 2021 maturity to 2.07% with a 4% coupon and 1.92% with a 5% coupon in a split 2030 maturity.

The deal is rated Aa2 by Moody's and AA by S&P and Fitch Ratings and Kroll Bond Rating Agency.

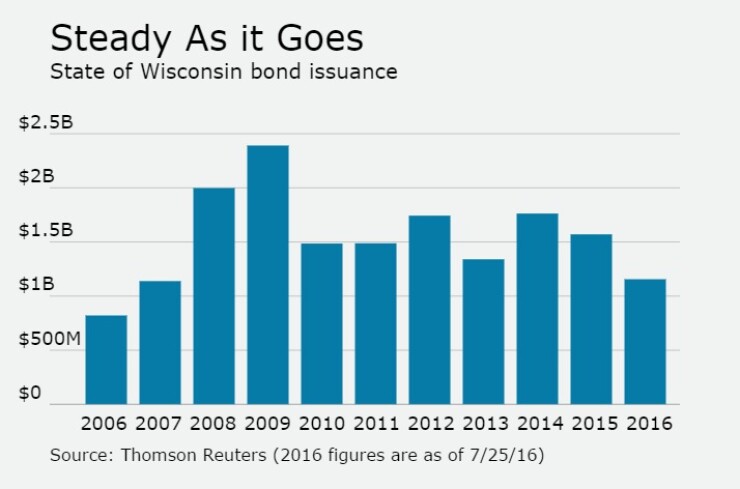

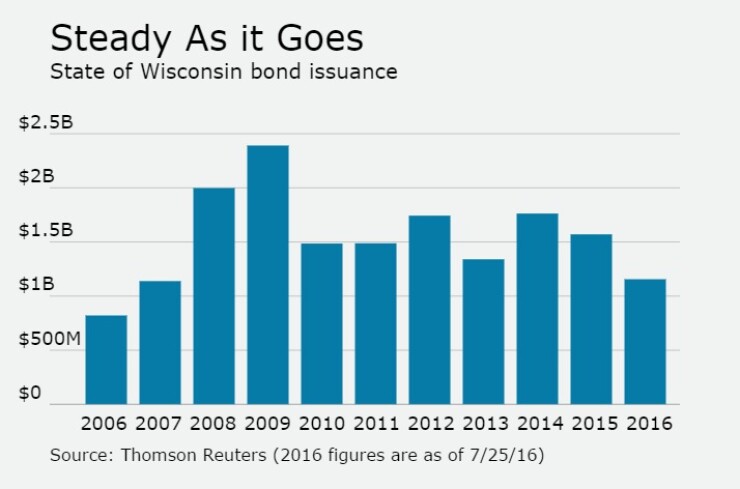

Since 2006, the state of Wisconsin has issued about $17 billion of debt, with the largest issuance occurring in 2009 when it sold $2.4 billion of securities. The Badger State is consistent, having sold more than $1 billion of bonds every year since 2007.

Secondary Market

The yield on the 10-year benchmark muni general obligation fell one basis point to 1.41% from 1.42% on Wednesday, while the yield on the 30-year muni dropped one basis point to 2.12% from 2.13%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mostly stronger on Thursday. The yield on the two-year Treasury declined to 0.71% from 0.73% on Wednesday, as the 10-year Treasury yield dropped to 1.51% from 1.52% and the yield on the 30-year Treasury bond was unchanged from 2.23%.

The 10-year muni to Treasury ratio was calculated at 93.3% on Thursday compared to 93.7% on Wednesday, while the 30-year muni to Treasury ratio stood at 95.1% versus 95.6%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 34,979 trades on Wednesday on volume of $14.43 billion.

Tax-Exempt Money Market Fund Outflows

Tax-exempt money market funds experienced outflows of $2.49 billion, bringing total net assets to $185.92 billion in the week ended July 25, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $1.25 million to $188.42 billion in the previous week.

The average, seven-day simple yield for the 272 weekly reporting tax-exempt funds was unchanged at 0.07% from the previous week.

The total net assets of the 889 weekly reporting taxable money funds increased $17.31 billion to $2.520 trillion in the week ended July 26, after an outflow of $7.99 billion to $2.502 trillion the prior before.

The average, seven-day simple yield for the taxable money funds remained at 0.11% from the week before.

Overall, the combined total net assets of the 1,161 weekly reporting money funds increased $14.82 billion to $2.706 trillion in the period ended July 26, which followed an outflow of $9.24 billion to $2.691 trillion.

Yvette Shields and Nora Colomer contributed to this report.