New York City sold about $1.05 billion of general obligation debt on Tuesday, after retail took more than $200 million during a two-day retail order period for its fixed-rate bonds.

The mom-and-pop investors uncharacteristically ventured out to the longer end in maturity to earn higher yields.

Goldman, Sachs priced the city's $800 million of Fiscal 2017 Series A Subseries A-1 GOs for institutions on Tuesday, after a two-day retail order period that started last Friday.

"They had a strong second day that was actually more than double from Friday," an underwriter involved in the deal said on Wednesday.

He said the retail orders just shy of $100 million on Friday were followed by more than $100 million in orders on Monday – which he said is unusual.

"The retail participation was pretty strong all things considered," he said. "Normally the first day is better, but when you have a Friday with a Monday wrap around, Fridays can be slow in the summer."

The underwriter said he was pleased with the retail participation and added that "$200 million in orders is very positive."

The city said in a press release it received about $215 million of retail orders for the tax-exempt fixed-rate bonds during the two-day retail order period preceding today's sale. "At the final pricing, the yield on the 2038 maturity was reduced by one basis point. Stated yields on the tax-exempt bonds ranged from 0.60% in 2018 to 2.85% in 2040."

For retail, the issue had been priced to yield from 0.68% with 3% and 5% coupons in a split 2019 maturity to approximately 2.739% with a 2.625% coupon in 2040. No retail orders were taken in the 2030-2033 or 2037-2038 maturities.

The retail investors veered from recent buying patterns on new issues and participated in longer maturities in order to get higher yields – even if it meant accepting lower than the 5% coupons they previously favored, according to the underwriter.

"The structure wasn't as retail-friendly as other deals," he said. "There were lots of bonds in the 15 to 20-year range and sometimes retail doesn't want to go that long."

However, the retail crowd made a consideration and showed "good appetite" for the 3% and 4% handles available in 2029 with a 2.07% yield and 2036 with a 2.78% yield. They even participated in the 2039 maturity, which had a split 3% and 4% coupon yielding 2.90% and 2.71%, respectively, he said.

The bonds were attractive compared to the generic, triple-A GO scale, which on Tuesday ended at a 2.11% in 2040, according to Municipal Market Data.

"The market acceptability of sub 5% is becoming more and more prevalent," the underwriter added. "With absolute yields as low as they are people are sacrificing a little less coupon to pick up a little more yield to the call."

Although that trend has been building among the retail crowd for over a year, the underwriter said it has "intensified as rates have gone lower and lower.

"Any deals getting done you're seeing quite a variety of sub 5% on the majority of the transactions."

Heavy demand for new issue paper in general, the city's name recognition, and the timing of the deal were the key selling points, according to a New York trader.

"New York is very strong; it's one of the better traders out there," he said on Wednesday.

"New issue products are doing very well and very strong, especially negotiated deals," the underwriter agreed. "Considering the absolute level of interest rates, [the retail order period] set a good tone for the institutional pricing."

At the institutional pricing, the GOs were priced to yield from 0.60% with a 3% coupon in 2018 to 2.85% with a 2.75% coupon in 2040.

The book-running senior manager was Goldman Sachs with Bank of America Merrill Lynch, Citigroup, Jefferies, JPMorgan, Loop Capital Markets, Ramirez & Co., RBC Capital Markets, Siebert Brandford Shank & Co., and Wells Fargo Securities serving as co-senior managers on the transaction.

Goldman also remarketed the city's $55.46 million of Fiscal 2017 Series 1 GO's. The deal was priced as 5s to yield 0.90% in 2020, 1.05% in 2021 and 1.36% in 2023. Proceeds of the sale will be used to convert the variable-rate demand bonds to fixed-rate bonds.

Additionally, the Big Apple competitively sold two separate issues of taxable GOs on Tuesday totaling $250 million.

JPMorgan Securities won the $172.95 million of Fiscal 2017 Subseries A-2 taxables with a bid of 99.52, a true interest cost of 2.20%. The deal was priced at par to yield 1.70% in 2022, 1.98% in 2023, 2.11% in 2024, 2.29% in 2025 and 2.46% in 2026.

BAML won the $77.06 million of Fiscal 2017 Subseries A-3 taxables with a bid of 99.50, a TIC of 2.66%. The GOs were priced at par to yield 2.52% in 2027 and 2.69% in 2028.

All the deals were rated Aa2 by Moody's Investors Service and AA by S&P Global Ratings and Fitch Ratings.

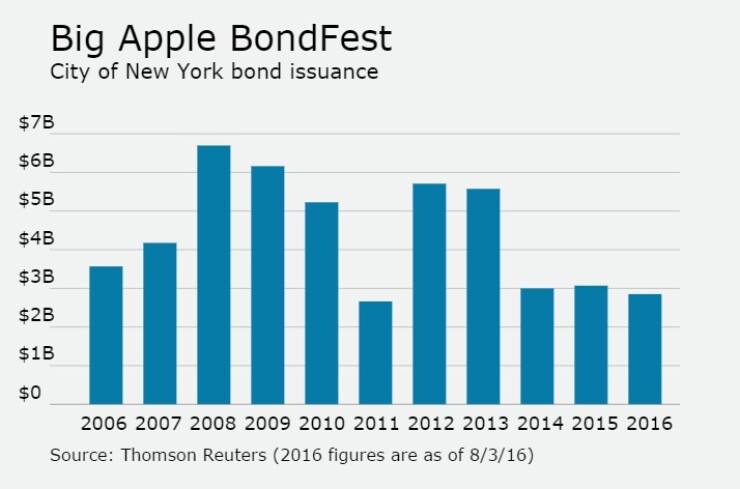

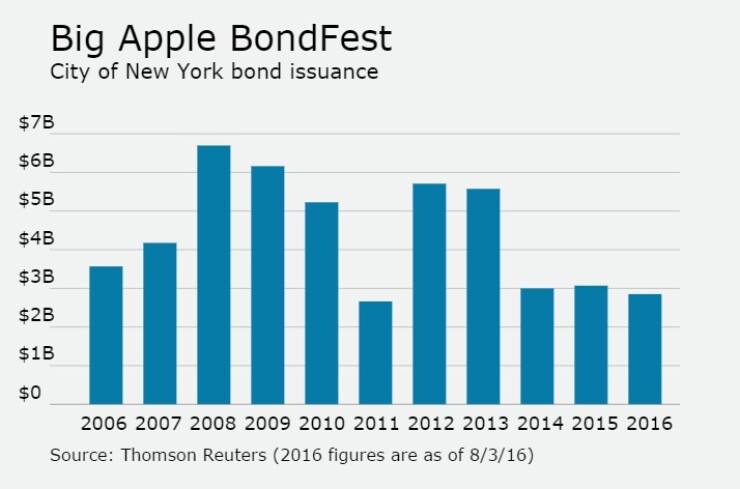

Since 2006, the city has sold about $48.7 billion of bonds, with the most issuance occurring in 2008 when it offered $6.69 billion and the least coming in 2011 when it sold $2.66 billion.