Nearly six years after Colorado voters legalized recreational marijuana, the economic and social impact remains hard to quantify, researchers say.

Since 2012, Colorado has saddled legalized cannabis with a slew of state and local taxes earmarked for special uses, and the state has enjoyed an incremental boost in tax revenues and a growing niche tourism industry.

The state’s 10% special sales tax on retail recreational sales was raised to 15% beginning in fiscal year 2018. A separate 15% excise tax is levied on retail recreational sales, with medical sales carrying a 2.9% sales tax.

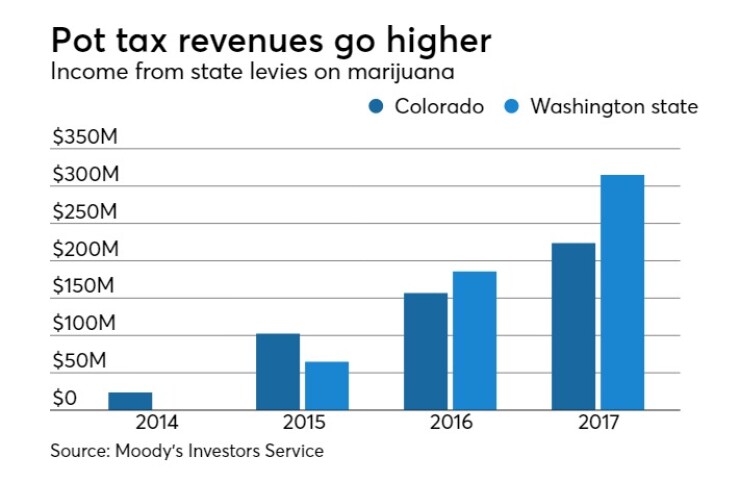

Total state tax revenues from medical and recreational sales on a cash basis grew by 118% to $223.5 million in fiscal 2017 from $102.4 million in fiscal 2015, the first full fiscal year of legal recreational sales. The state projects total state marijuana revenues to grow to $258.6 million in fiscal 2018.

“For Colorado, the projected growth in revenues in fiscal 2018 is primarily because of an increase in the tax rate, rather than an increase in sales,” wrote Moody’s Investors Service senior analyst Grayson Nichols in a May 8 report. “Also, as more states legalize recreational marijuana, states will face increased competition from their neighbors.”

Regardless of how the industry develops in the future, the immediate effects are positive for Colorado’s Aa1 issuer credit rating and stable outlook, analysts said. That also applies to the Aa1 rating of Washington, which legalized recreational pot the same year as Colorado. Ditto for California, where recreational use became legal last year, and six other states and the District of Columbia.

"For U.S. states and local governments that allow retail sales of marijuana, the related tax revenue is marginally credit positive," Nichols wrote. "Even for states with mature industries, such as Colorado, and large states like California, expected revenue will remain only a small share of annual general fund revenue, given the limited opportunities for significant market expansion."

About half of Colorado’s fiscal 2018 marijuana revenues are directed to the Marijuana Tax Cash Fund for a variety of marijuana-related programs including enforcement, regulation and prevention, as well as substance abuse programs.

The state general fund garners only about 5% of the tax revenue, representing only 0.1% of overall general fund revenues, according to Moody’s.

In Washington, only about one-third of state marijuana revenues are directed to the state's general fund, representing only 0.6% of general fund revenues in the 2017-19 biennium.

“Local governments in states that have legalized marijuana also experience minimal, but still credit positive, revenue effects,” Nichols said. “They receive revenue from the state and from local collections. However, some local governments opt out of licensing retail outlets, in part because of political reasons and the potential for increased enforcement costs. Any increased law enforcement and public safety expenditures fall to the local governments.”

In a

To arrive at that figure, researchers compiled sales figures, tax revenue and a multiplier effect from the commercial activity. From that, they subtracted a rough cost of dealing with issues such as homelessness, crime and related issues that might arise from marijuana usage.

“The bottom line showed that the revenue from the taxes and the multiplier from the taxes, the net monies coming into the county exceeded the cost,” Rick Kreminski, CSU Pueblo’s director of research and sponsored programs, told The Bond Buyer.

“On social and economic impact, there were a lot of questions,” he said. “It’s difficult to get some of the data.”

Researchers interviewed police, social workers, teachers and others, seeking insight into how legalized marijuana affected health, poverty, education, jobs and other areas that could be affected by pot use.

The study found evidence of increased migration to Pueblo since passage of Amendment 64 legalized recreational use of marijuana.

“As is often the case when considering migrants, opinion is divided about whether migrants have a positive or negative impact on the Pueblo community,” the study said. “Cannabis tourism has become a lucrative new component of Colorado’s economic profile. . . . Rather than siphoning resources, in-migrating cannabis tourists and college graduates contribute to Colorado’s overall economic strength.”

Although household income in Pueblo is considerably lower than that of other Front Range cities such as Denver and Colorado Springs to the north, the study said that legal cannabis may have had a more positive impact than the statistics reflect.

“Given the ongoing federal prohibition, most cannabis businesses are still obligated to operate in a cash-only financial environment,” the study noted. “If the federal prohibition ends, it is possible that businesses and individuals might feel safer about reporting cannabis-derived income.”

Moody’s also said federal enforcement of marijuana laws poses an ongoing risk to future revenues.

In January, U.S. Attorney General Jeff Sessions reversed the policy of the Obama administration to accommodate states that had legalized marijuana. Sessions directed the 93 U.S. attorneys across the nation to enforce existing federal laws regarding marijuana, even in states that legalized the substance.

In April, Sen. Cory Gardner, R-Colo., said he had

Gardner said that President Trump assured him that despite the Sessions policy, the marijuana industry in Colorado would not be targeted.

“Since the campaign, President Trump has consistently supported states’ rights to decide for themselves how best to approach marijuana,” Gardner said in a prepared statement. “President Trump has assured me that he will support a federalism-based legislative solution to fix this states’ rights issue once and for all.”